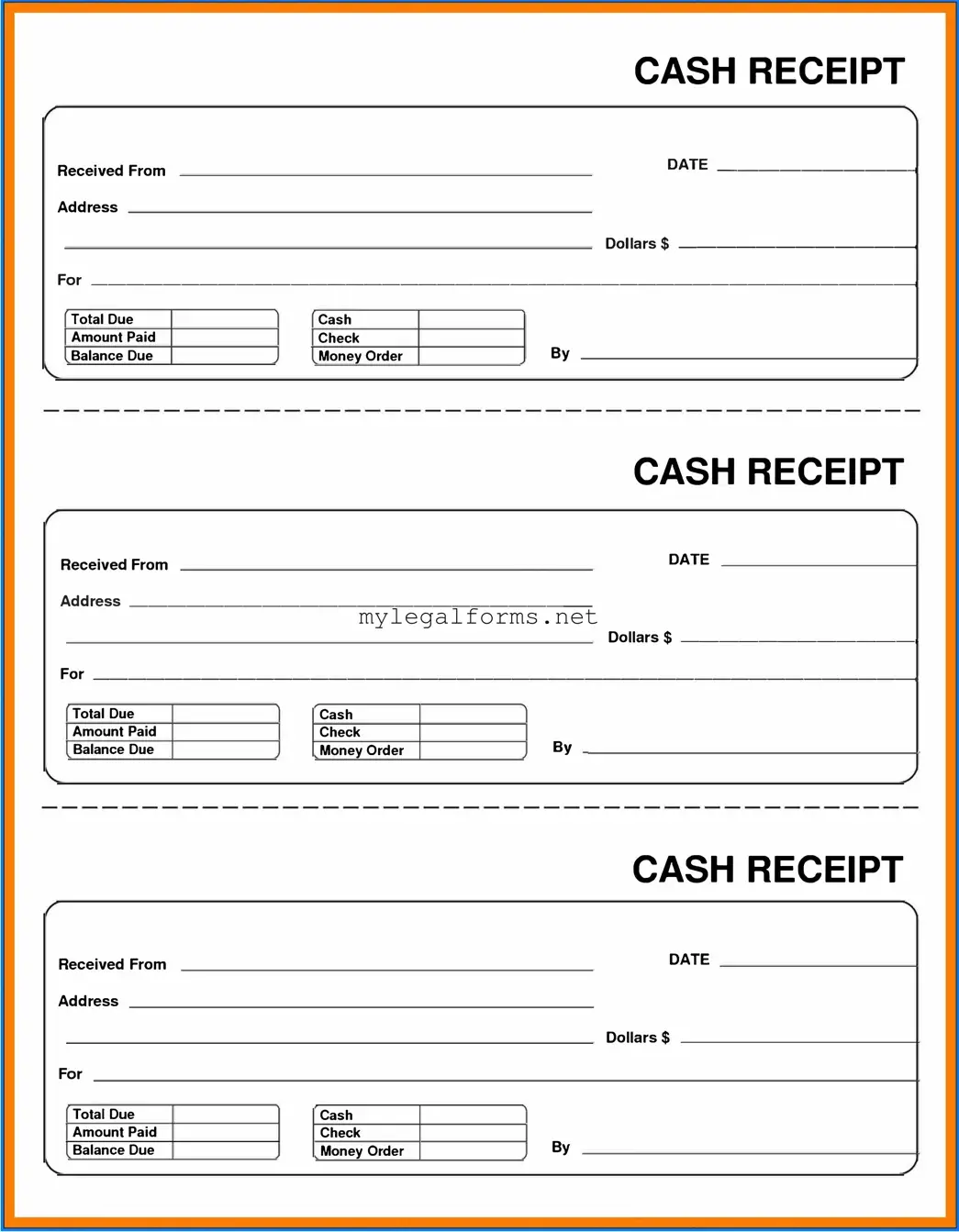

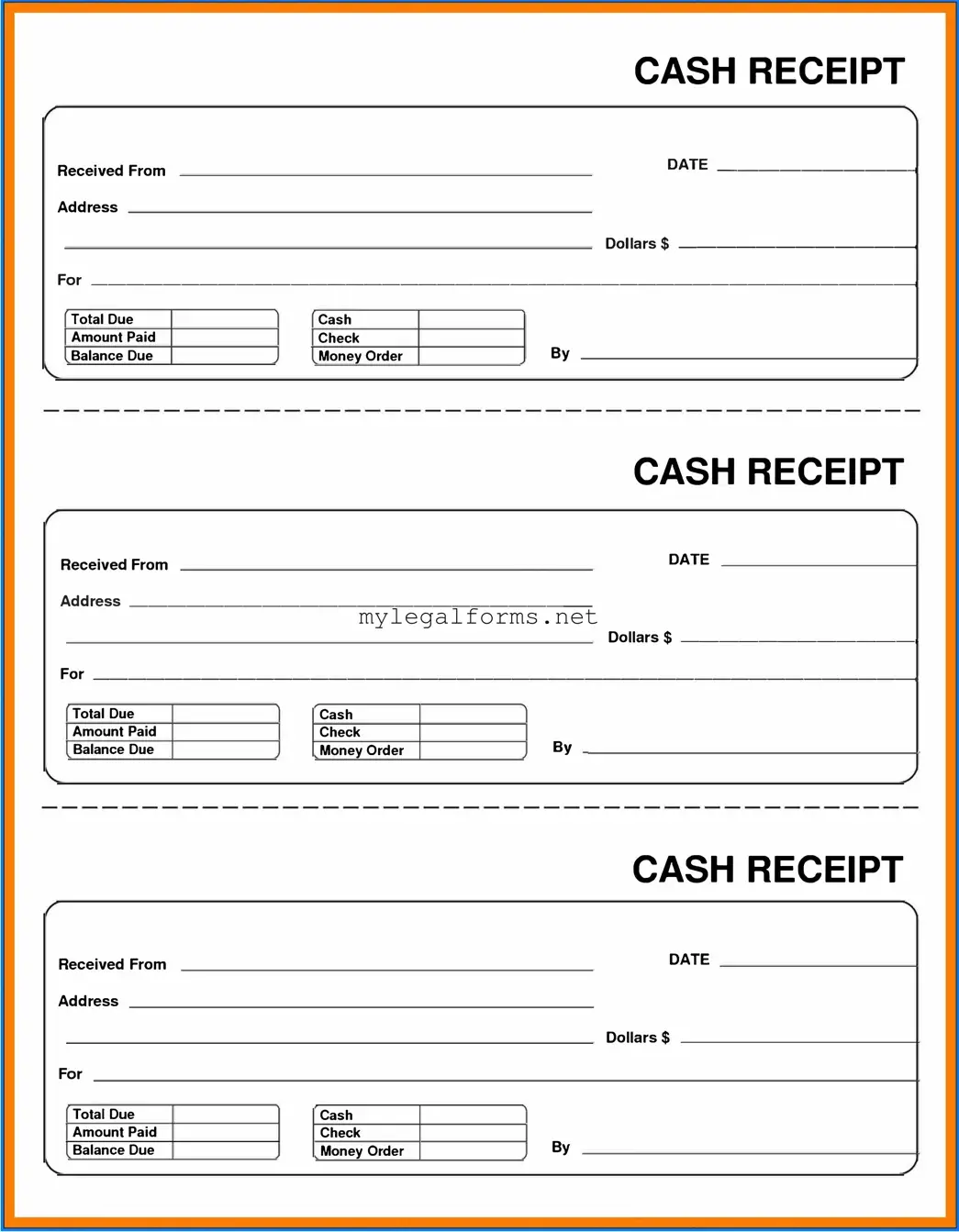

Filling out a Cash Receipt form may seem straightforward, but many individuals make common mistakes that can lead to confusion and errors in record-keeping. One prevalent mistake is failing to provide complete information. Each section of the form is designed to capture specific details, such as the date, amount, and purpose of the transaction. Omitting any of this information can result in discrepancies that complicate financial tracking.

Another frequent error involves incorrect calculations. When entering the amount received, it is crucial to double-check the figures. Simple arithmetic mistakes can lead to significant issues, especially when reconciling accounts later. A thorough review can prevent these errors from occurring.

People often neglect to sign the Cash Receipt form. A signature serves as a confirmation of the transaction and provides a level of accountability. Without a signature, the receipt may not hold up as valid documentation, which could pose problems in the future if questions arise regarding the transaction.

Additionally, using the wrong payment method can create confusion. For instance, if a payment was made via check but recorded as cash, this inconsistency can lead to misunderstandings during audits or financial reviews. It is essential to accurately represent the method of payment to maintain clear records.

Another mistake to be aware of is failing to keep a copy of the Cash Receipt form. Retaining a duplicate is crucial for personal records and for any future references. This practice not only aids in tracking but also provides evidence of the transaction should any disputes arise.

In some cases, individuals may rush through the process, leading to incomplete forms. Taking the time to carefully fill out each section can save time and effort later. A well-completed form minimizes the risk of errors and enhances the overall efficiency of financial management.

Finally, people sometimes overlook the importance of consistency in record-keeping. Each Cash Receipt form should follow the same format and style. Inconsistencies can create confusion and make it difficult to analyze financial data accurately. Establishing a standard procedure for completing these forms can enhance clarity and organization.