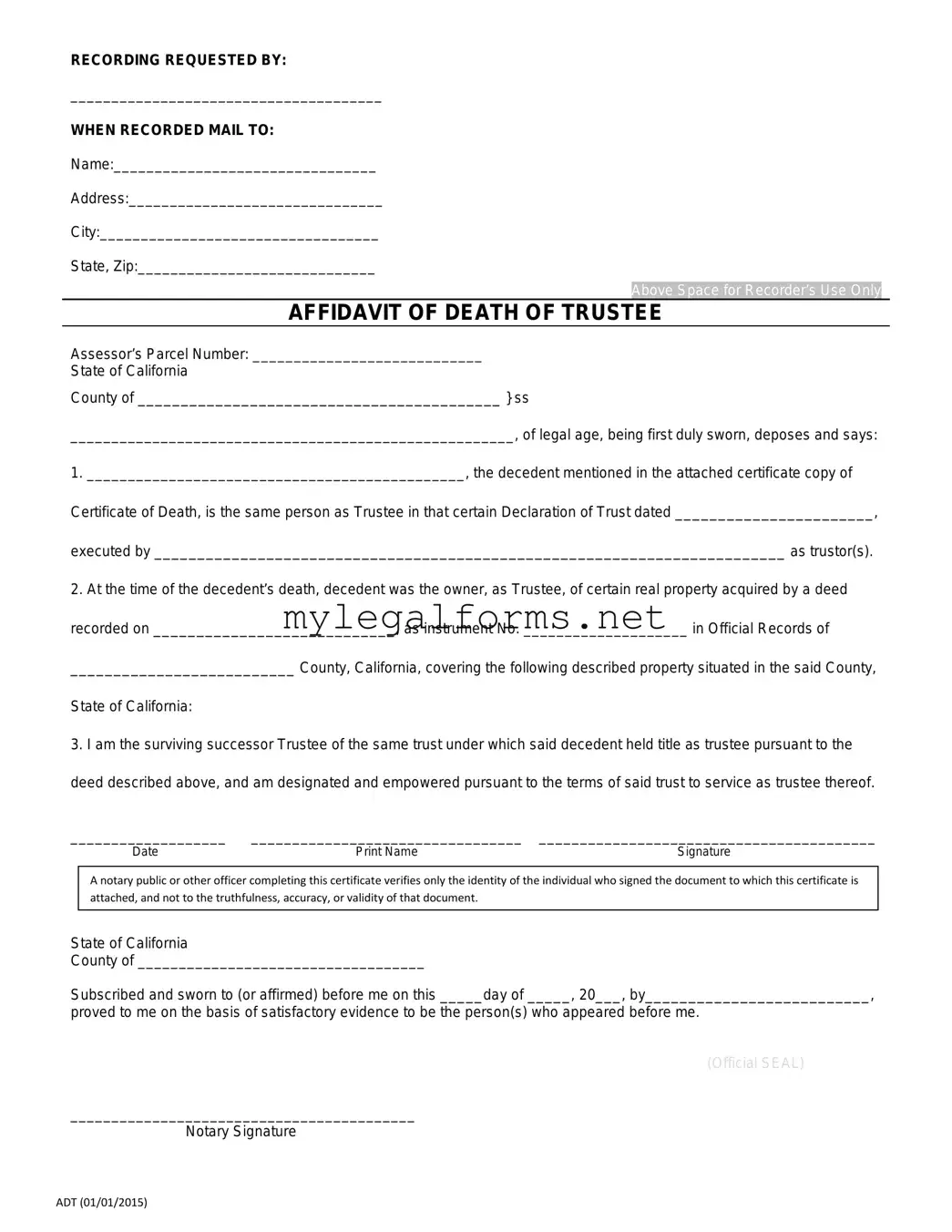

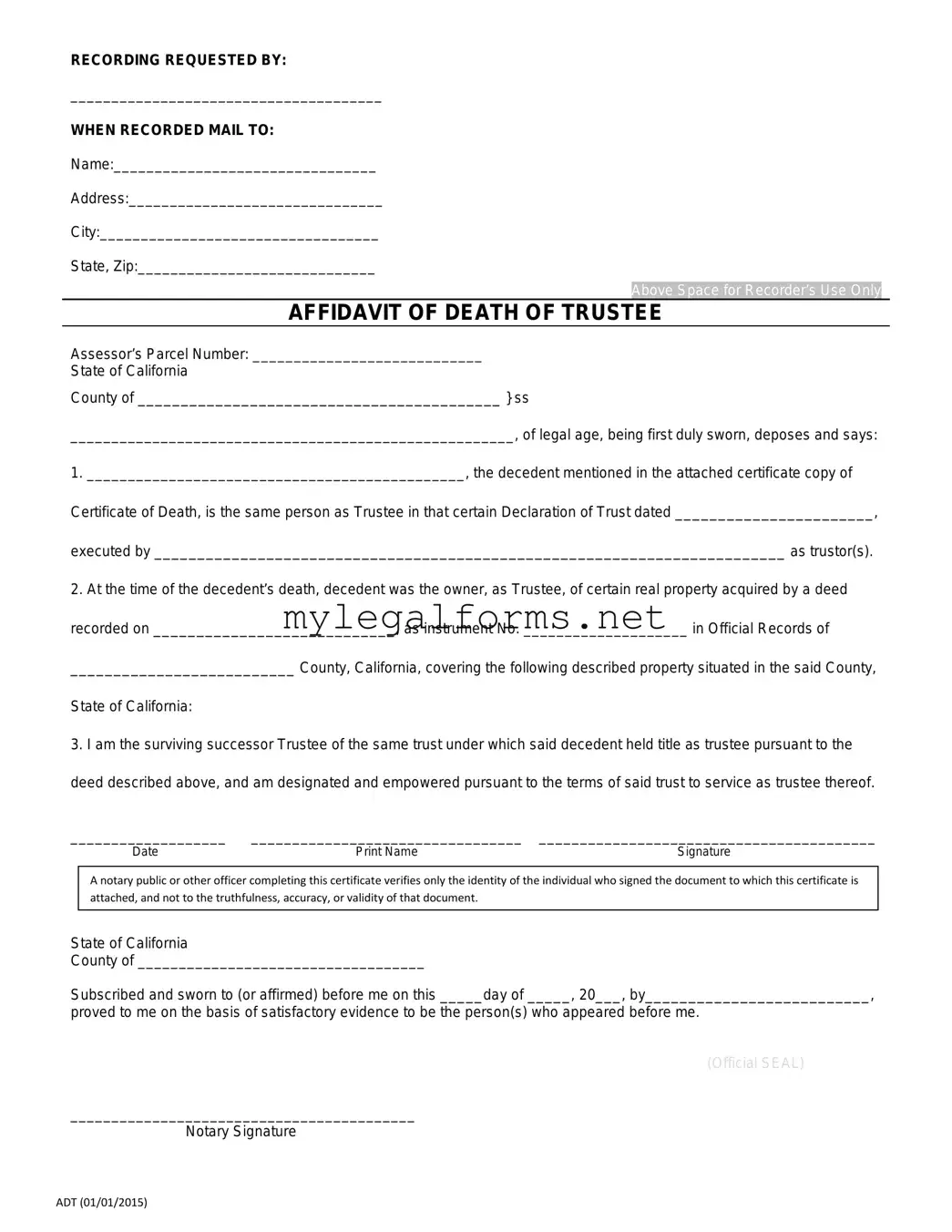

California Affidavit of Death of a Trustee Template

The California Affidavit of Death of a Trustee form is a legal document used to formally declare the death of a trustee in a trust arrangement. This affidavit serves as an official record, allowing the remaining trustees or beneficiaries to manage the trust's assets and ensure a smooth transition of responsibilities. Understanding this form is essential for those involved in estate planning or trust administration in California.

Launch California Affidavit of Death of a Trustee Editor

California Affidavit of Death of a Trustee Template

Launch California Affidavit of Death of a Trustee Editor

Launch California Affidavit of Death of a Trustee Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your California Affidavit of Death of a Trustee online and download the final version.