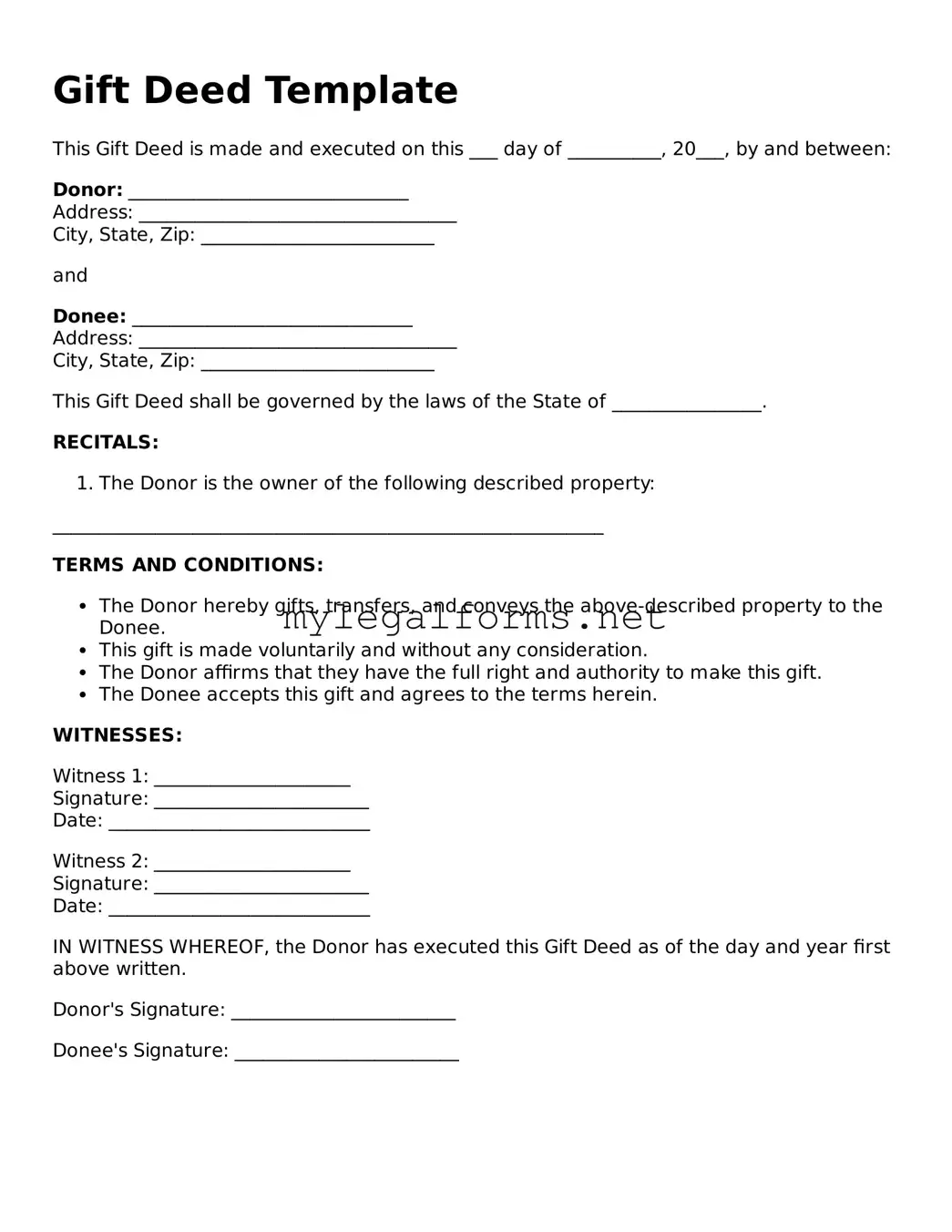

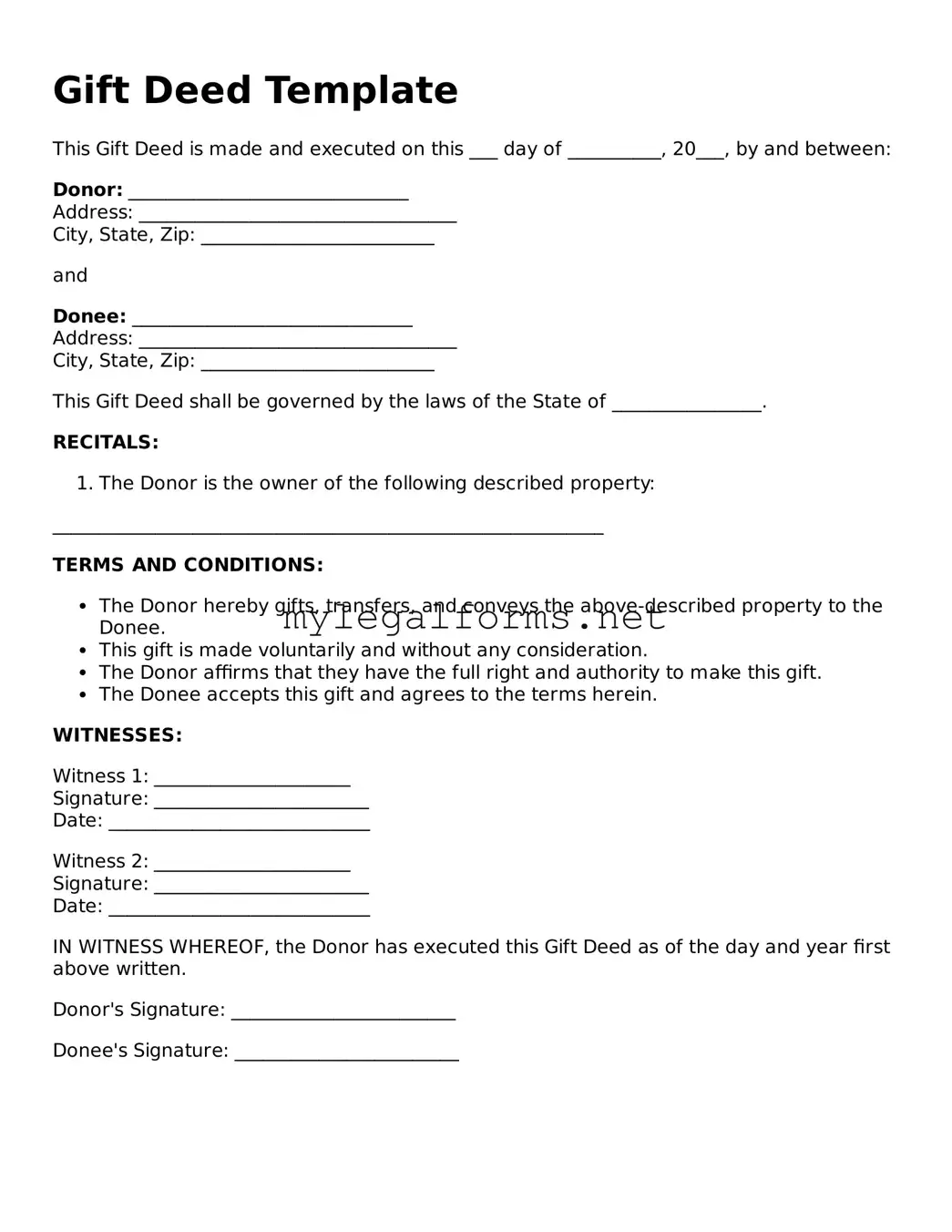

Attorney-Approved Gift Deed Form

A Gift Deed is a legal document that facilitates the transfer of property or assets from one person to another without any exchange of money. This form serves to formalize the intent of the donor, ensuring that the recipient receives the gift in a clear and unambiguous manner. Understanding the nuances of a Gift Deed can help individuals navigate the complexities of property transfers with confidence.

Launch Gift Deed Editor

Attorney-Approved Gift Deed Form

Launch Gift Deed Editor

Launch Gift Deed Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Gift Deed online and download the final version.