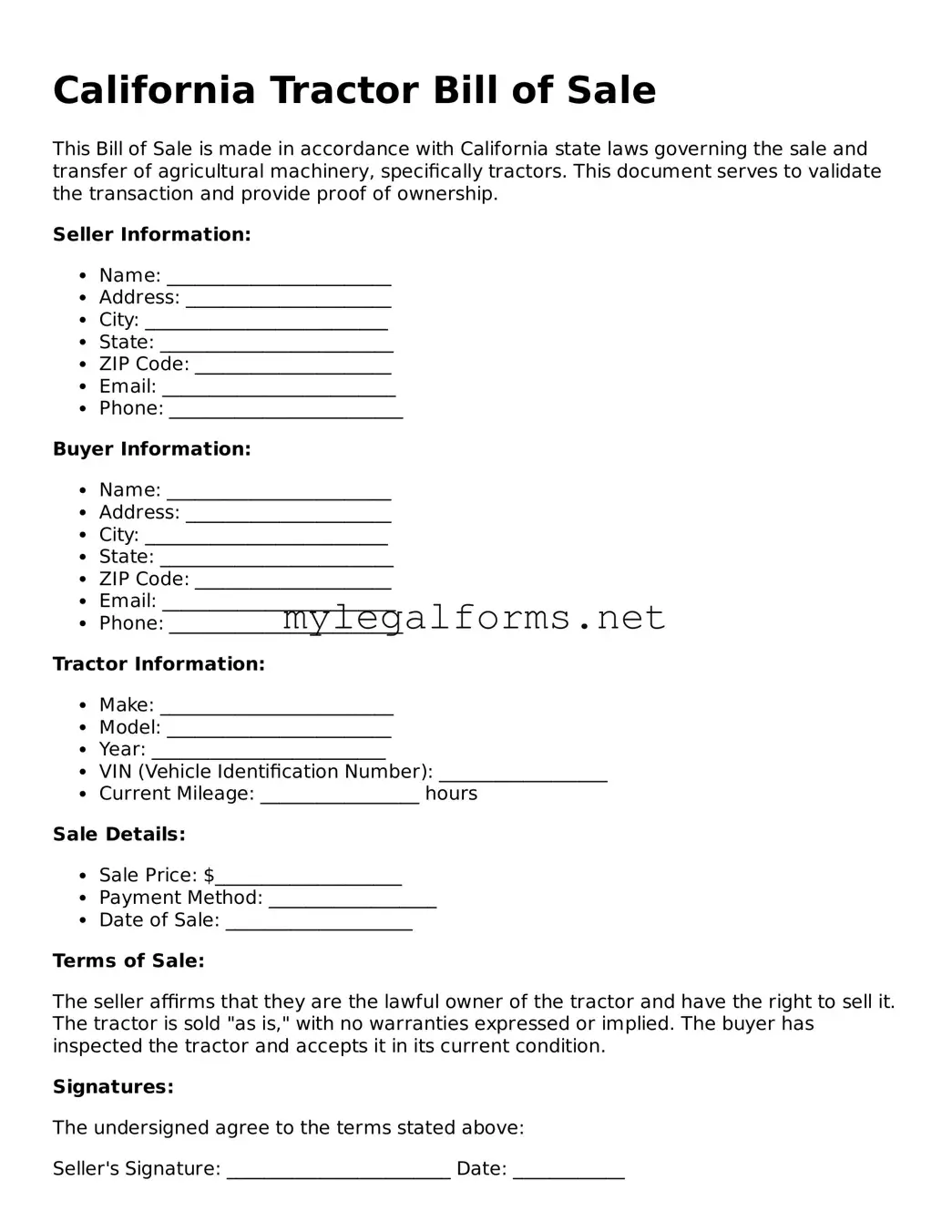

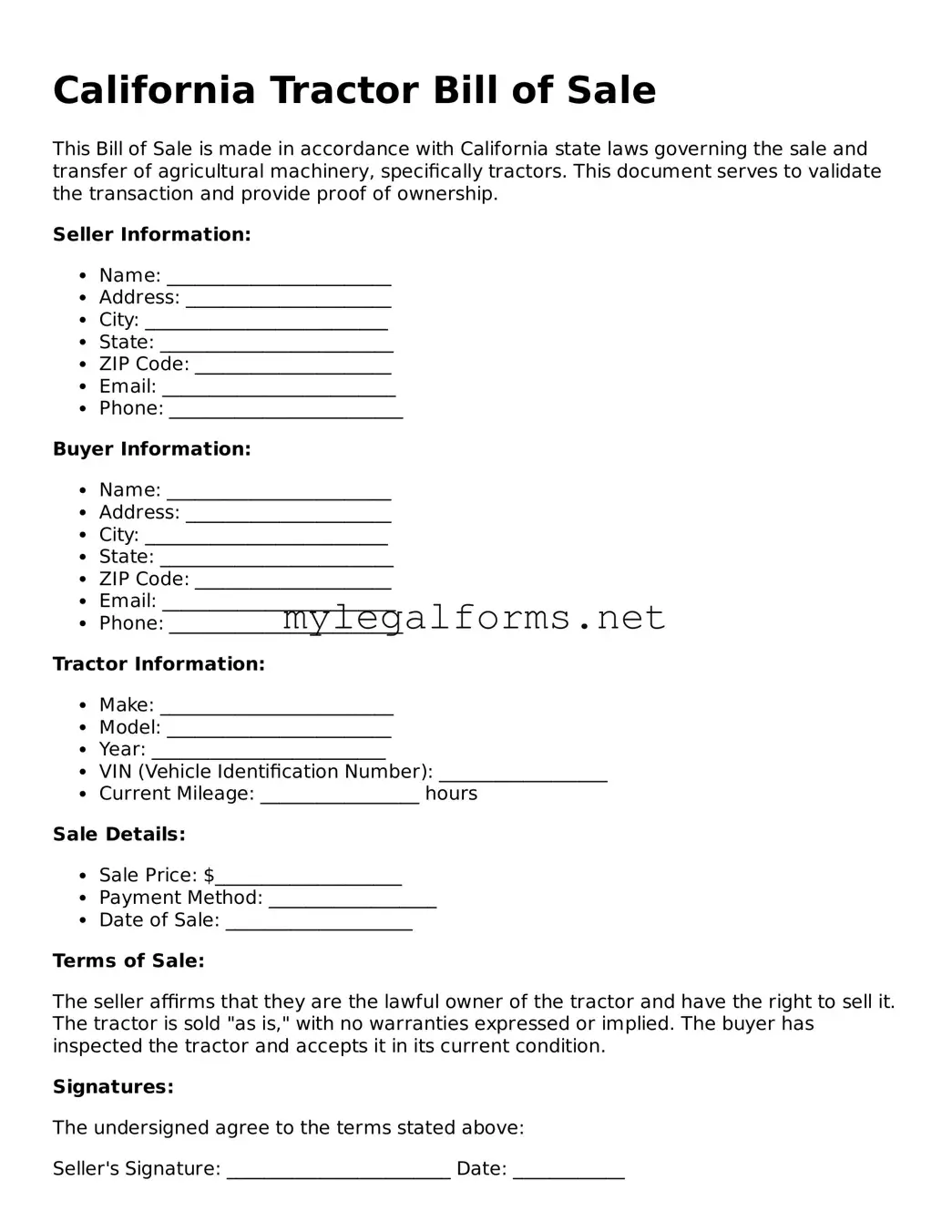

Tractor Bill of Sale Document for California State

The California Tractor Bill of Sale form is a legal document that facilitates the transfer of ownership for tractors in the state of California. This form serves as proof of the transaction between the seller and the buyer, detailing essential information about the tractor and the parties involved. Understanding this document is crucial for anyone looking to buy or sell a tractor in California.

Launch Tractor Bill of Sale Editor

Tractor Bill of Sale Document for California State

Launch Tractor Bill of Sale Editor

Launch Tractor Bill of Sale Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Tractor Bill of Sale online and download the final version.