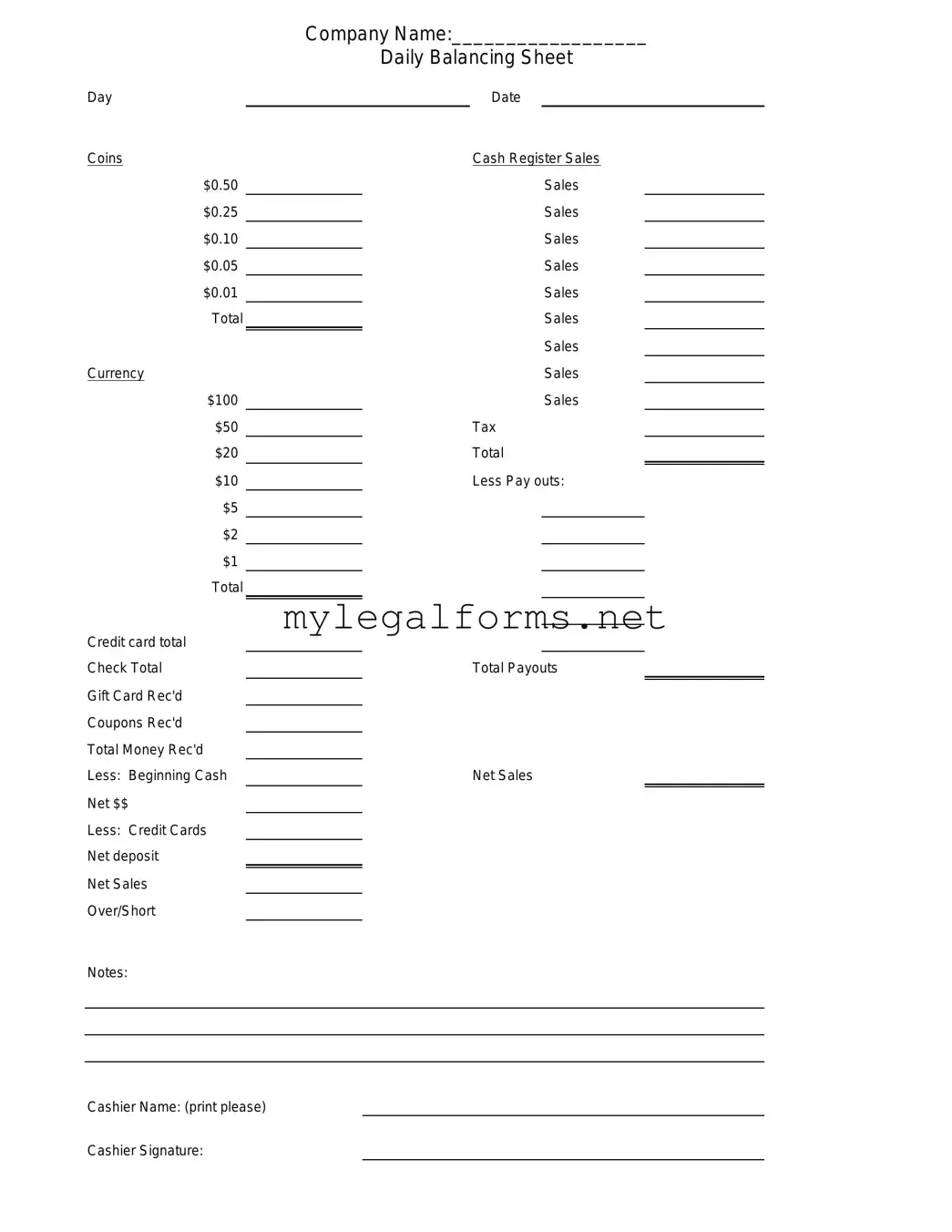

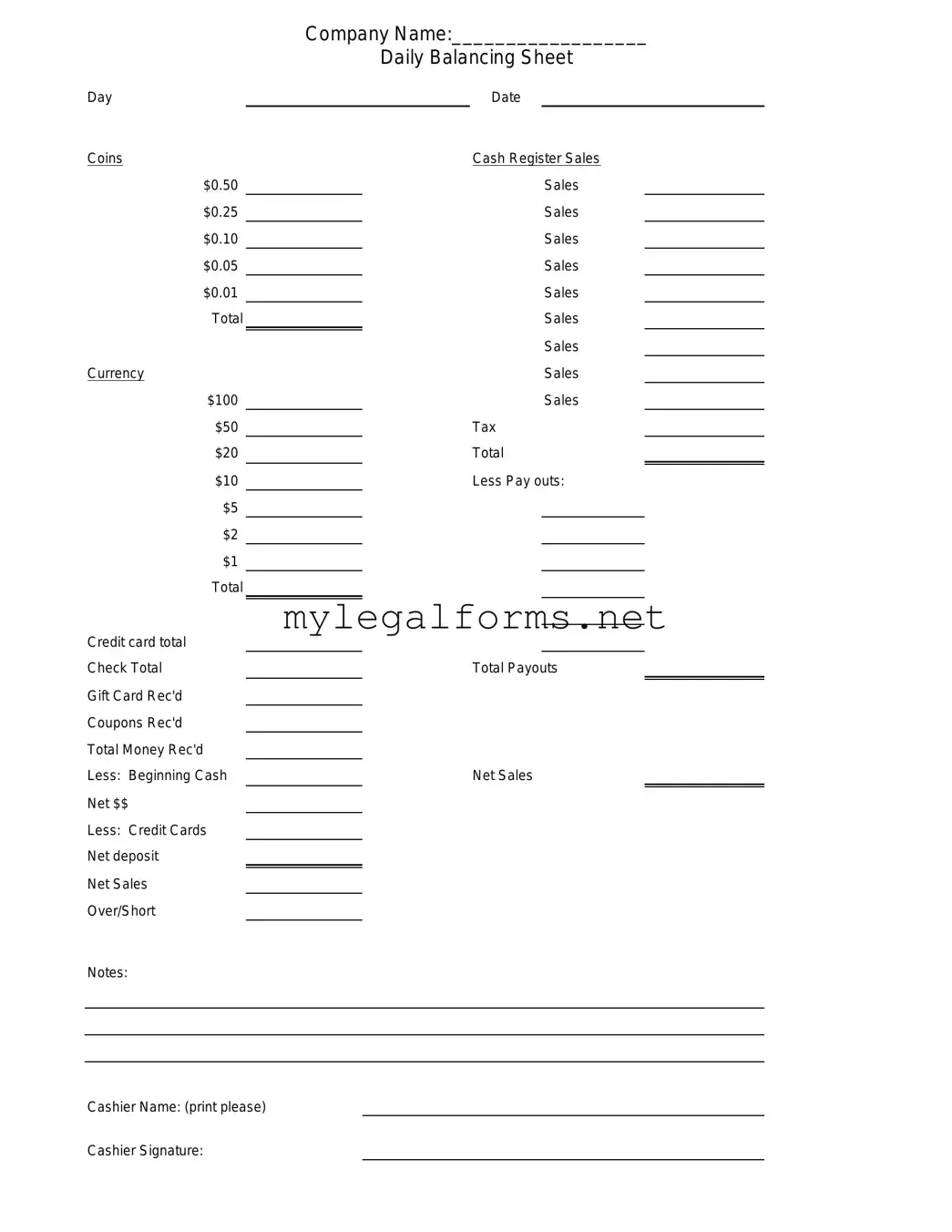

Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is a vital tool used by businesses to accurately track cash transactions and ensure financial accountability. This form helps in documenting the amount of cash present in the drawer at the beginning and end of each shift, facilitating easy reconciliation. By maintaining accurate records, businesses can prevent discrepancies and enhance overall financial management.

Launch Cash Drawer Count Sheet Editor

Cash Drawer Count Sheet Template

Launch Cash Drawer Count Sheet Editor

Launch Cash Drawer Count Sheet Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Cash Drawer Count Sheet online and download the final version.