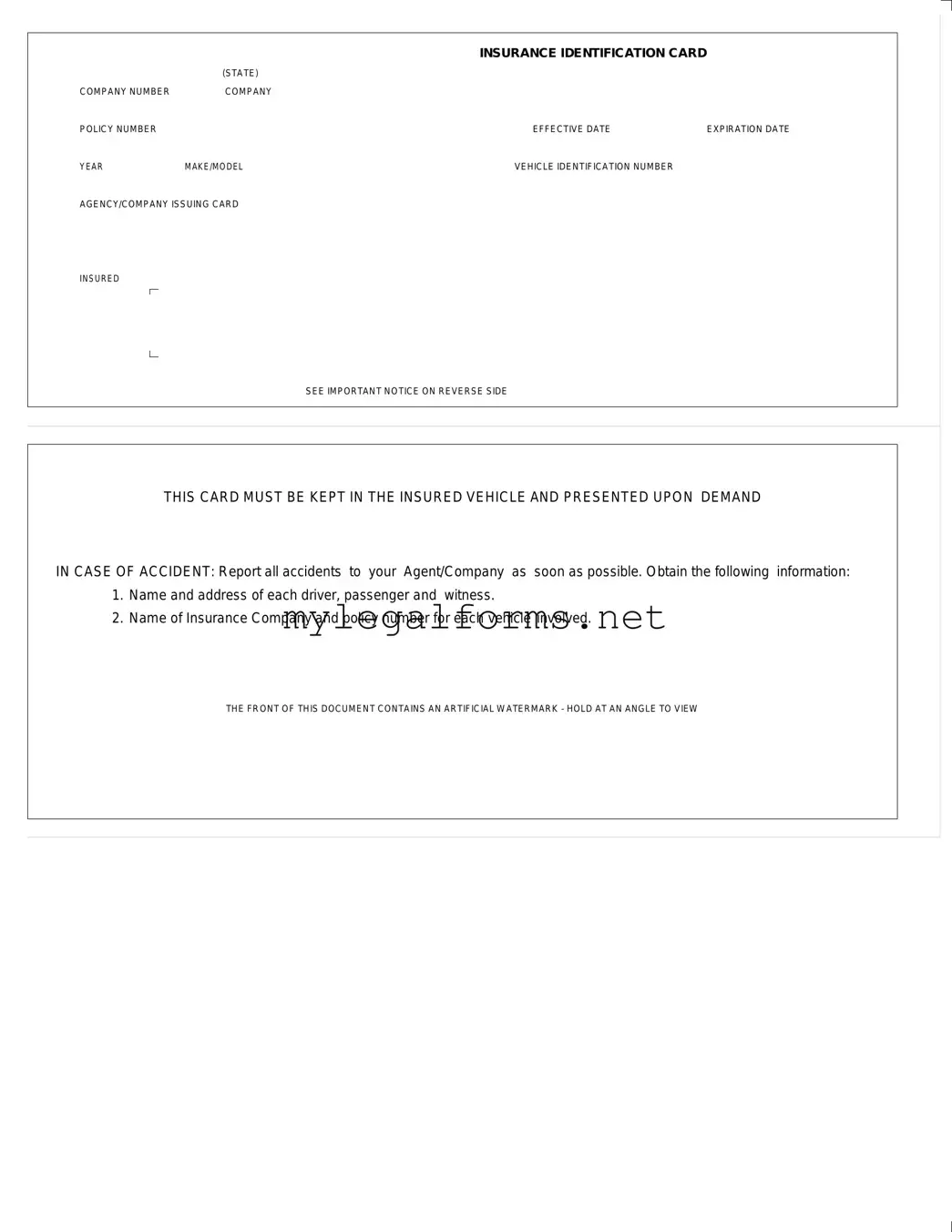

Filling out the Auto Insurance Card form can seem straightforward, but many individuals make common mistakes that can lead to complications later. One frequent error is neglecting to include the company policy number. This number is crucial for identifying your specific insurance coverage and ensuring that you are protected in the event of an accident. Without it, you may face difficulties when trying to prove your insurance status.

Another mistake often made is failing to update the effective and expiration dates. These dates indicate when your coverage begins and ends. If they are incorrect, you may inadvertently find yourself without valid insurance, which can lead to legal penalties and financial liability. Always double-check these dates to avoid any lapses in coverage.

People also frequently overlook the importance of accurately recording the vehicle identification number (VIN). The VIN is a unique identifier for your vehicle, and any discrepancies can create problems when filing a claim or during a traffic stop. Taking the time to verify this number against your vehicle’s registration can save you from potential headaches down the road.

