Gift Deed Document for California State

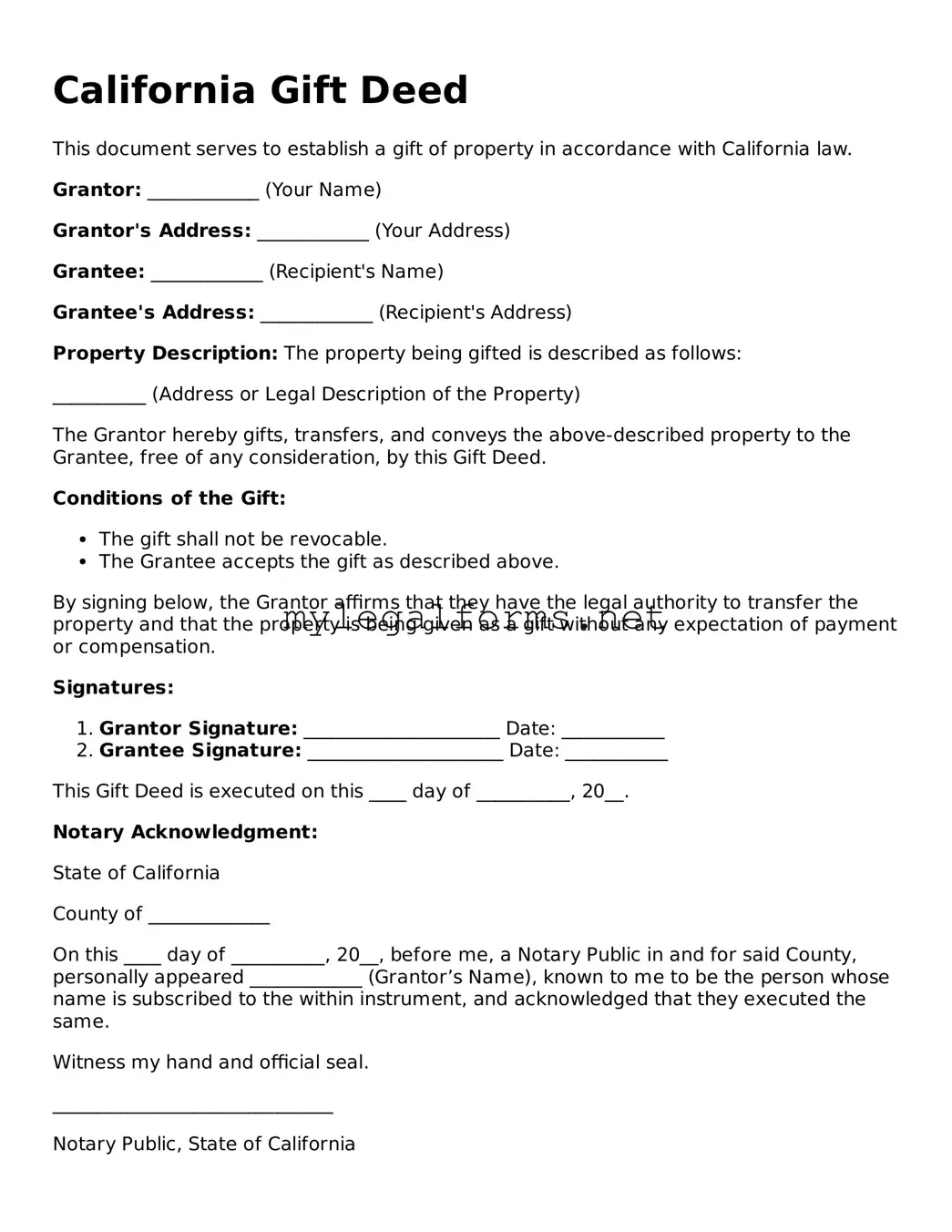

A California Gift Deed form is a legal document used to transfer property ownership from one individual to another without any exchange of money. This form ensures that the transfer is recognized by the state and provides a clear record of the gift. Understanding the nuances of this document can help both givers and receivers navigate the process smoothly.

Launch Gift Deed Editor

Gift Deed Document for California State

Launch Gift Deed Editor

Launch Gift Deed Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Gift Deed online and download the final version.