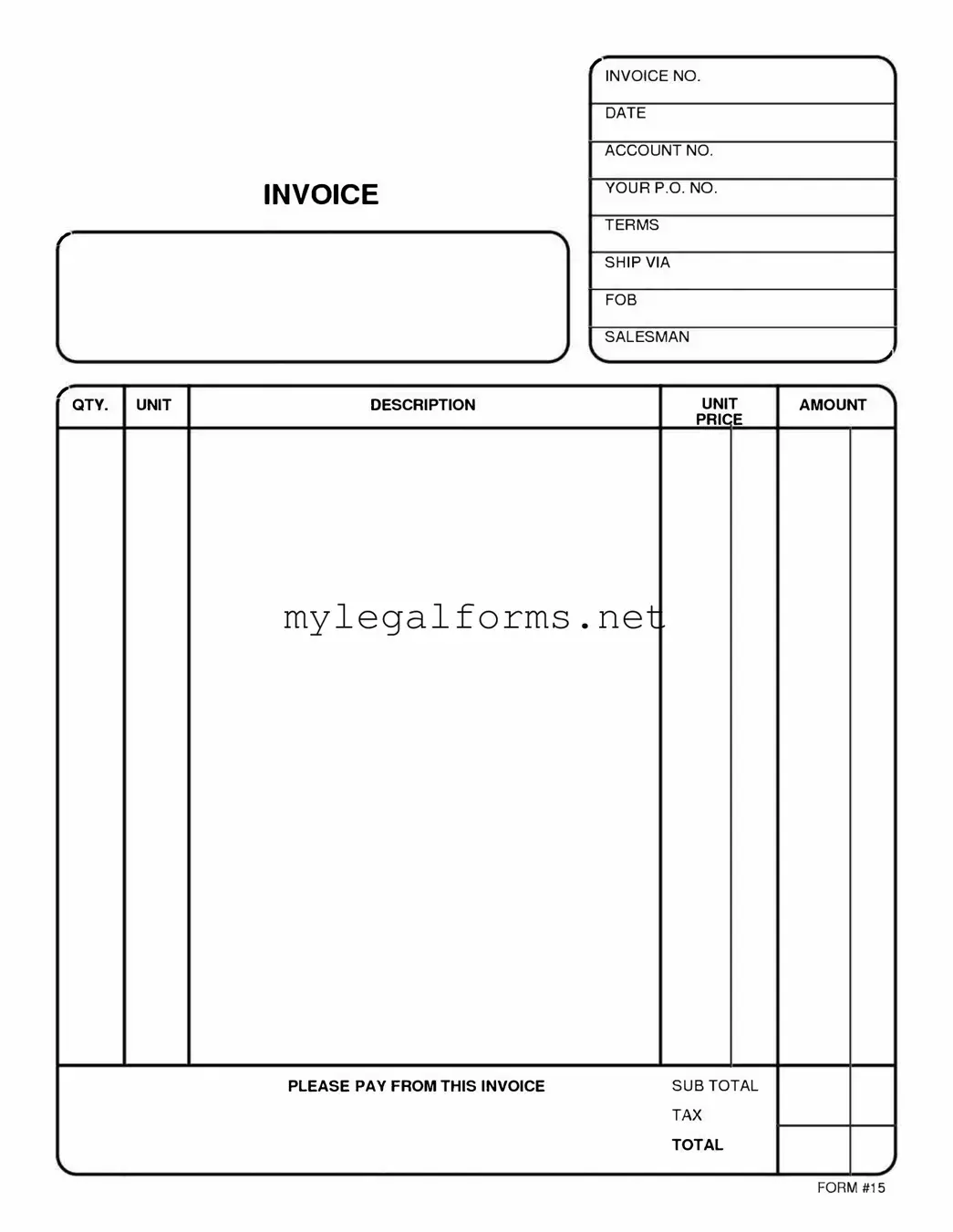

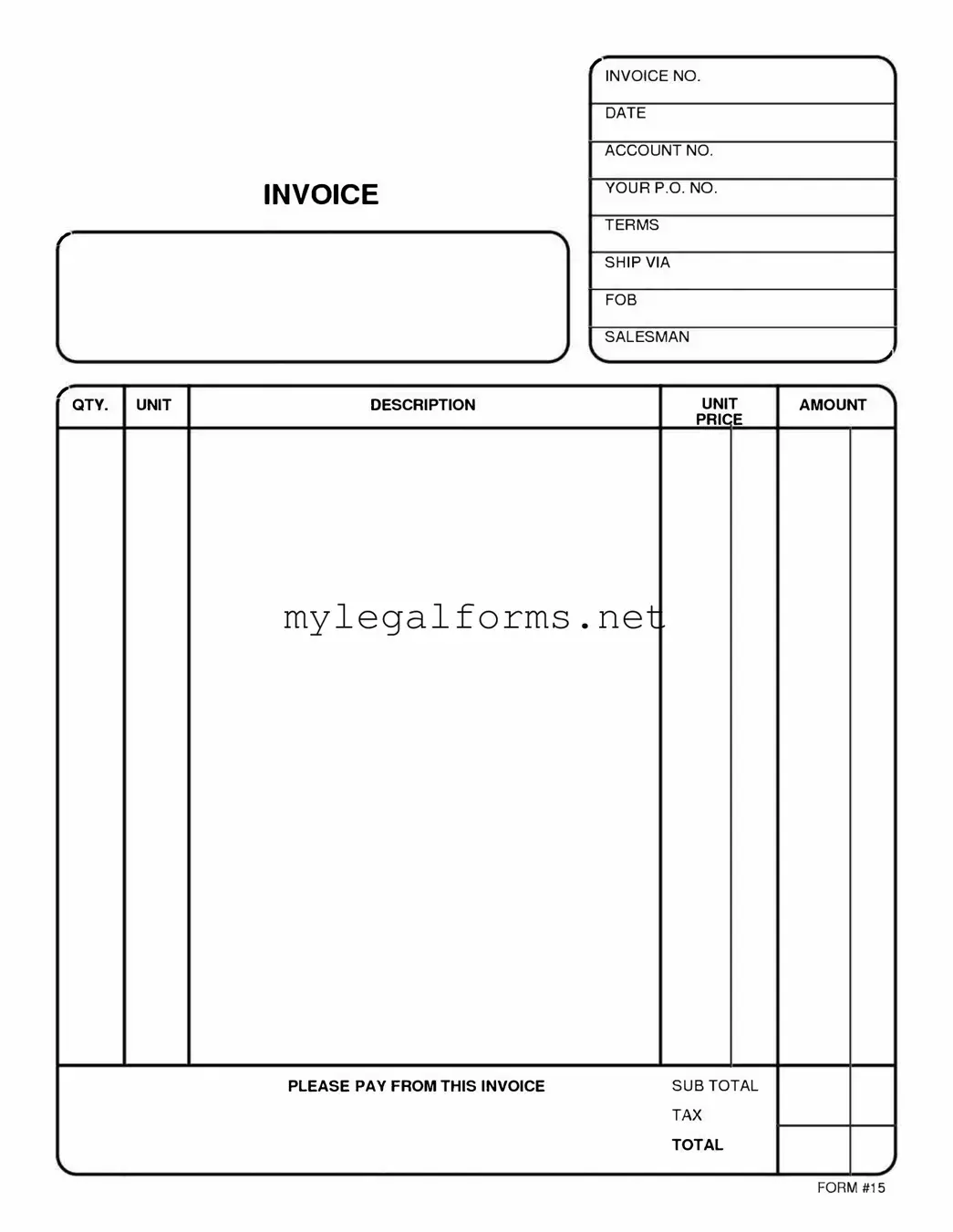

Free And Invoice Pdf Template

The Free And Invoice PDF form is a document designed to help individuals and businesses create professional invoices effortlessly. This form allows users to input essential information such as services rendered, payment details, and client information. By utilizing this tool, you can streamline your billing process and ensure timely payments.

Launch Free And Invoice Pdf Editor

Free And Invoice Pdf Template

Launch Free And Invoice Pdf Editor

Launch Free And Invoice Pdf Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Free And Invoice Pdf online and download the final version.