Attorney-Approved Affidavit of Gift Form

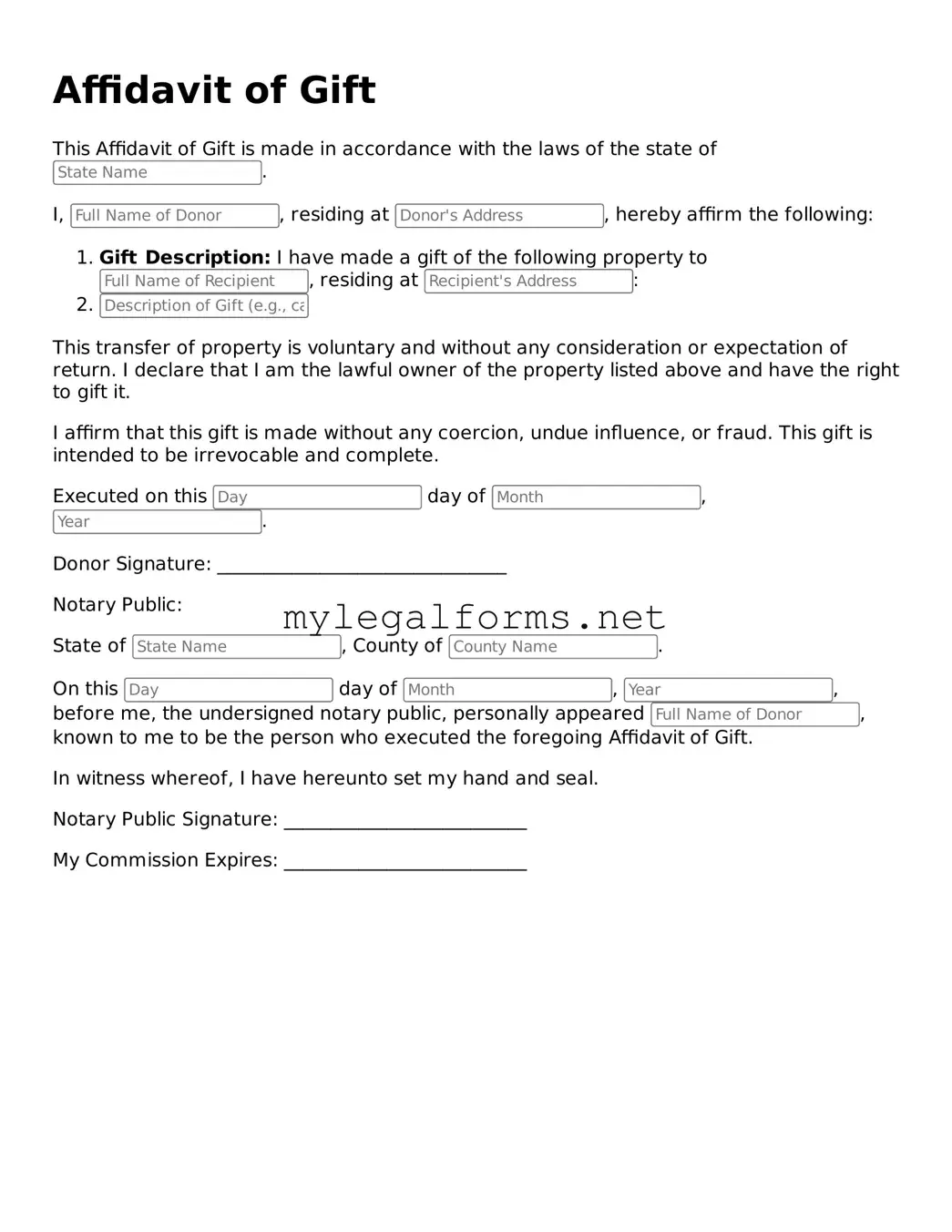

The Affidavit of Gift is a legal document used to declare the transfer of property or assets as a gift. This form serves to establish the intent of the donor and provides a record of the transaction for both parties. Understanding its components and implications is essential for anyone considering gifting property.

Launch Affidavit of Gift Editor

Attorney-Approved Affidavit of Gift Form

Launch Affidavit of Gift Editor

Launch Affidavit of Gift Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Affidavit of Gift online and download the final version.