Cg 20 10 07 04 Liability Endorsement Template

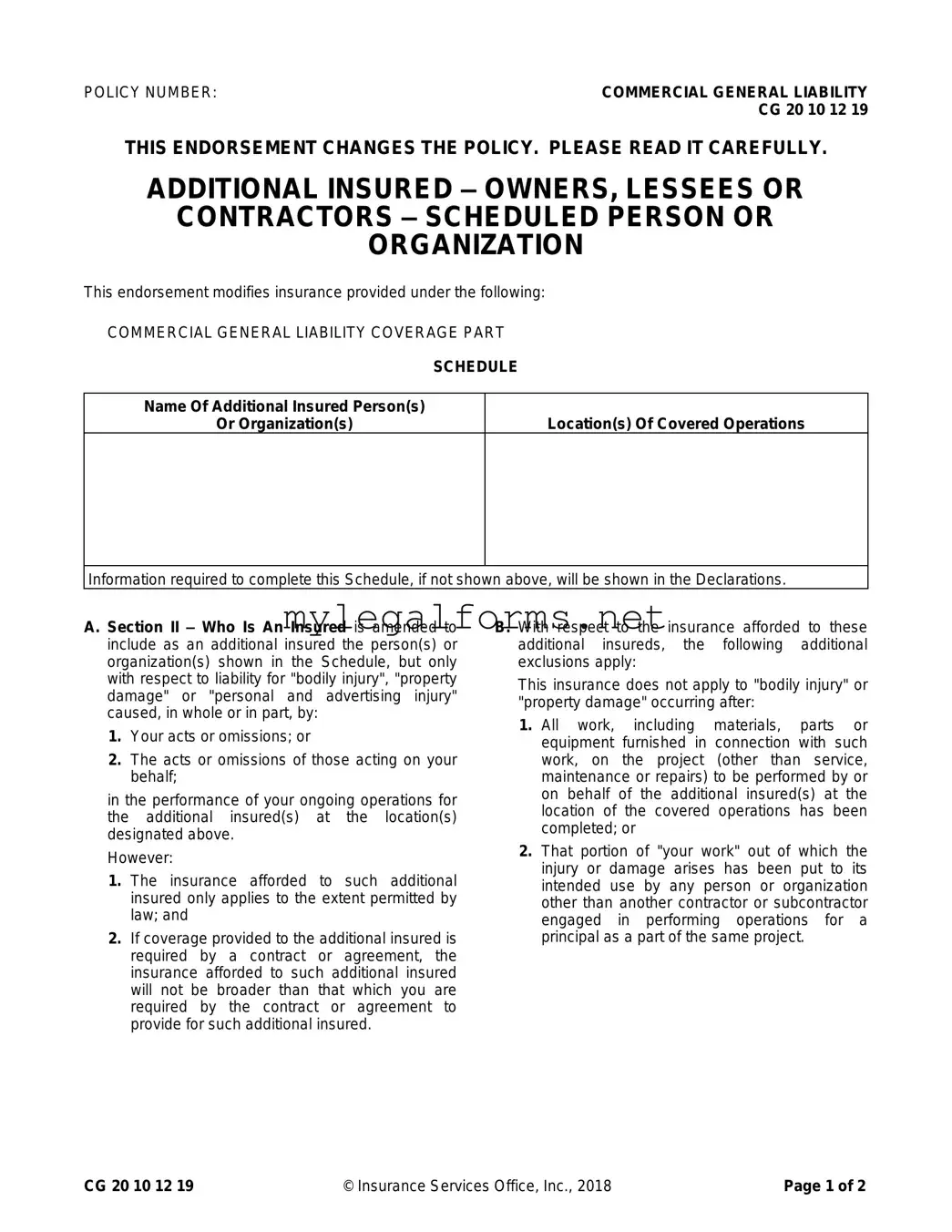

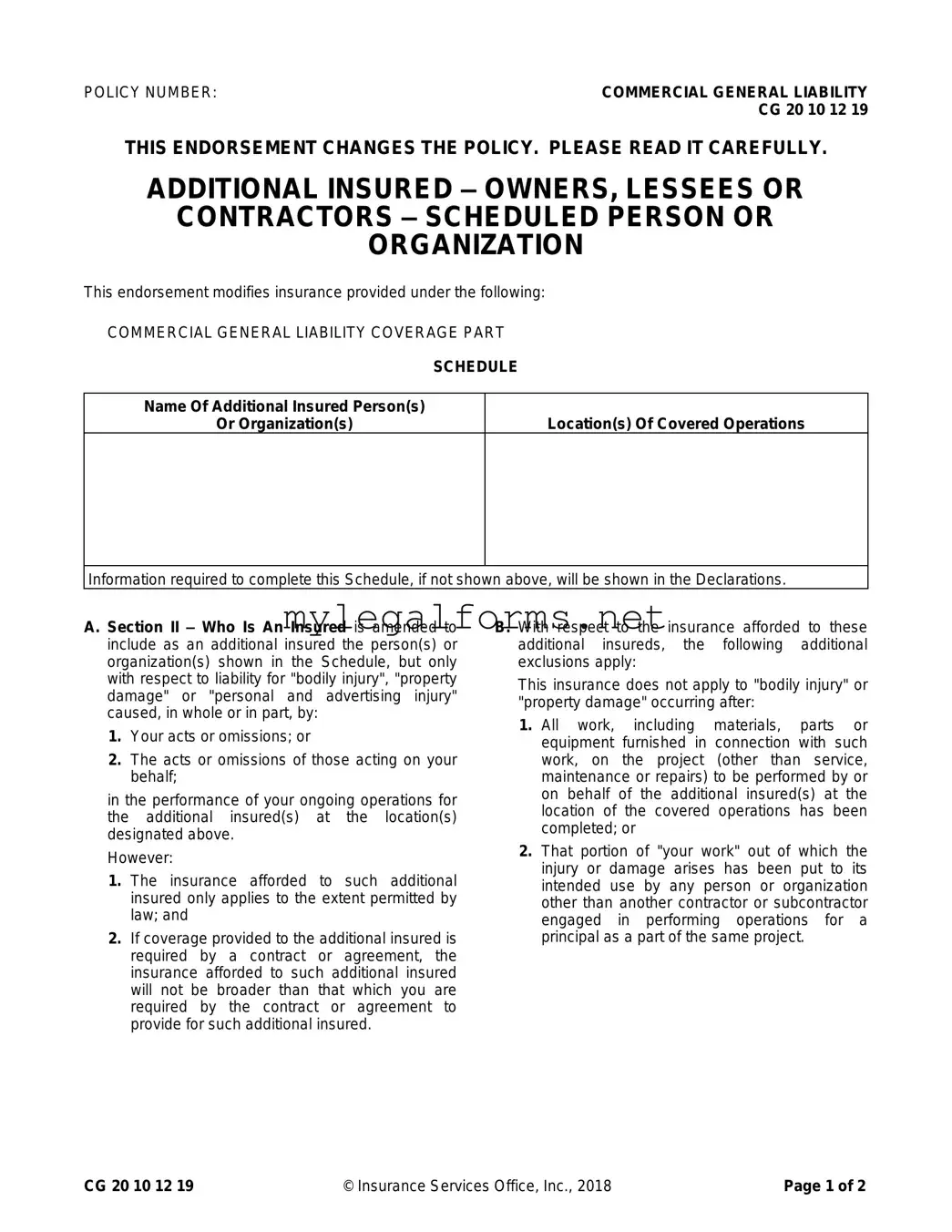

The CG 20 10 07 04 Liability Endorsement form is a document that modifies a Commercial General Liability policy to add specific individuals or organizations as additional insureds. This endorsement provides coverage for liability related to bodily injury, property damage, or personal and advertising injury caused by the named insured's actions or those acting on their behalf. It is essential to review the specific terms and limitations outlined in the endorsement to understand the scope of coverage provided.

Launch Cg 20 10 07 04 Liability Endorsement Editor

Cg 20 10 07 04 Liability Endorsement Template

Launch Cg 20 10 07 04 Liability Endorsement Editor

Launch Cg 20 10 07 04 Liability Endorsement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Cg 20 10 07 04 Liability Endorsement online and download the final version.