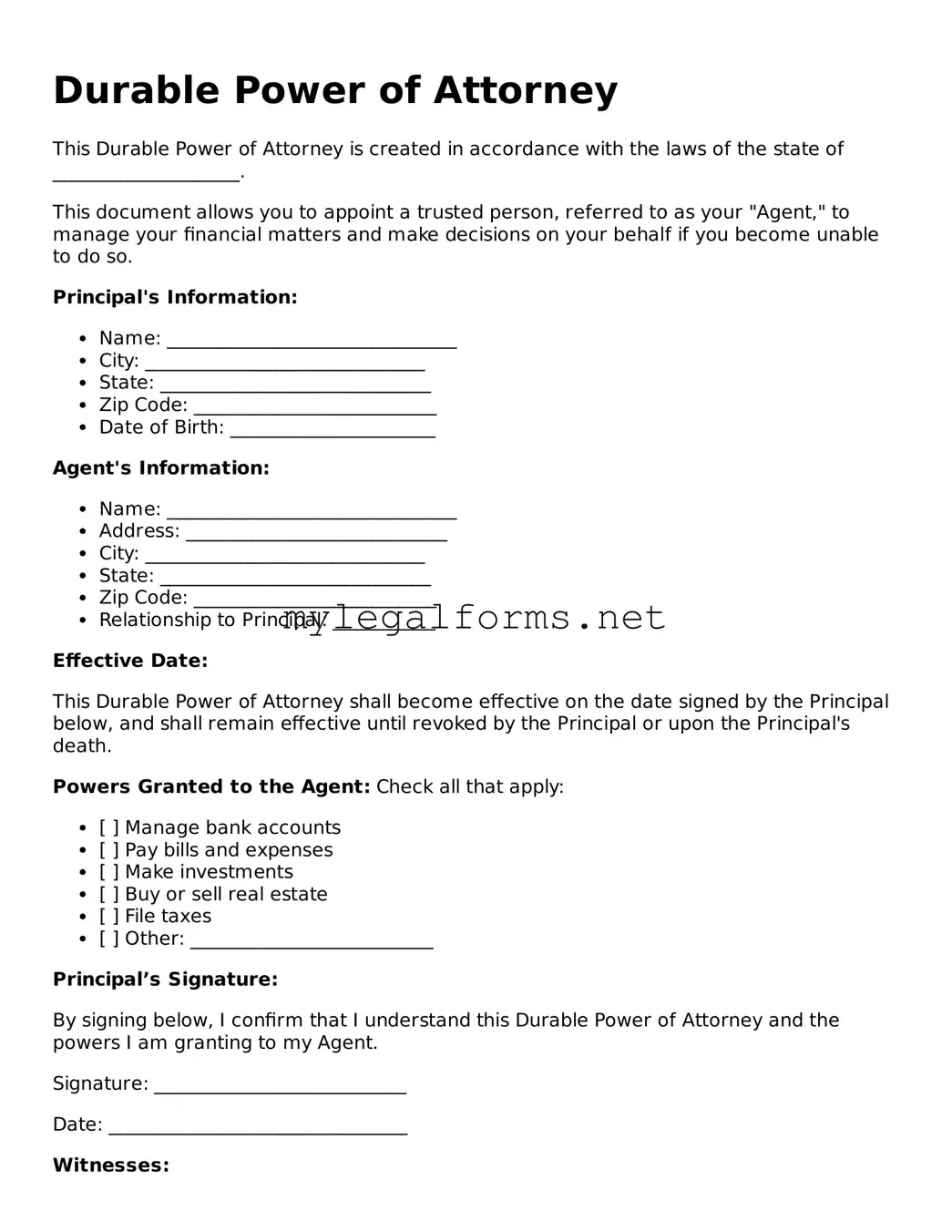

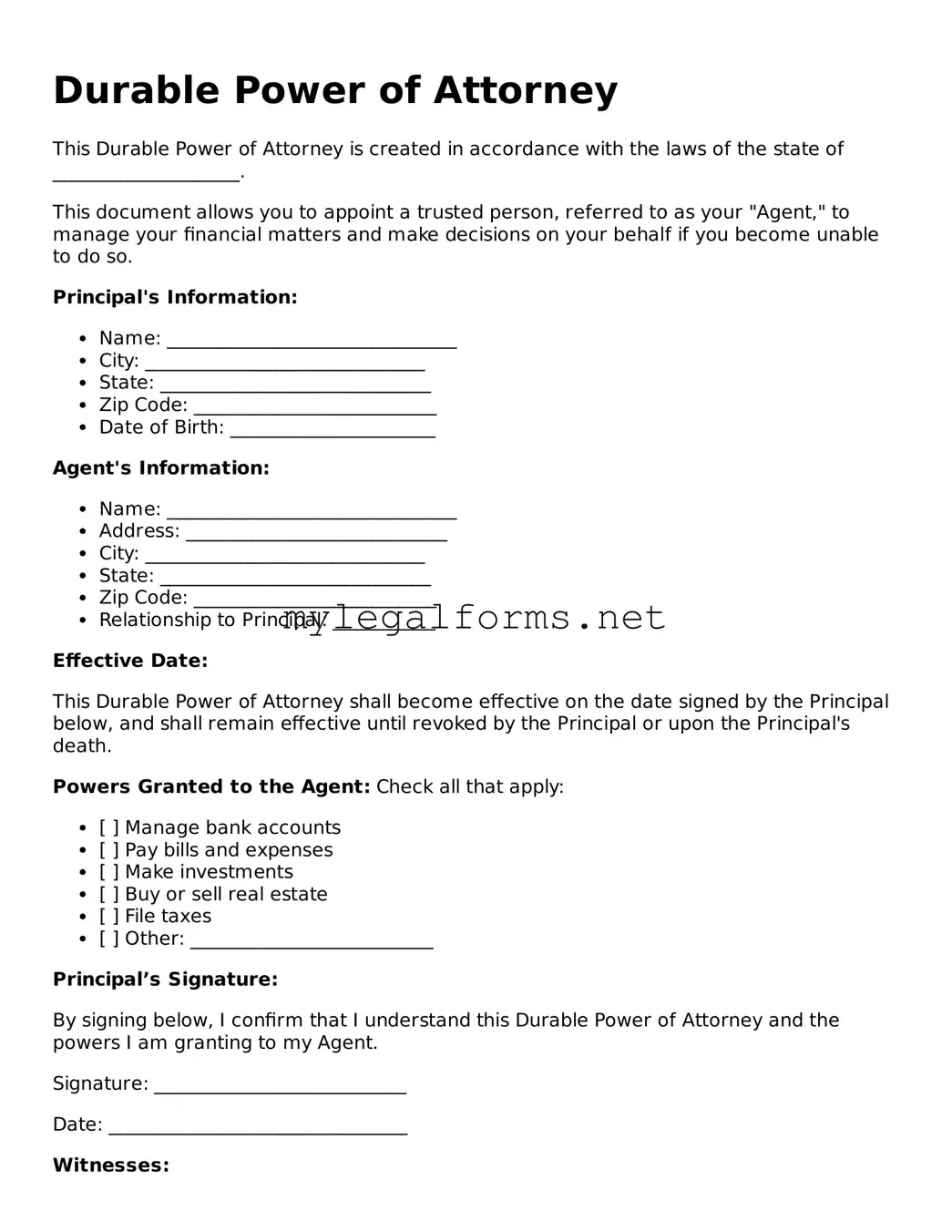

Attorney-Approved Durable Power of Attorney Form

A Durable Power of Attorney is a legal document that allows you to designate someone to make decisions on your behalf, particularly in financial or medical matters, should you become unable to do so yourself. This form remains effective even if you become incapacitated, ensuring that your wishes are honored. Understanding its importance can provide peace of mind for you and your loved ones.

Launch Durable Power of Attorney Editor

Attorney-Approved Durable Power of Attorney Form

Launch Durable Power of Attorney Editor

Launch Durable Power of Attorney Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Durable Power of Attorney online and download the final version.