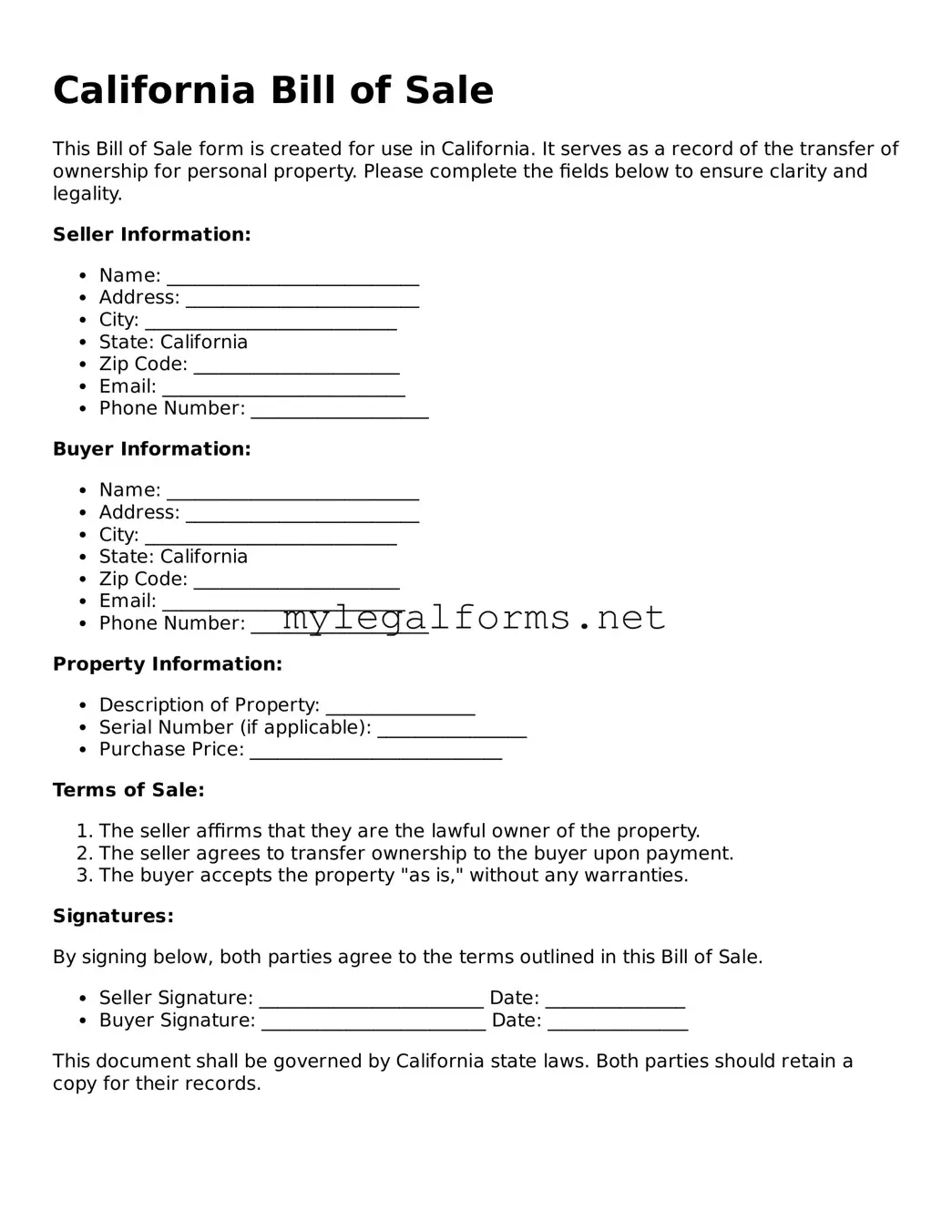

Filling out the California Bill of Sale form can seem straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is failing to include all necessary information. This includes the names and addresses of both the buyer and the seller, as well as a complete description of the item being sold. Omitting any of this information can render the document incomplete.

Another mistake is not providing the correct date of the transaction. The date is crucial for establishing the timeline of ownership and can affect the legal standing of the sale. Ensure that the date is clearly written and corresponds with the actual transaction date.

People often overlook the importance of signatures. Both the buyer and the seller must sign the Bill of Sale for it to be valid. Neglecting to obtain a signature can lead to disputes later on regarding the legitimacy of the sale.

Inaccurate descriptions of the item being sold can also pose problems. Buyers need a clear understanding of what they are purchasing. Including details such as the make, model, year, and condition of the item can help avoid misunderstandings and potential legal issues.

Another common mistake involves not retaining copies of the Bill of Sale. Both parties should keep a signed copy for their records. This document serves as proof of the transaction and can be essential for future reference, especially if disputes arise.

Some individuals fail to check for any outstanding liens or obligations on the item being sold. If the item has a lien, the buyer may inherit financial responsibilities, which can complicate the sale. It's advisable to conduct a lien search prior to completing the transaction.

Not understanding the implications of the Bill of Sale can lead to further issues. This document serves as a legal record of the sale, and both parties should be aware of their rights and responsibilities. Ignorance of these details can result in disputes down the line.

People sometimes rush through the process, leading to careless mistakes. Taking the time to carefully review the form before submission can prevent errors that might otherwise complicate the transaction. Double-checking all entries can save time and effort in the long run.

Finally, neglecting to consult with a legal professional when needed can be a significant oversight. If there are any uncertainties about the Bill of Sale or the transaction itself, seeking advice can provide clarity and help avoid potential pitfalls.