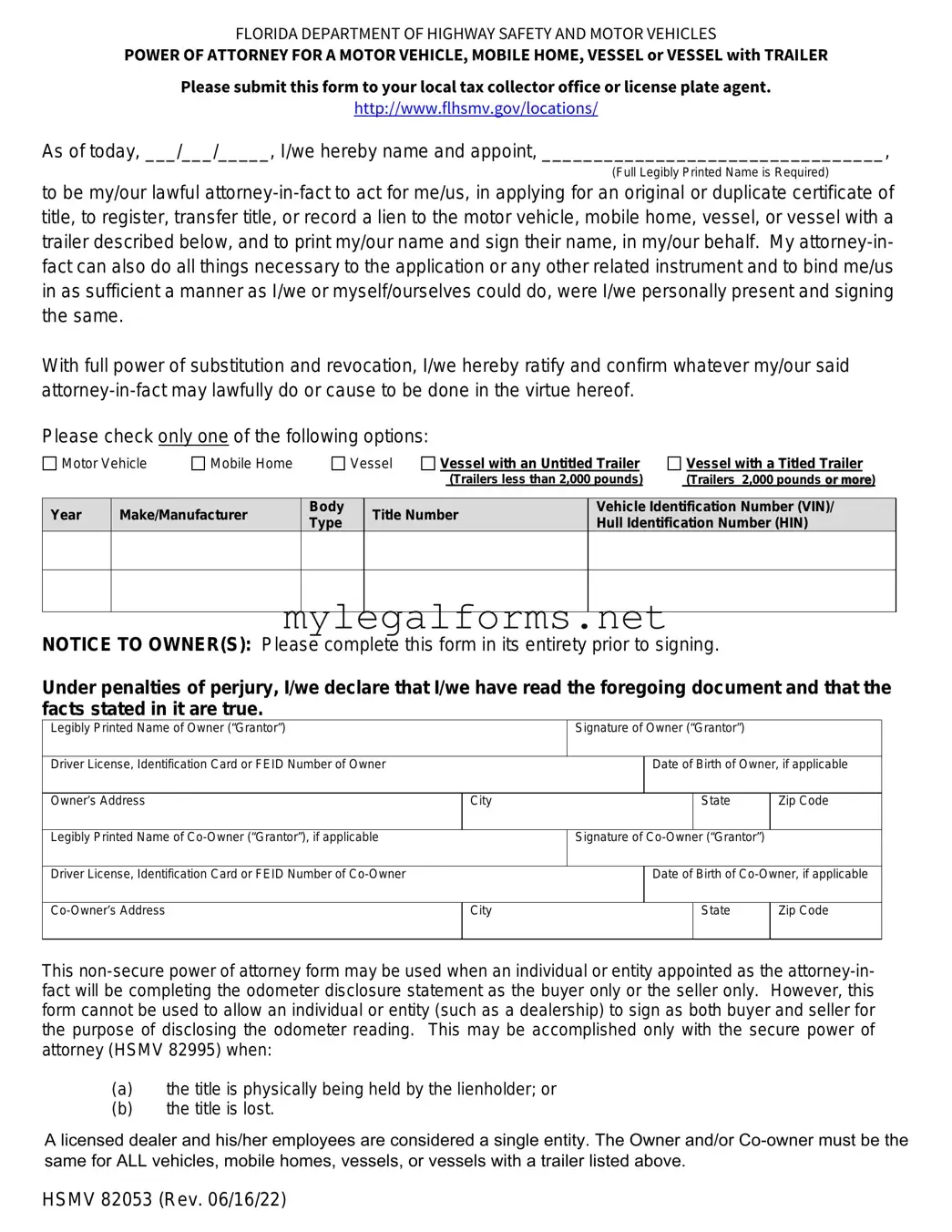

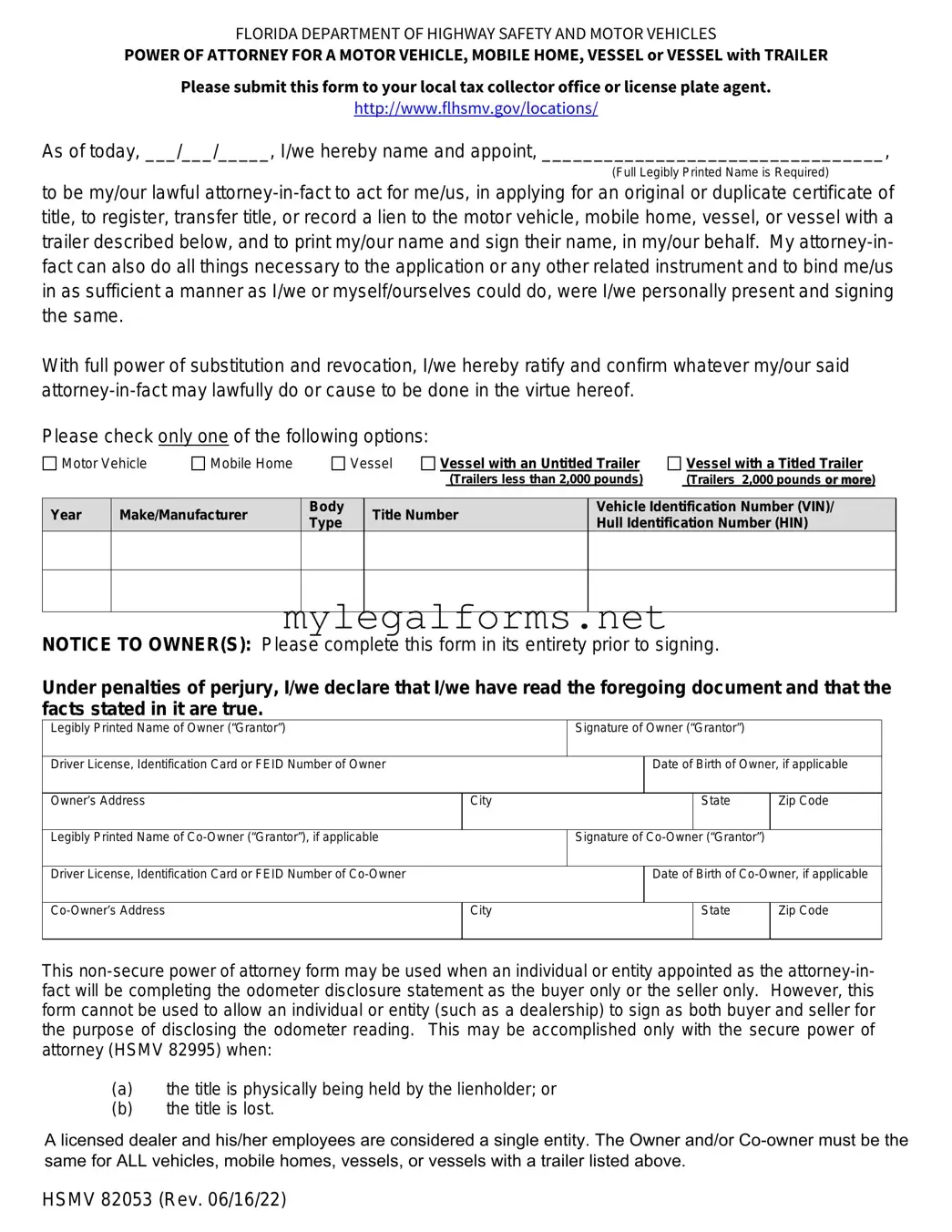

FLORIDA DEPARTMENT OF HIGHWAY SAFETY AND MOTOR VEHICLES

POWER OF ATTORNEY FOR A MOTOR VEHICLE, MOBILE HOME, VESSEL or VESSEL with TRAILER

Please submit this form to your local tax collector office or license plate agent.

http://www.flhsmv.gov/locations/

As of today, ___/___/_____, I/we hereby name and appoint, _________________________________,

(Full Legibly Printed Name is Required)

to be my/our lawful attorney-in-fact to act for me/us, in applying for an original or duplicate certificate of title, to register, transfer title, or record a lien to the motor vehicle, mobile home, vessel, or vessel with a trailer described below, and to print my/our name and sign their name, in my/our behalf. My attorney-in- fact can also do all things necessary to the application or any other related instrument and to bind me/us in as sufficient a manner as I/we or myself/ourselves could do, were I/we personally present and signing the same.

With full power of substitution and revocation, I/we hereby ratify and confirm whatever my/our said attorney-in-fact may lawfully do or cause to be done in the virtue hereof.

Please check only one of the following options:

Motor Vehicle |

Mobile Home |

Vessel |

Vessel with an Untitled Trailer |

Vessel with a Titled Trailer |

|

|

|

(Trailers less than 2,000 pounds) |

(Trailers 2,000 pounds or more) |

Vehicle Identification Number (VIN)/

Hull Identification Number (HIN)

NOTICE TO OWNER(S): Please complete this form in its entirety prior to signing.

