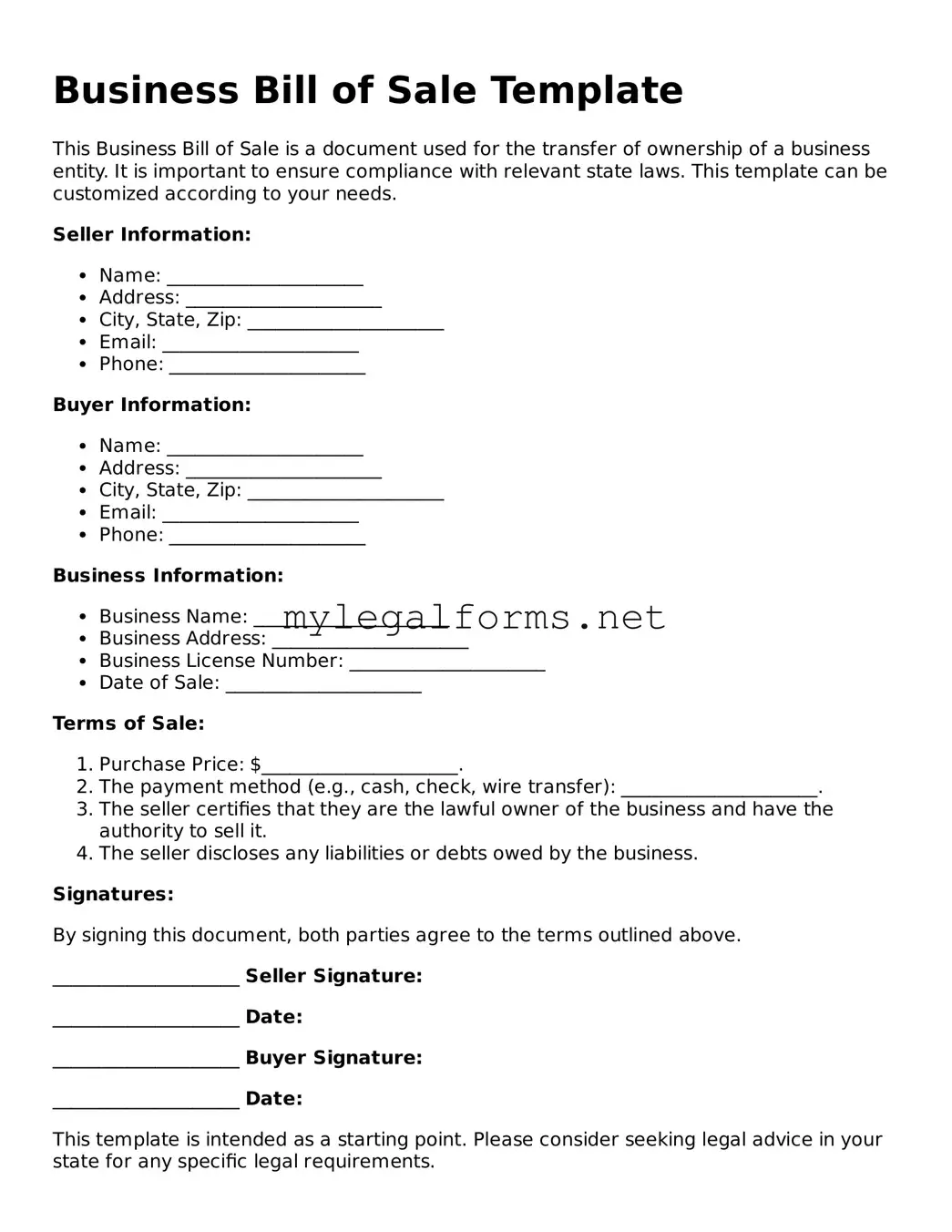

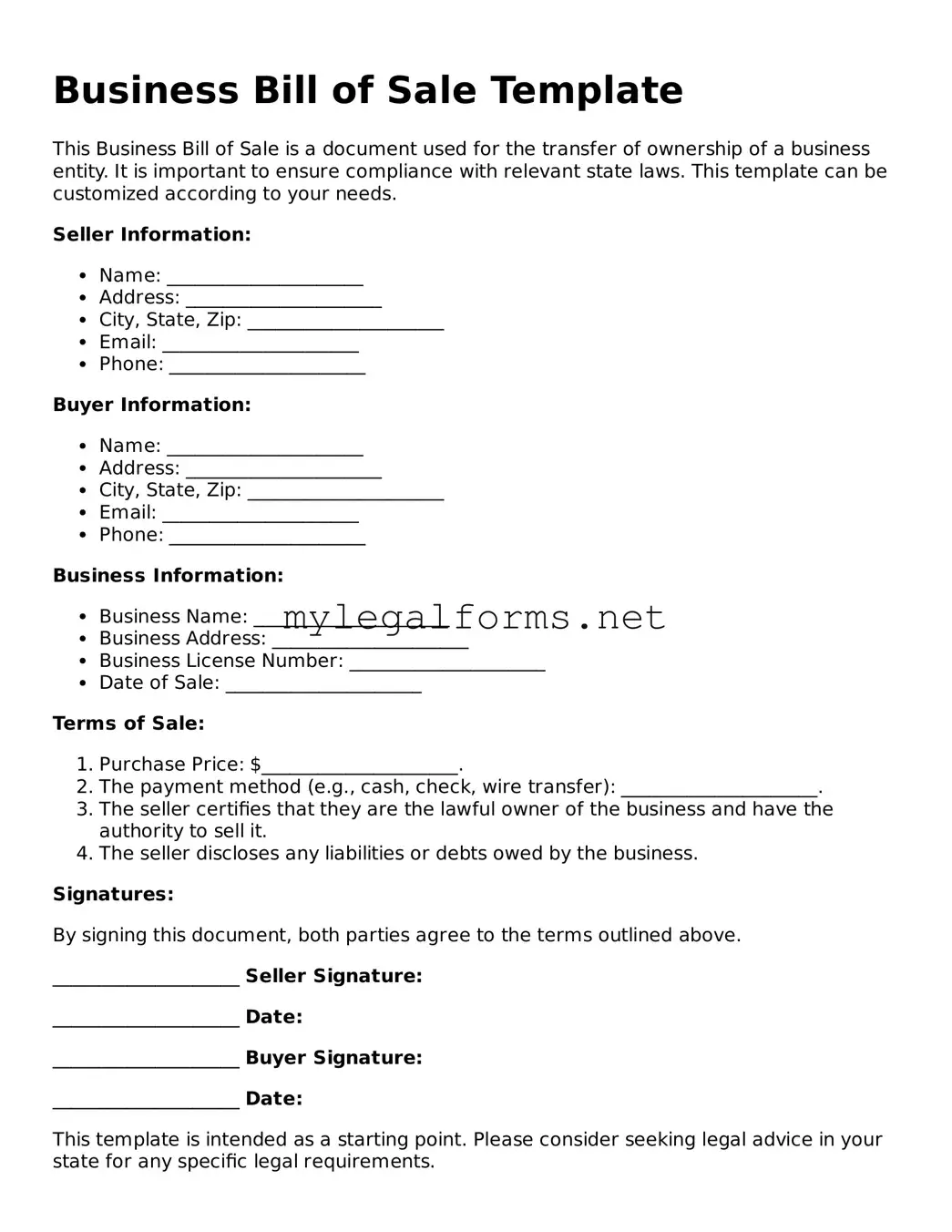

When filling out a Business Bill of Sale form, many people overlook important details that can lead to complications down the line. One common mistake is failing to include all necessary information about the buyer and seller. It's essential to provide full names, addresses, and contact information for both parties. Omitting any of these details can create confusion and may even lead to disputes later.

Another frequent error is not accurately describing the business being sold. This includes the business name, location, and any relevant identification numbers, such as a tax ID. A vague description can lead to misunderstandings about what exactly is being transferred, which could cause issues for both parties.

Many individuals also neglect to specify the purchase price clearly. It's crucial to write the total amount being paid for the business in both numerical and written form. This helps avoid any ambiguity about the agreed-upon price and ensures that both parties are on the same page.

People sometimes forget to include the date of the transaction. This date is important for record-keeping and can impact the legal standing of the sale. Without a clear date, it may be difficult to establish when the transfer of ownership actually took place.

Additionally, failing to have the document signed by both parties is a significant oversight. A Business Bill of Sale is not legally binding unless it is signed by both the buyer and the seller. Without these signatures, the document may not hold up in court if any disputes arise.

Another mistake is not having a witness or notary present during the signing process. While not always required, having a witness can add an extra layer of protection and credibility to the transaction. A notary can also help verify the identities of both parties, which can be beneficial if any issues come up later.

Some individuals overlook the importance of keeping a copy of the completed form. After the sale, both parties should retain a signed copy for their records. This serves as proof of the transaction and can be useful for tax purposes or in case of future disputes.

People may also forget to check for any local or state requirements that could affect the sale. Different jurisdictions may have specific rules regarding business sales, and failing to comply with these can lead to complications. It’s wise to research any applicable regulations before finalizing the sale.

Lastly, many make the mistake of not consulting with a legal professional. While it may seem straightforward, having an expert review the Business Bill of Sale can help ensure that everything is in order. This can prevent potential problems and provide peace of mind for both the buyer and the seller.