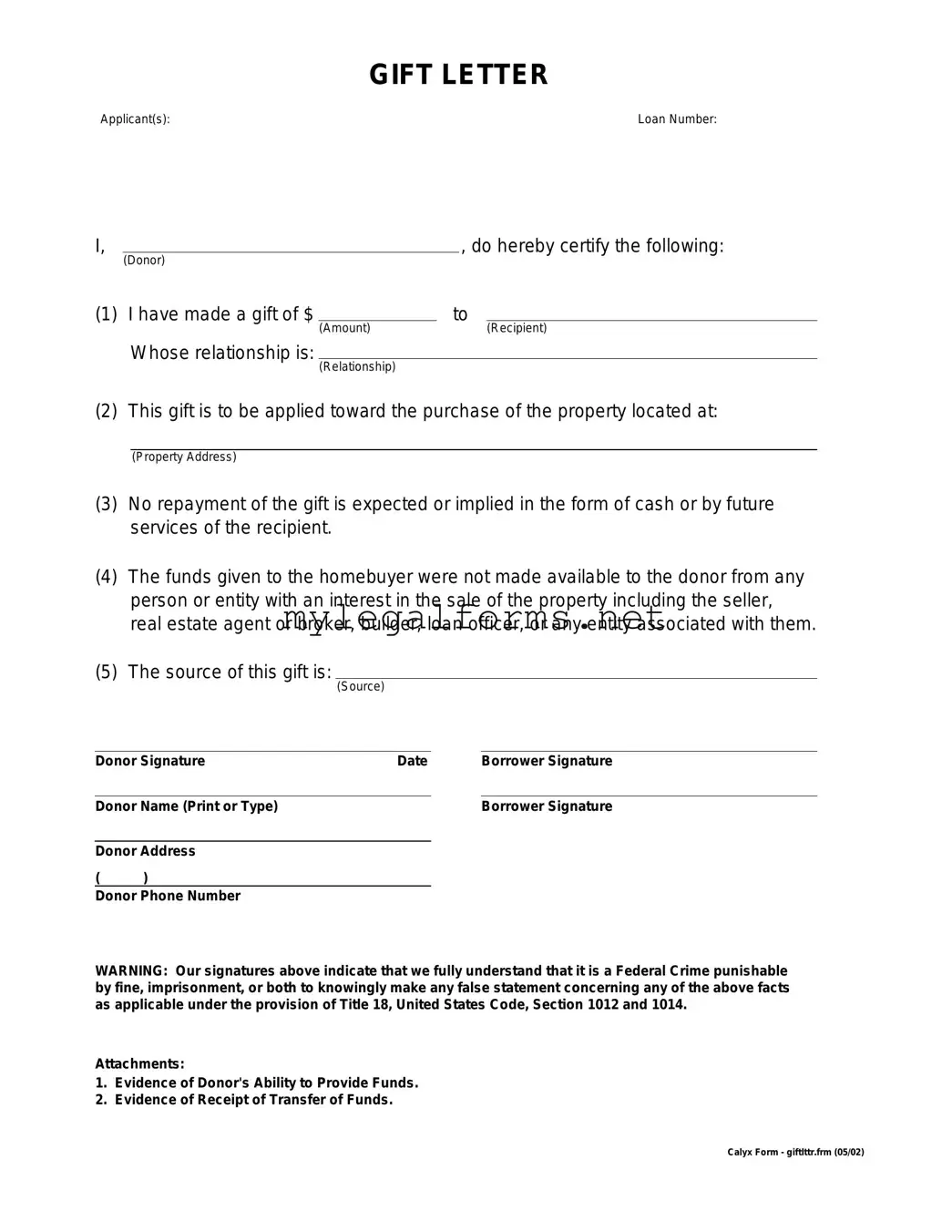

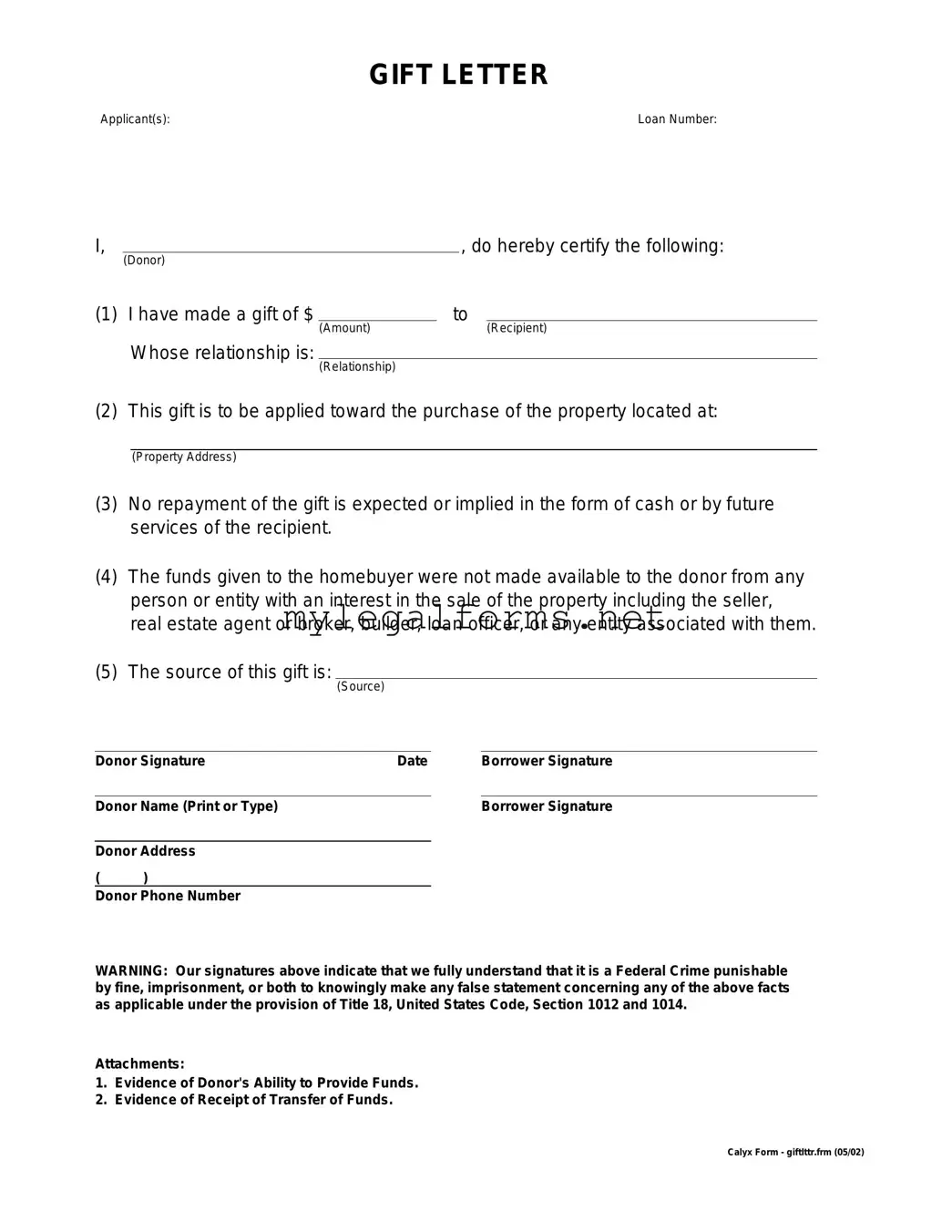

Gift Letter Template

The Gift Letter form is a document used to confirm that a monetary gift has been given to an individual, typically for the purpose of assisting with a home purchase. This form serves to clarify that the funds are a gift and not a loan, ensuring transparency in financial transactions. By providing essential details about the donor and recipient, the Gift Letter helps to streamline the mortgage approval process.

Launch Gift Letter Editor

Gift Letter Template

Launch Gift Letter Editor

Launch Gift Letter Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Gift Letter online and download the final version.