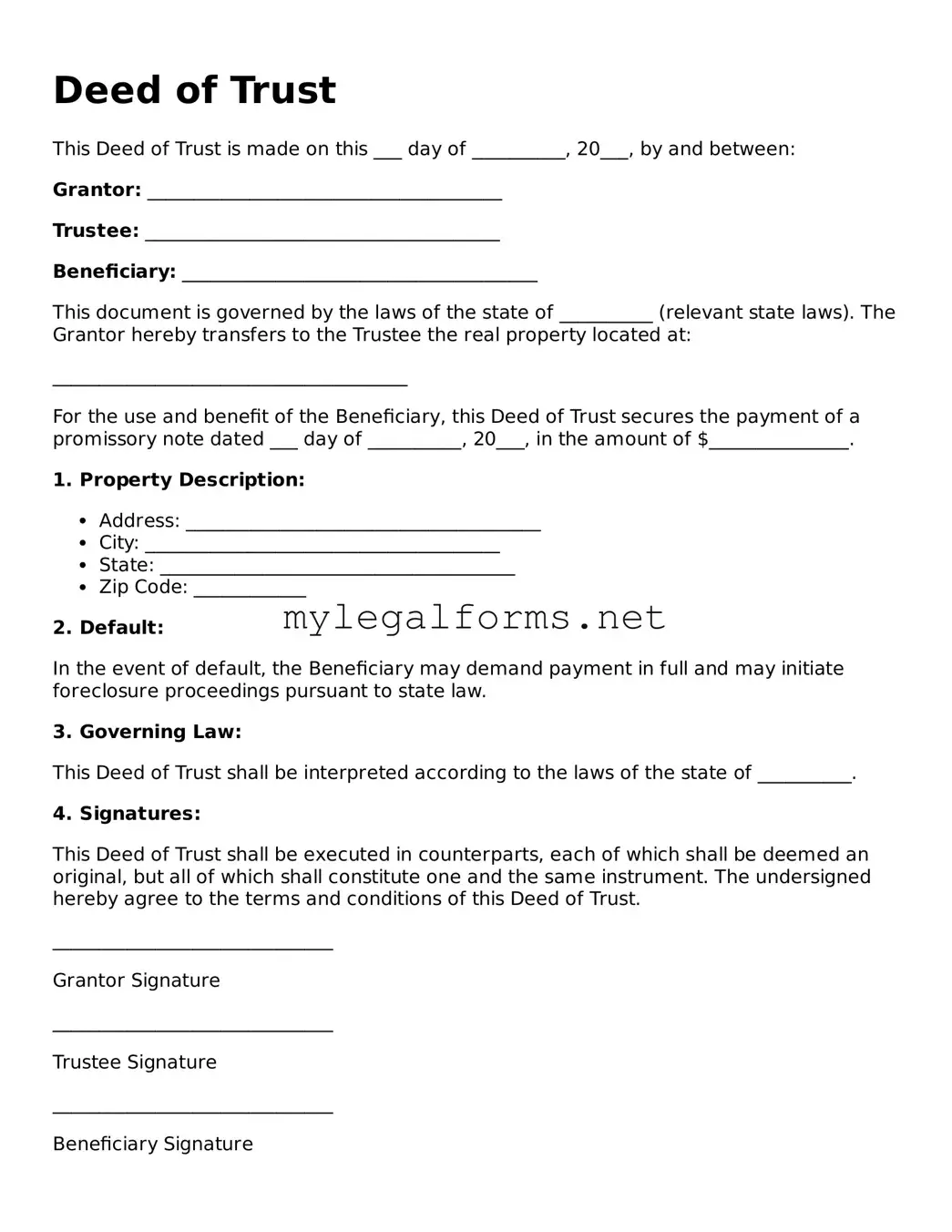

Attorney-Approved Deed of Trust Form

A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee until the borrower repays the debt. This arrangement protects both the lender and the borrower, ensuring that the lender can recover the loan amount in case of default. Understanding the implications and processes associated with a Deed of Trust is crucial for anyone involved in real estate transactions.

Launch Deed of Trust Editor

Attorney-Approved Deed of Trust Form

Launch Deed of Trust Editor

Launch Deed of Trust Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Deed of Trust online and download the final version.