Under penalties of perjury, I/we declare that I/we have read the foregoing document and that the facts stated in it are true.

Legibly Printed Name of Owner (“Grantor”) |

|

Signature of Owner (“Grantor”) |

|

|

|

|

|

|

|

Driver License, Identification Card or FEID Number of Owner |

|

|

Date of Birth of Owner, if applicable |

|

|

|

|

|

|

Owner’s Address |

City |

|

|

State |

Zip Code |

|

|

|

|

|

Legibly Printed Name of Co-Owner (“Grantor”), if applicable |

|

Signature of Co-Owner (“Grantor”) |

|

|

|

|

|

Driver License, Identification Card or FEID Number of Co-Owner |

|

|

Date of Birth of Co-Owner, if applicable |

|

|

|

|

|

|

Co-Owner’s Address |

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

This non-secure power of attorney form may be used when an individual or entity appointed as the attorney-in- fact will be completing the odometer disclosure statement as the buyer only or the seller only. However, this form cannot be used to allow an individual or entity (such as a dealership) to sign as both buyer and seller for the purpose of disclosing the odometer reading. This may be accomplished only with the secure power of attorney (HSMV 82995) when:

(a)the title is physically being held by the lienholder; or

(b)the title is lost.

A licensed dealer and his/her employees are considered a single entity. The Owner and/or Co-owner must be the same for ALL vehicles, mobile homes, vessels, or vessels with a trailer listed above.

HSMV 82053 (Rev. 06/16/22)