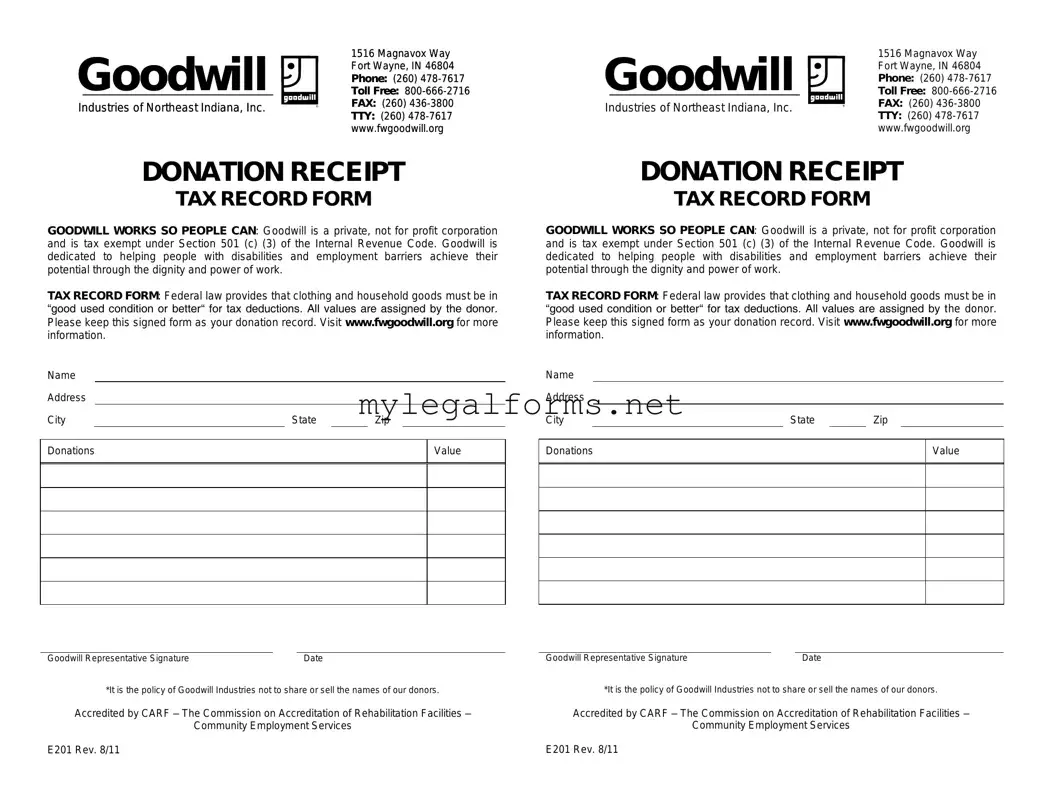

Goodwill donation receipt Template

The Goodwill donation receipt form is a document provided to donors when they contribute items to Goodwill Industries. This form serves as proof of the donation and can be used for tax deduction purposes. Understanding its importance can help donors maximize their charitable contributions while ensuring compliance with tax regulations.

Launch Goodwill donation receipt Editor

Goodwill donation receipt Template

Launch Goodwill donation receipt Editor

Launch Goodwill donation receipt Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Goodwill donation receipt online and download the final version.