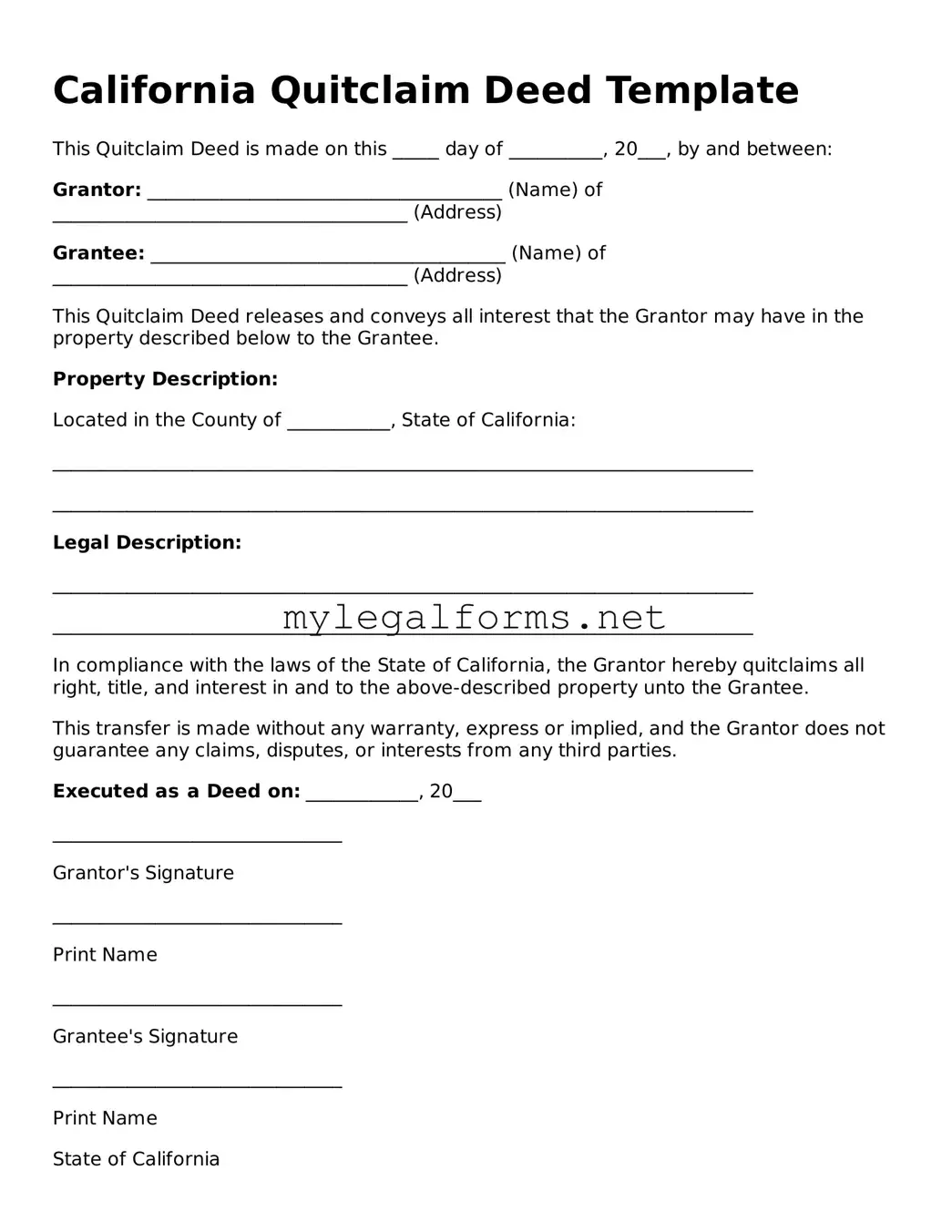

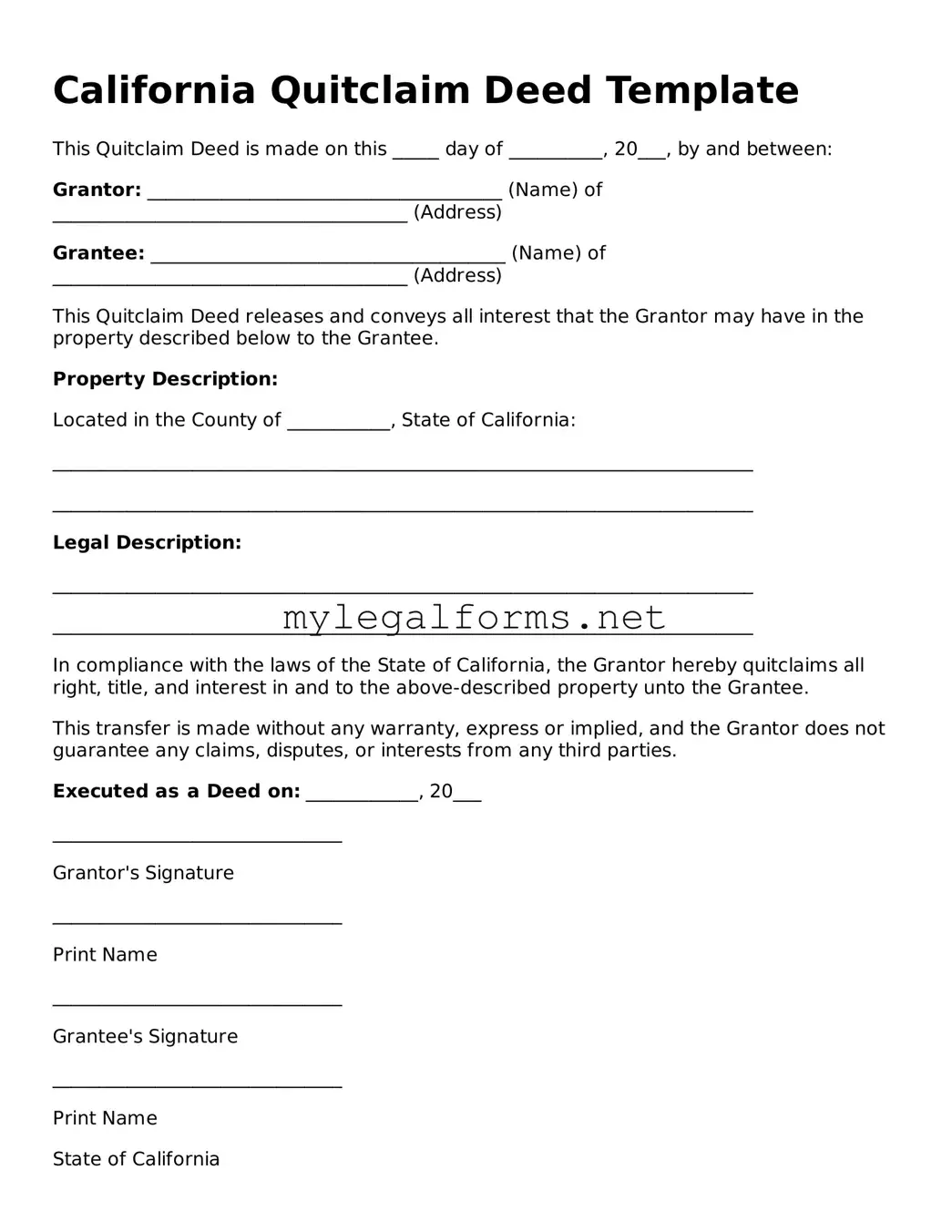

California Quitclaim Deed Template

This Quitclaim Deed is made on this _____ day of __________, 20___, by and between:

Grantor: ______________________________________ (Name) of ______________________________________ (Address)

Grantee: ______________________________________ (Name) of ______________________________________ (Address)

This Quitclaim Deed releases and conveys all interest that the Grantor may have in the property described below to the Grantee.

Property Description:

Located in the County of ___________, State of California:

___________________________________________________________________________

___________________________________________________________________________

Legal Description:

___________________________________________________________________________

___________________________________________________________________________

In compliance with the laws of the State of California, the Grantor hereby quitclaims all right, title, and interest in and to the above-described property unto the Grantee.

This transfer is made without any warranty, express or implied, and the Grantor does not guarantee any claims, disputes, or interests from any third parties.

Executed as a Deed on: ____________, 20___

_______________________________

Grantor's Signature

_______________________________

Print Name

_______________________________

Grantee's Signature

_______________________________

Print Name

State of California

County of ___________

On ____________________, before me, ___________________________________________________ (Name of Notary Public), a Notary Public, personally appeared __________________________________________ (Grantor's Name) and ______________________________________________ (Grantee's Name), who proved to me on the basis of satisfactory evidence to be the persons whose names are subscribed to the within instrument and acknowledged to me that they executed the same in their authorized capacities, and that by their signatures on the instrument, the persons, or the entity upon behalf of which the persons acted, executed the instrument.

I certify under penalty of perjury under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

_______________________________

Signature of Notary Public

Seal:

Feel free to fill in the blanks with the appropriate information. This template outlines the necessary components of a Quitclaim Deed for California and adheres to the state's legal requirements. Always consider consulting with a legal professional for guidance specific to your situation.