Power of Attorney Document for Florida State

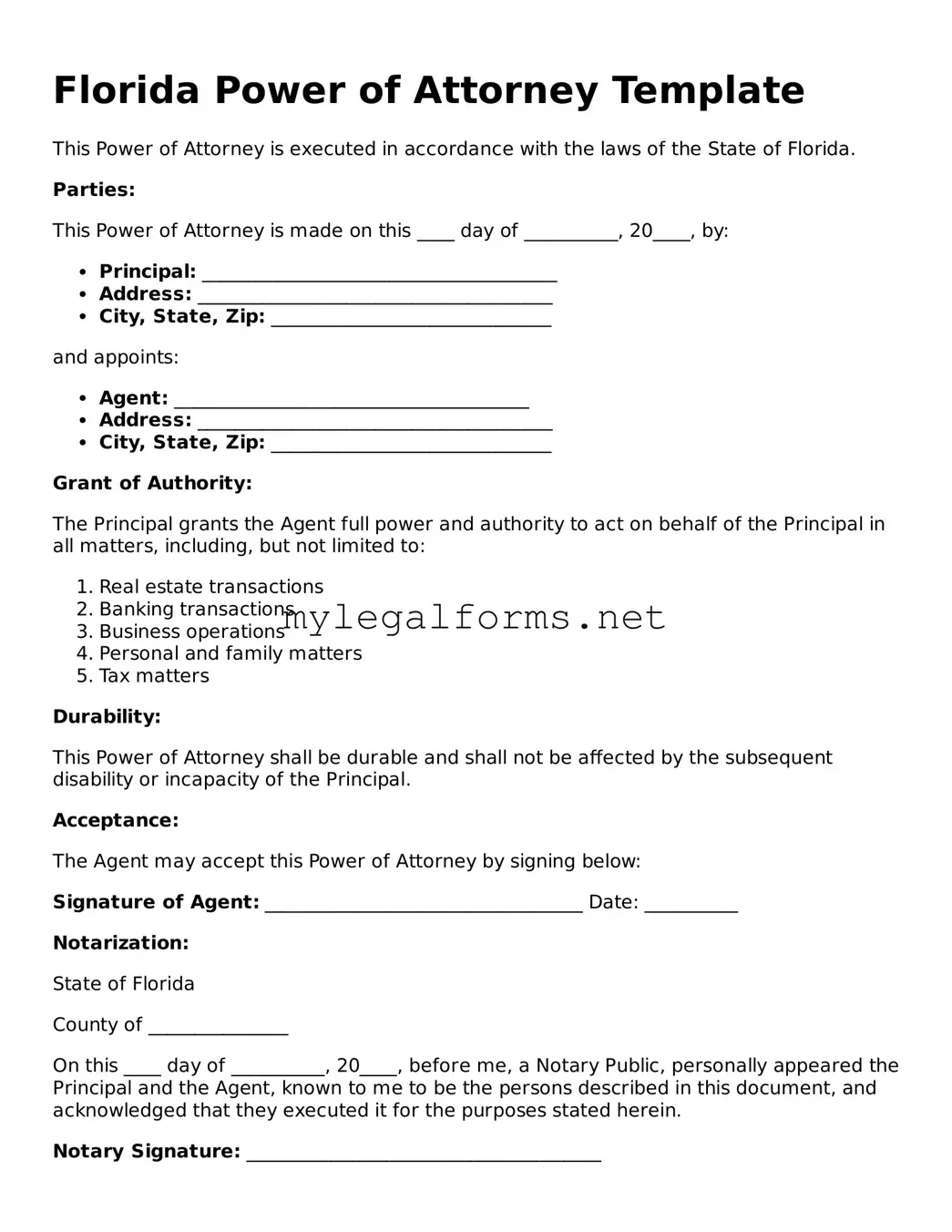

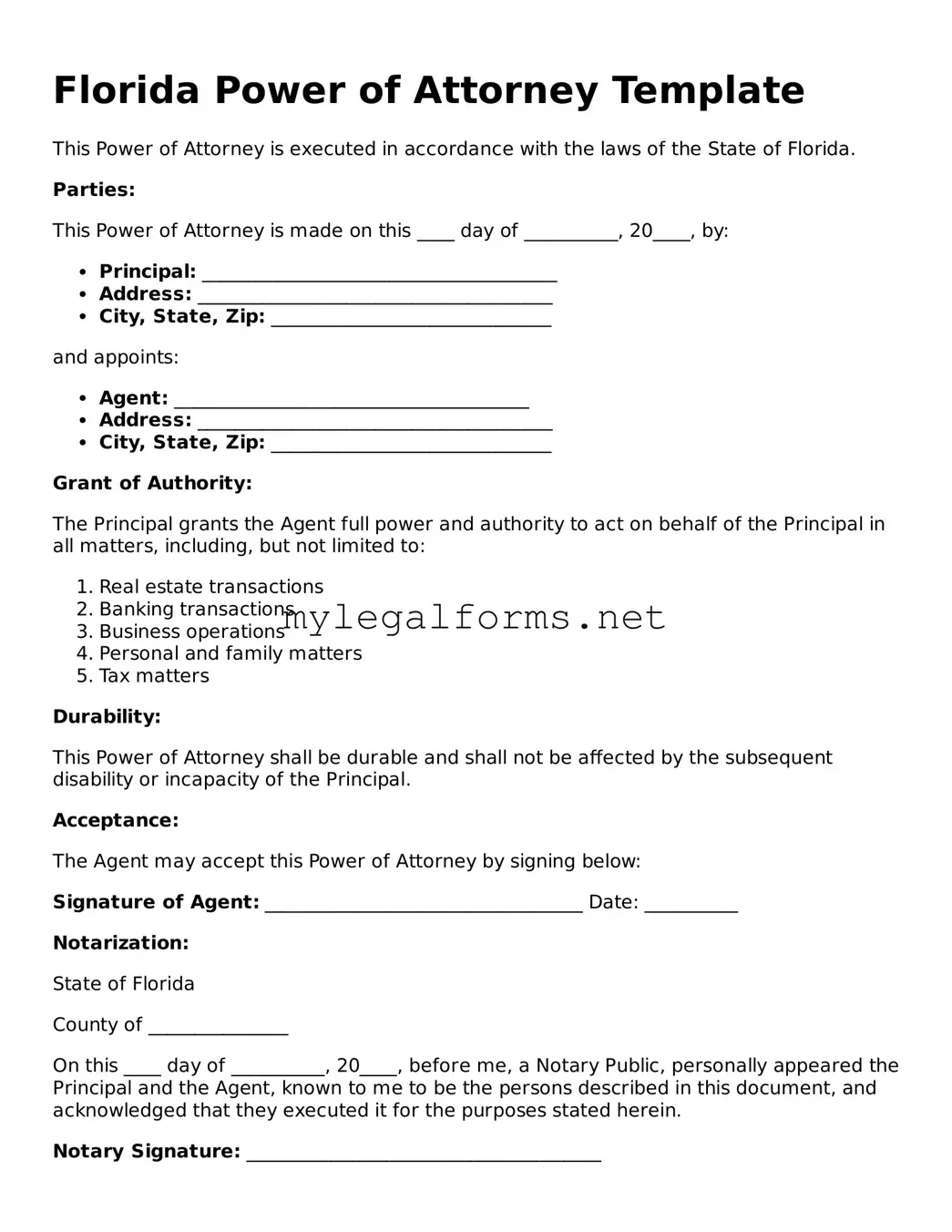

A Florida Power of Attorney form is a legal document that allows one person to grant another person the authority to act on their behalf in financial or legal matters. This form is essential for individuals who want to ensure their affairs are managed according to their wishes, especially in the event of incapacitation. Understanding the nuances of this document can help you make informed decisions about your personal and financial well-being.

Launch Power of Attorney Editor

Power of Attorney Document for Florida State

Launch Power of Attorney Editor

Launch Power of Attorney Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Power of Attorney online and download the final version.