Note: If this certification is a joint certification, the statements will be considered made on behalf of both spouses, even though the pronoun "I" is used. If spouses submitting a joint certification have different reasons for their failure to report all income, pay all tax, and submit all required information returns, including FBARs, they must state their individual reasons separately in the required statement of facts.

Certification

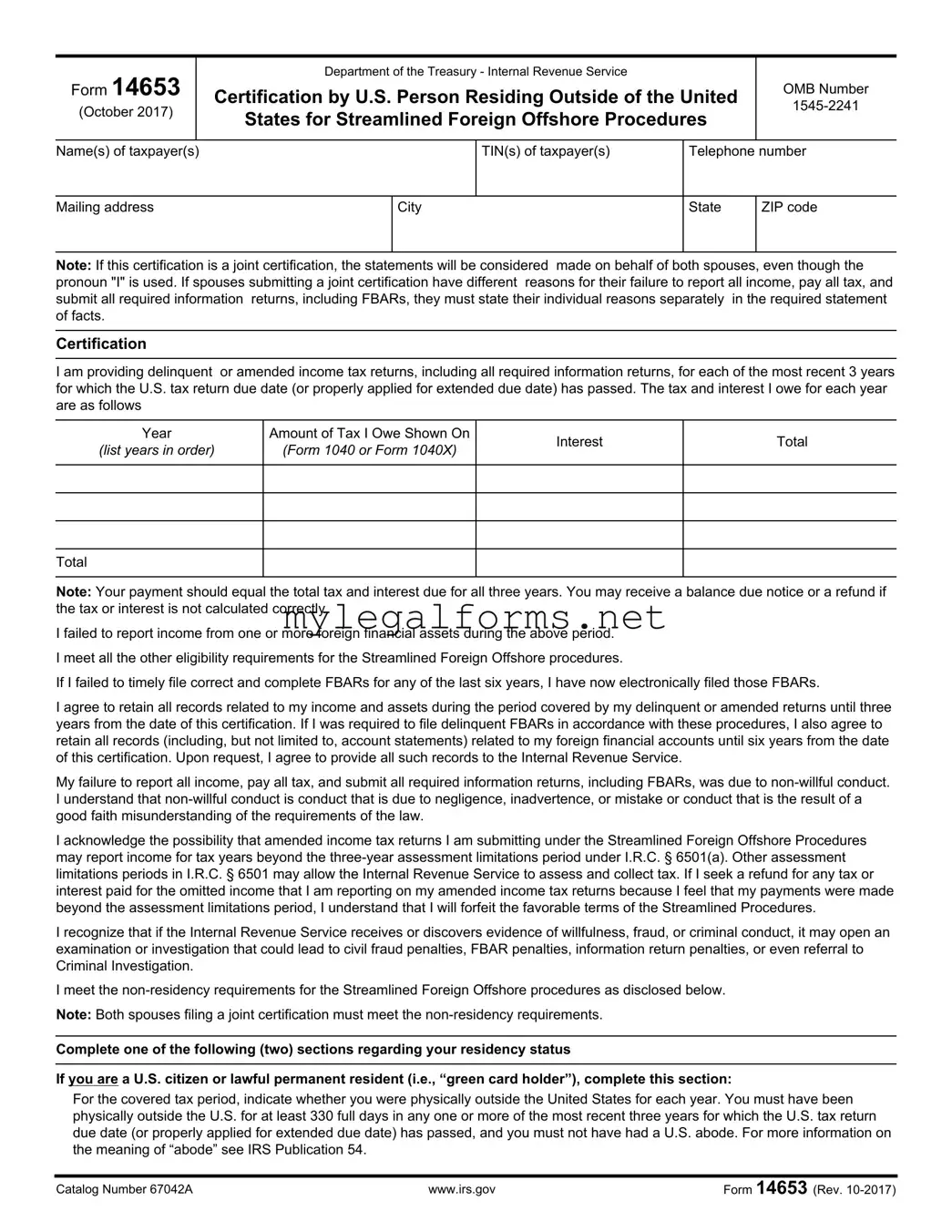

I am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the U.S. tax return due date (or properly applied for extended due date) has passed. The tax and interest I owe for each year are as follows

Total

Note: Your payment should equal the total tax and interest due for all three years. You may receive a balance due notice or a refund if the tax or interest is not calculated correctly.

I failed to report income from one or more foreign financial assets during the above period.

I meet all the other eligibility requirements for the Streamlined Foreign Offshore procedures.

If I failed to timely file correct and complete FBARs for any of the last six years, I have now electronically filed those FBARs.

I agree to retain all records related to my income and assets during the period covered by my delinquent or amended returns until three years from the date of this certification. If I was required to file delinquent FBARs in accordance with these procedures, I also agree to retain all records (including, but not limited to, account statements) related to my foreign financial accounts until six years from the date of this certification. Upon request, I agree to provide all such records to the Internal Revenue Service.

My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to non-willful conduct. I understand that non-willful conduct is conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law.

I acknowledge the possibility that amended income tax returns I am submitting under the Streamlined Foreign Offshore Procedures may report income for tax years beyond the three-year assessment limitations period under I.R.C. § 6501(a). Other assessment limitations periods in I.R.C. § 6501 may allow the Internal Revenue Service to assess and collect tax. If I seek a refund for any tax or interest paid for the omitted income that I am reporting on my amended income tax returns because I feel that my payments were made beyond the assessment limitations period, I understand that I will forfeit the favorable terms of the Streamlined Procedures.

I recognize that if the Internal Revenue Service receives or discovers evidence of willfulness, fraud, or criminal conduct, it may open an examination or investigation that could lead to civil fraud penalties, FBAR penalties, information return penalties, or even referral to Criminal Investigation.

I meet the non-residency requirements for the Streamlined Foreign Offshore procedures as disclosed below.

Note: Both spouses filing a joint certification must meet the non-residency requirements.

Complete one of the following (two) sections regarding your residency status

If you are a U.S. citizen or lawful permanent resident (i.e., “green card holder”), complete this section:

For the covered tax period, indicate whether you were physically outside the United States for each year. You must have been physically outside the U.S. for at least 330 full days in any one or more of the most recent three years for which the U.S. tax return due date (or properly applied for extended due date) has passed, and you must not have had a U.S. abode. For more information on the meaning of “abode” see IRS Publication 54.