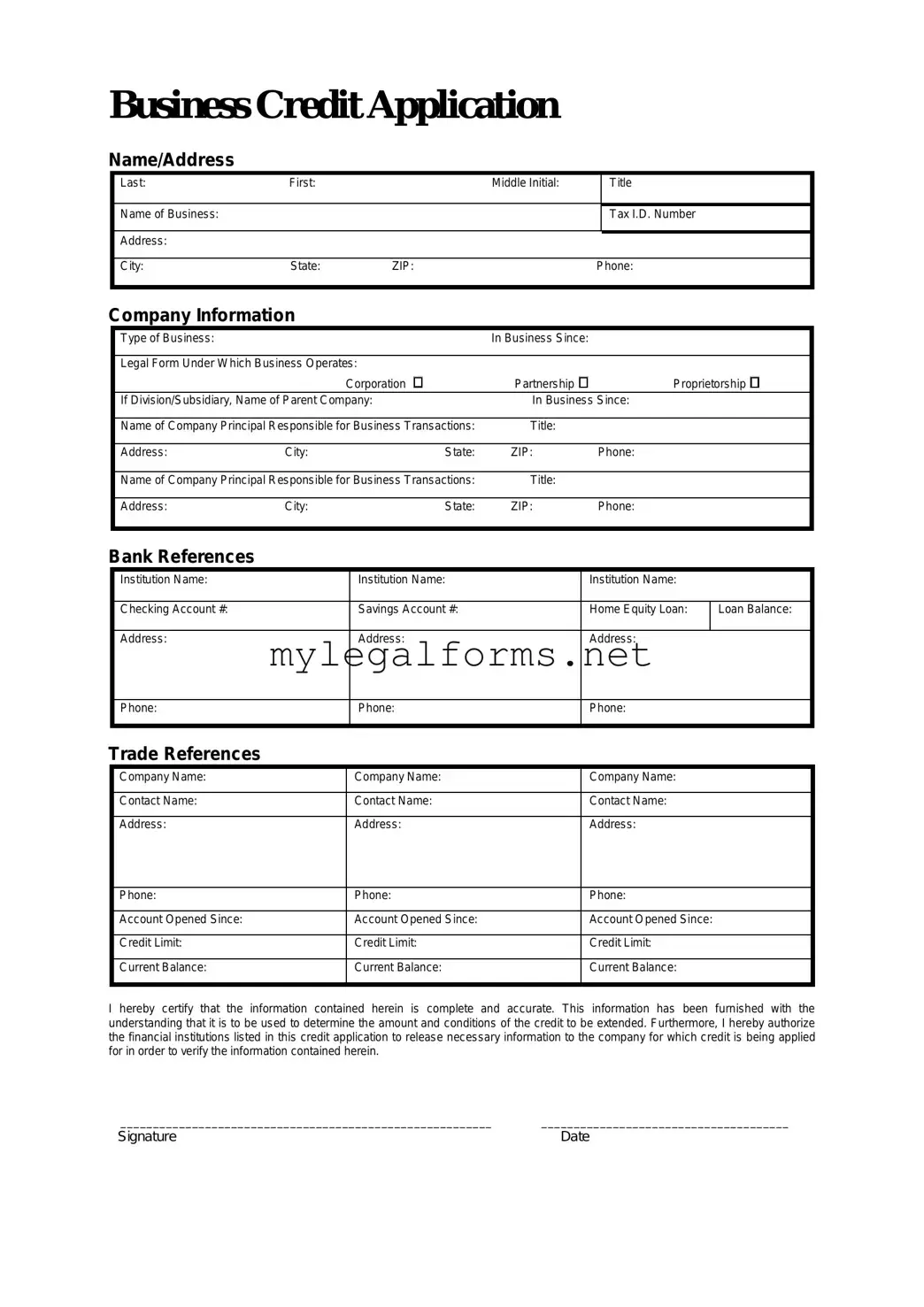

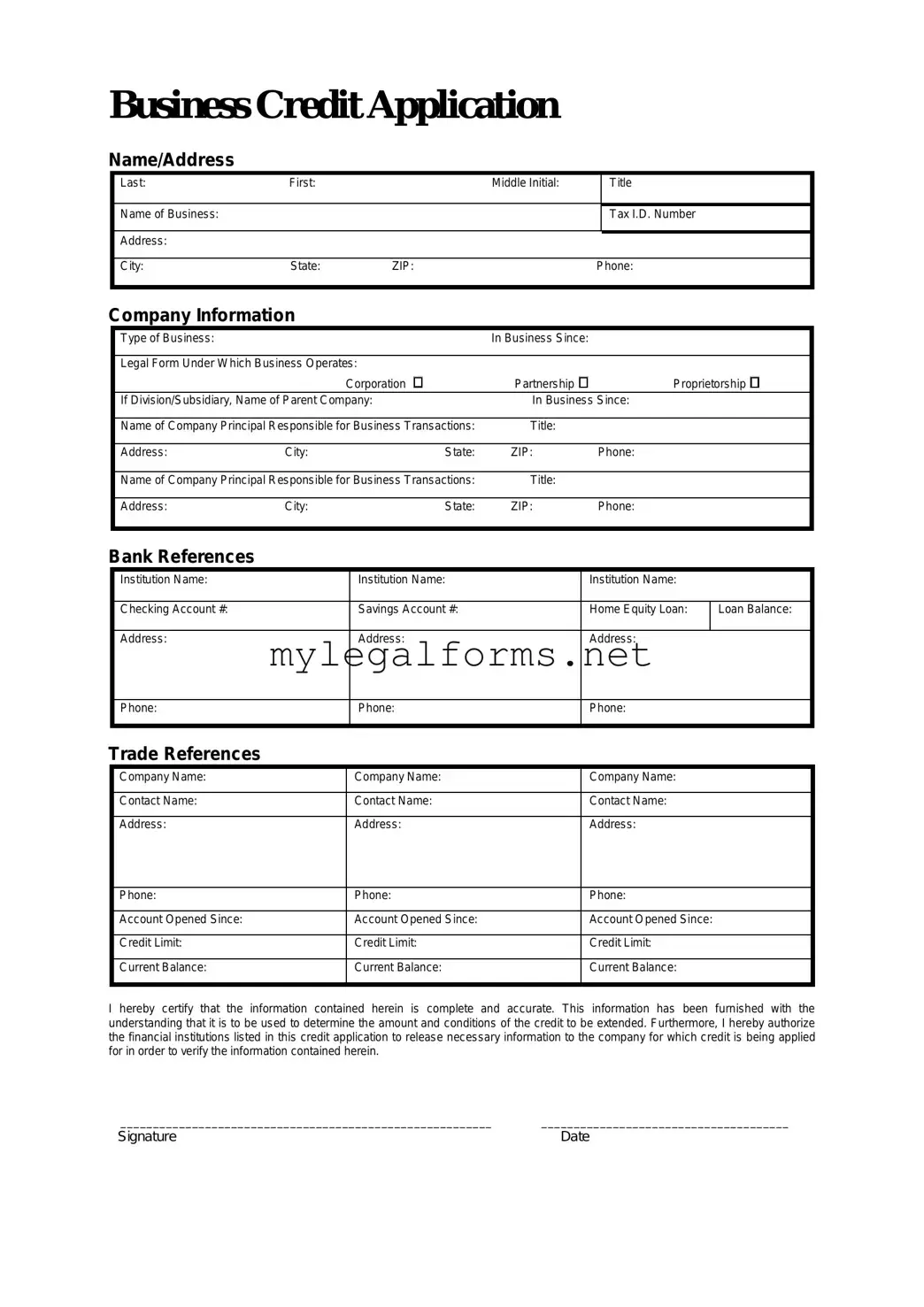

Business Credit Application Template

The Business Credit Application form is a crucial document that allows businesses to apply for credit from suppliers or lenders. This form collects essential information about the company's financial health and creditworthiness. Completing it accurately can open doors to valuable financing opportunities.

Launch Business Credit Application Editor

Business Credit Application Template

Launch Business Credit Application Editor

Launch Business Credit Application Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Business Credit Application online and download the final version.