Lady Bird Deed Document for Florida State

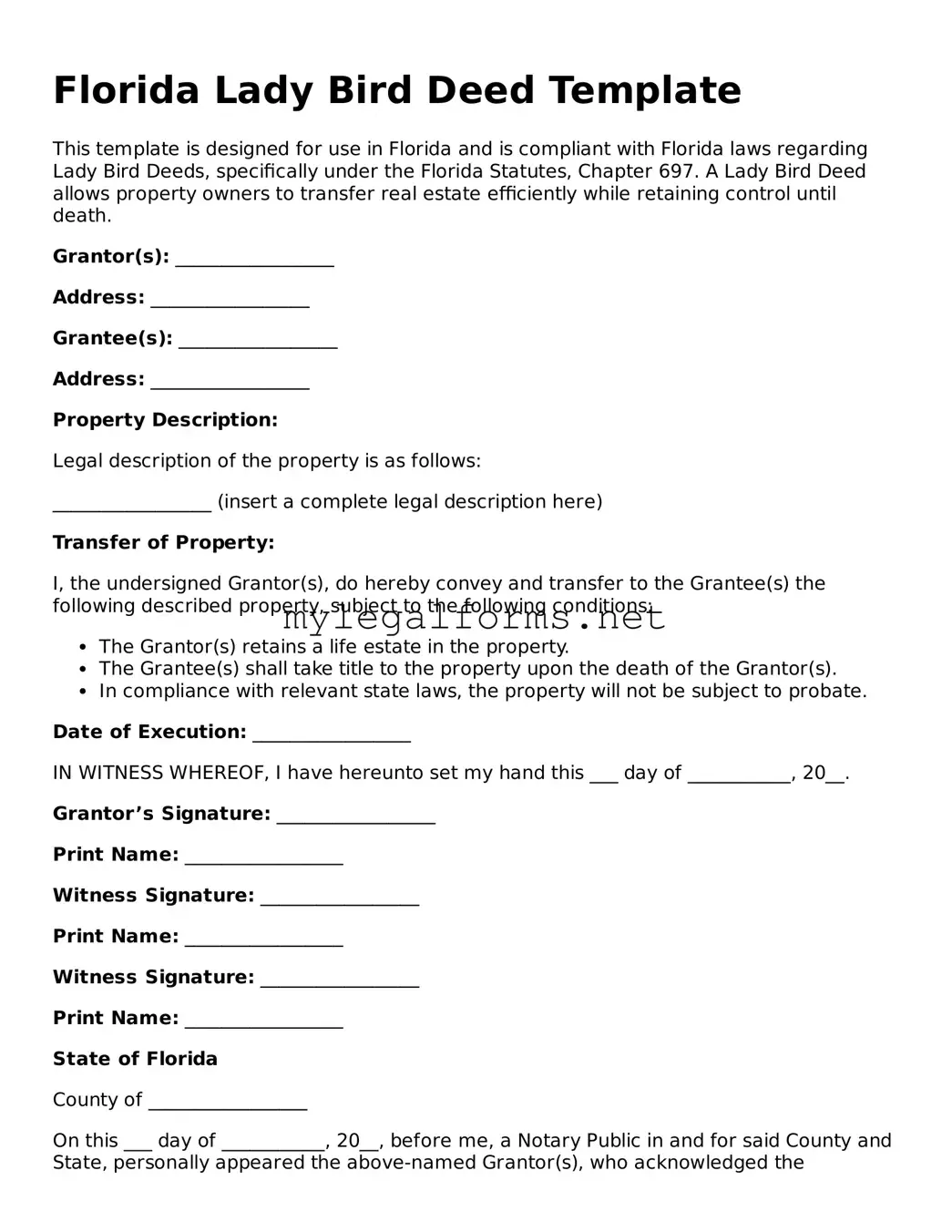

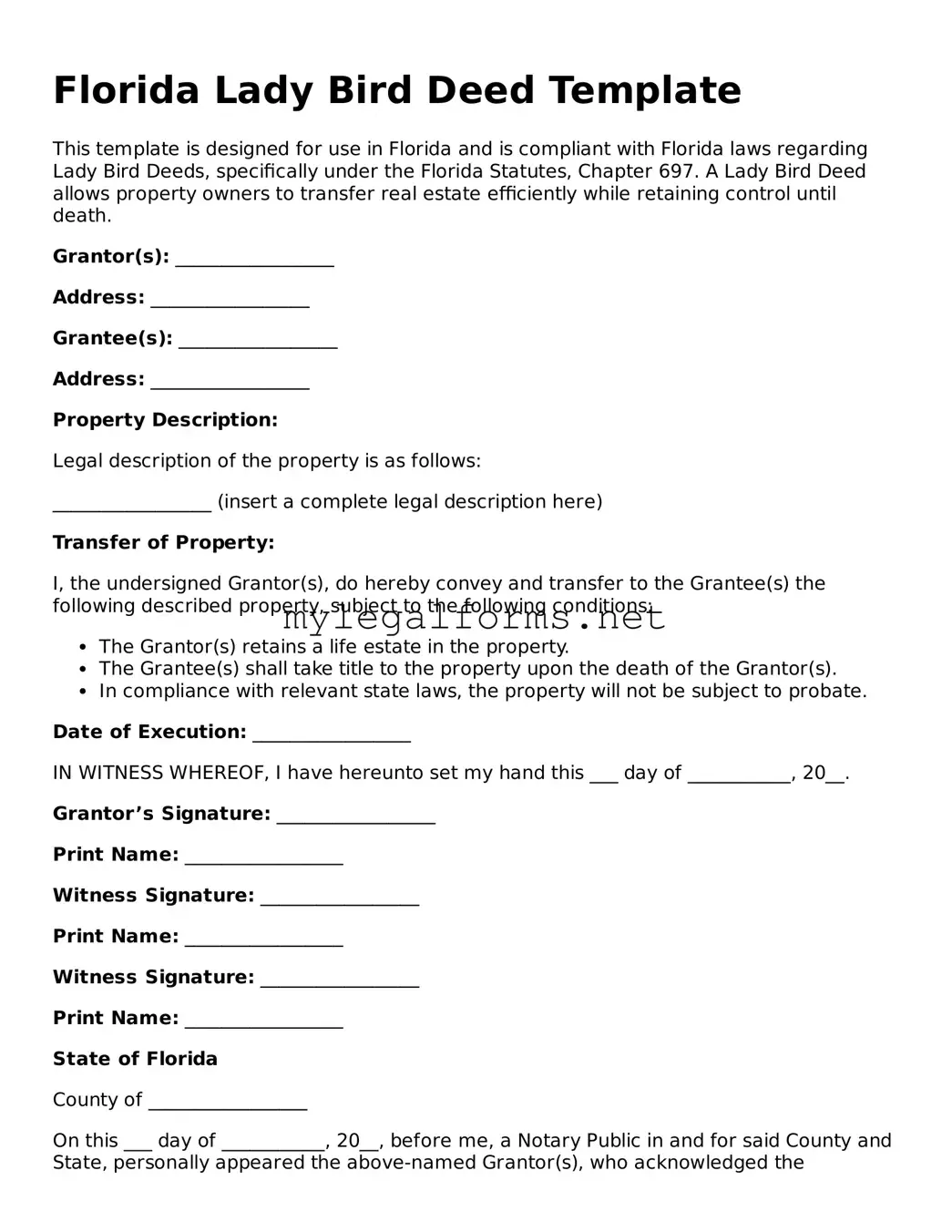

The Florida Lady Bird Deed form is a unique legal document that allows property owners to transfer their real estate to beneficiaries while retaining the right to live in and control the property during their lifetime. This form provides a straightforward way to avoid probate, ensuring a smoother transition of assets upon the owner's passing. With its flexibility and advantages, the Lady Bird Deed has become a popular choice for many Floridians looking to simplify their estate planning.

Launch Lady Bird Deed Editor

Lady Bird Deed Document for Florida State

Launch Lady Bird Deed Editor

Launch Lady Bird Deed Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Lady Bird Deed online and download the final version.