In addition, many individuals fail to include the correct make and model of their vehicle. This information is necessary for insurers to assess risk and determine premiums. An incorrect entry can lead to issues with coverage and claims processing. Always ensure that this information matches what is on your vehicle registration documents.

Another common oversight is not listing the agency or company issuing the card. This detail is essential for confirming that the insurance policy is legitimate and active. Without this information, law enforcement or other parties may question the validity of your insurance.

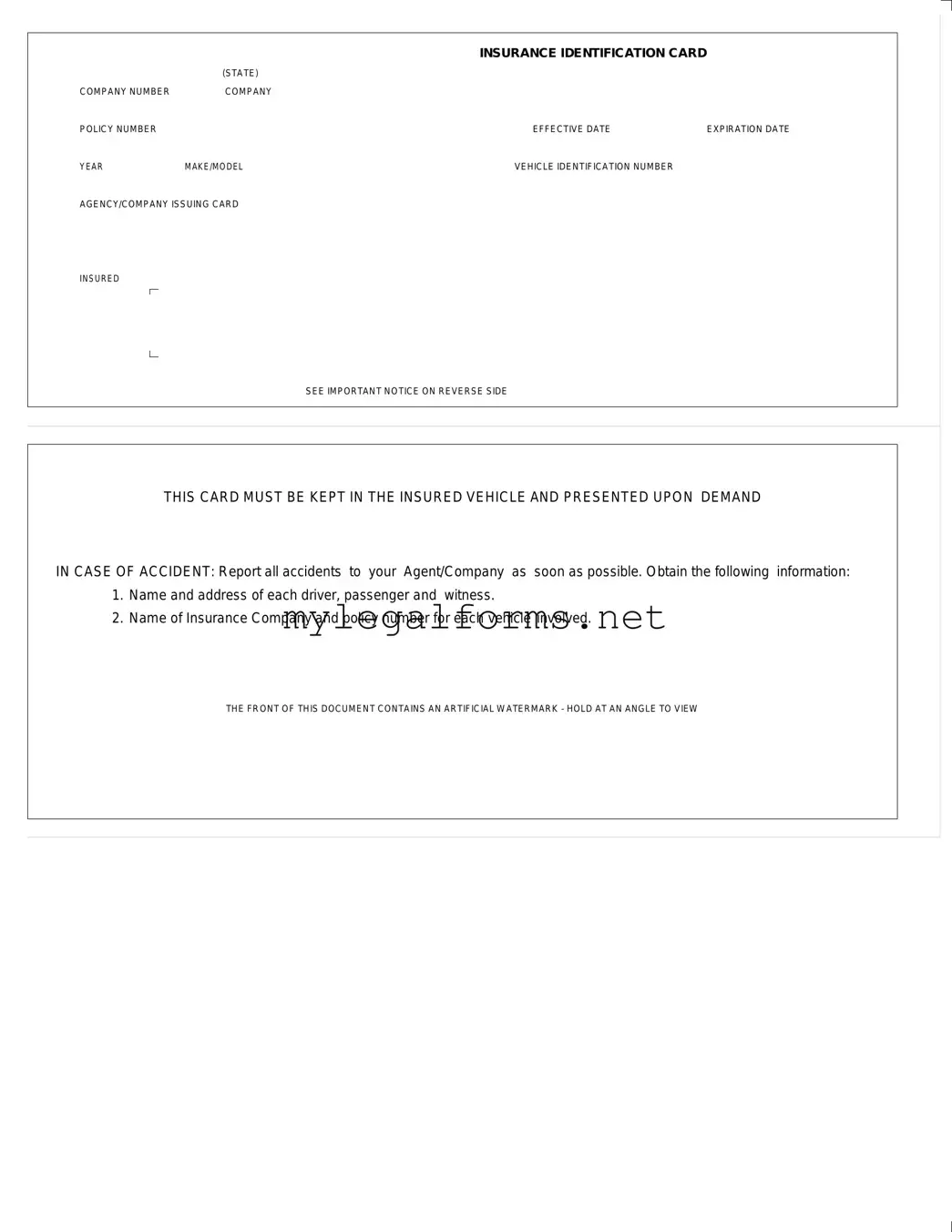

Some people mistakenly assume that the insurance identification card is only for their records. In reality, it must be kept in the vehicle and presented upon demand. Failing to do so can result in fines or legal repercussions. Keeping the card accessible in your vehicle is a simple yet vital step.

Lastly, individuals often ignore the important notice on the reverse side of the card. This section contains critical information about what to do in case of an accident, including how to report it and what details to collect. Not following these guidelines can complicate the claims process and potentially jeopardize your coverage.

By being aware of these common mistakes and taking steps to avoid them, you can ensure that your Auto Insurance Card form is filled out correctly. This diligence will help protect you and your assets in the event of an accident.