Loan Agreement Document for California State

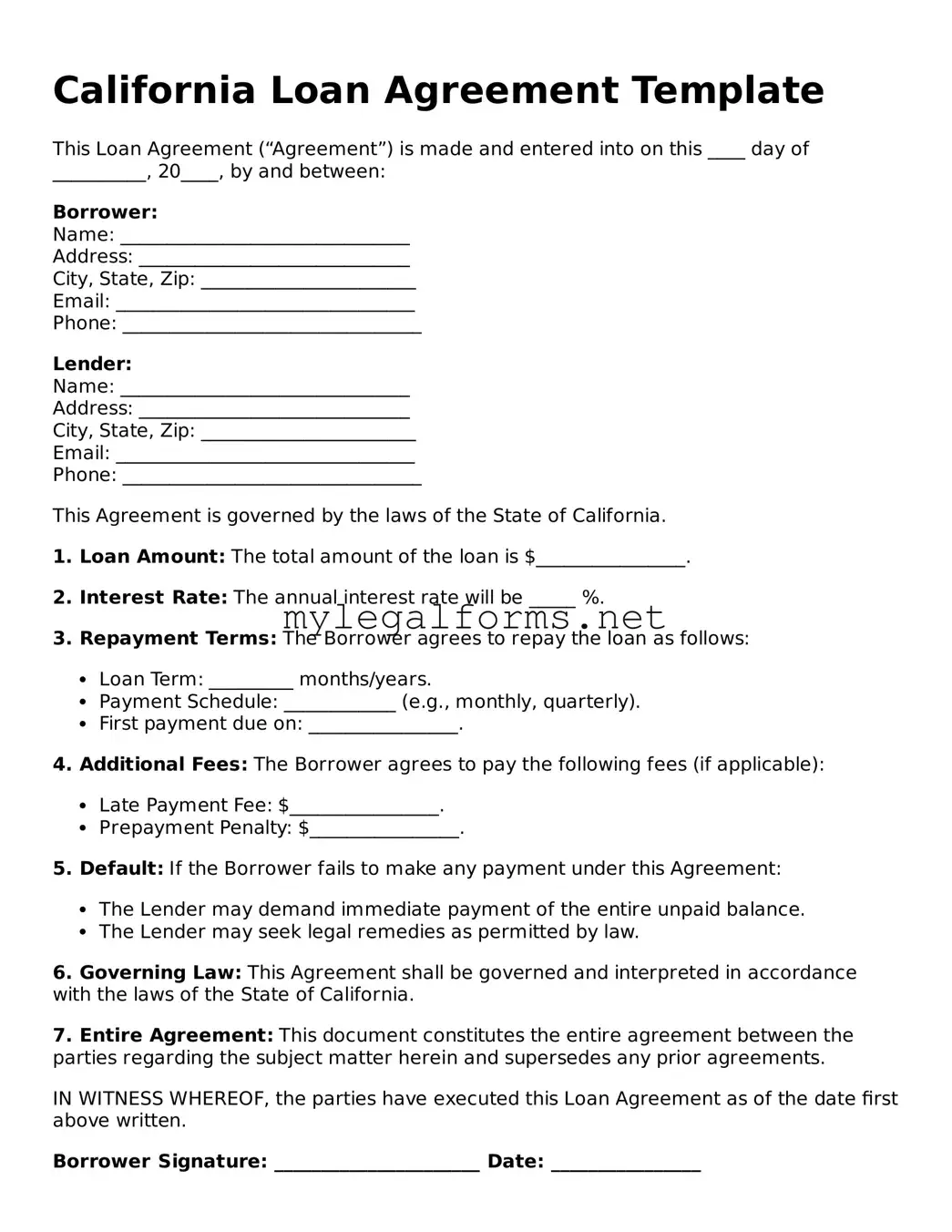

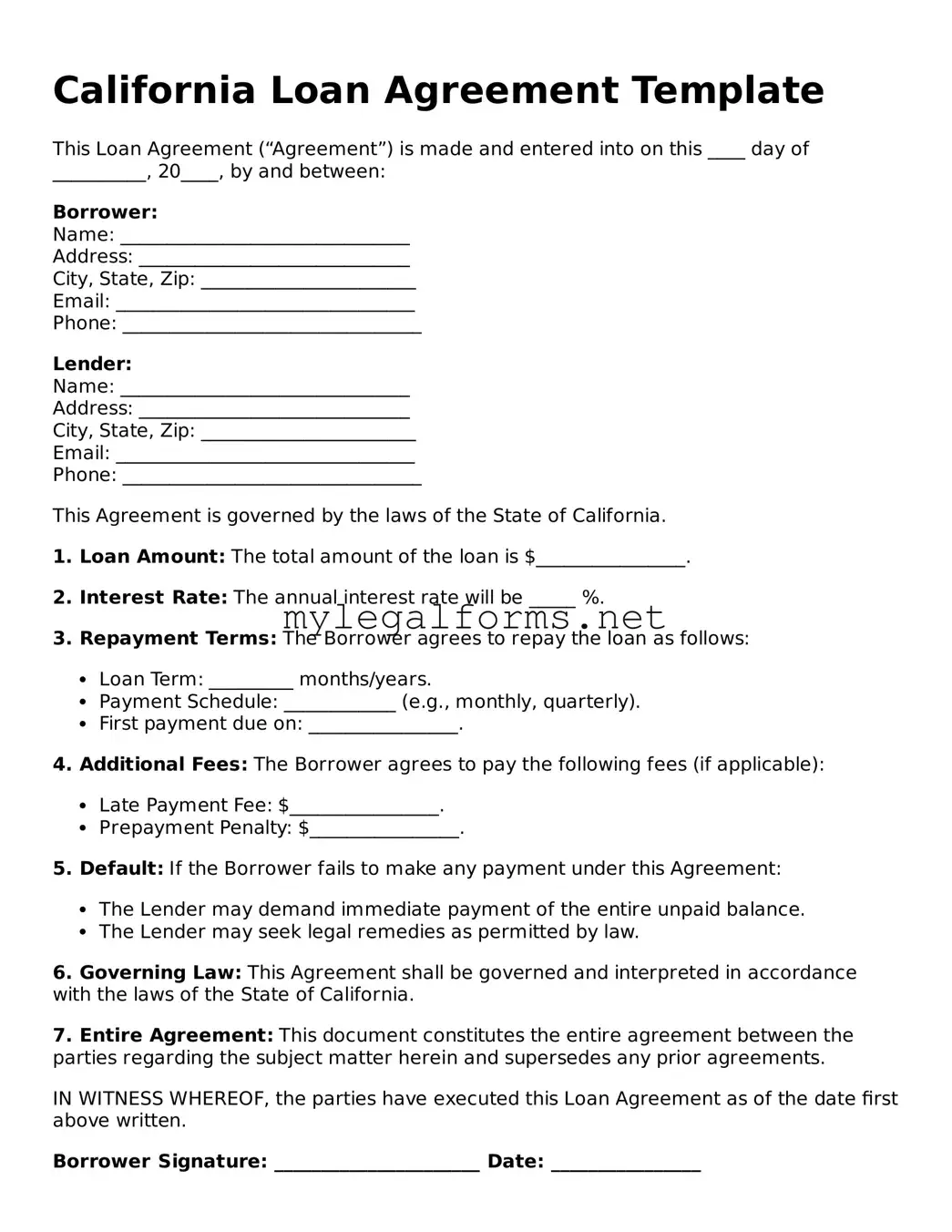

A California Loan Agreement form is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender. This form serves as a crucial tool for both parties, ensuring clarity and protection throughout the lending process. Understanding its components is essential for anyone involved in a loan transaction in California.

Launch Loan Agreement Editor

Loan Agreement Document for California State

Launch Loan Agreement Editor

Launch Loan Agreement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Loan Agreement online and download the final version.