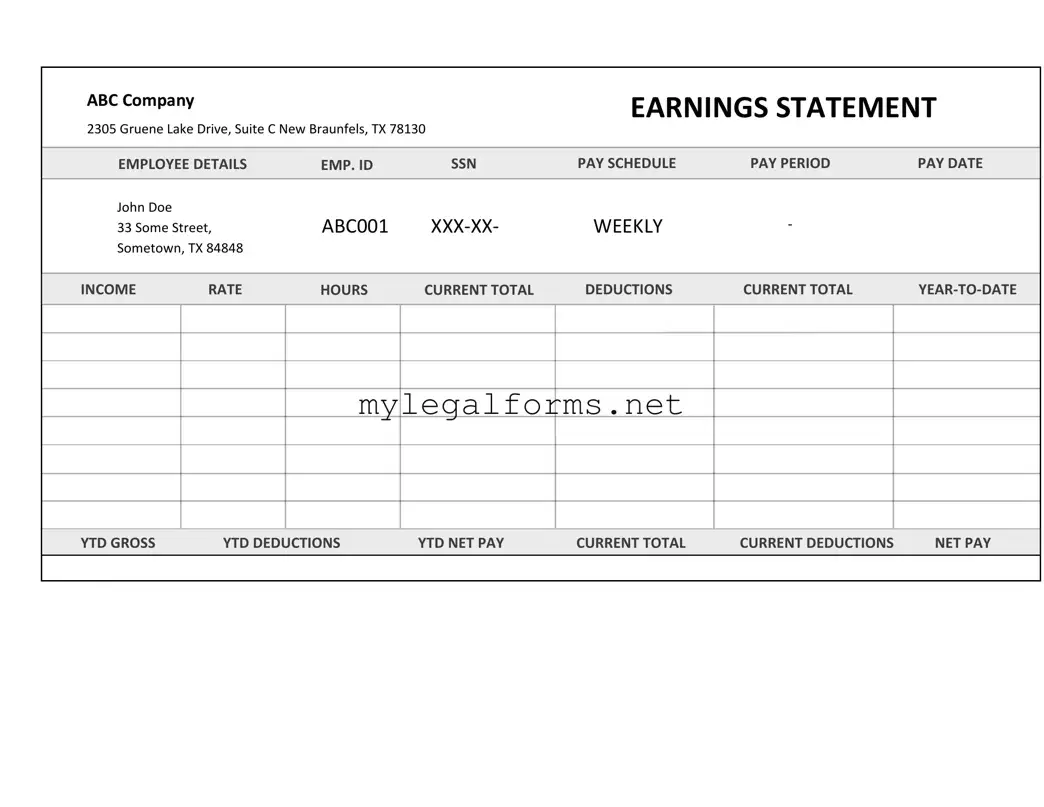

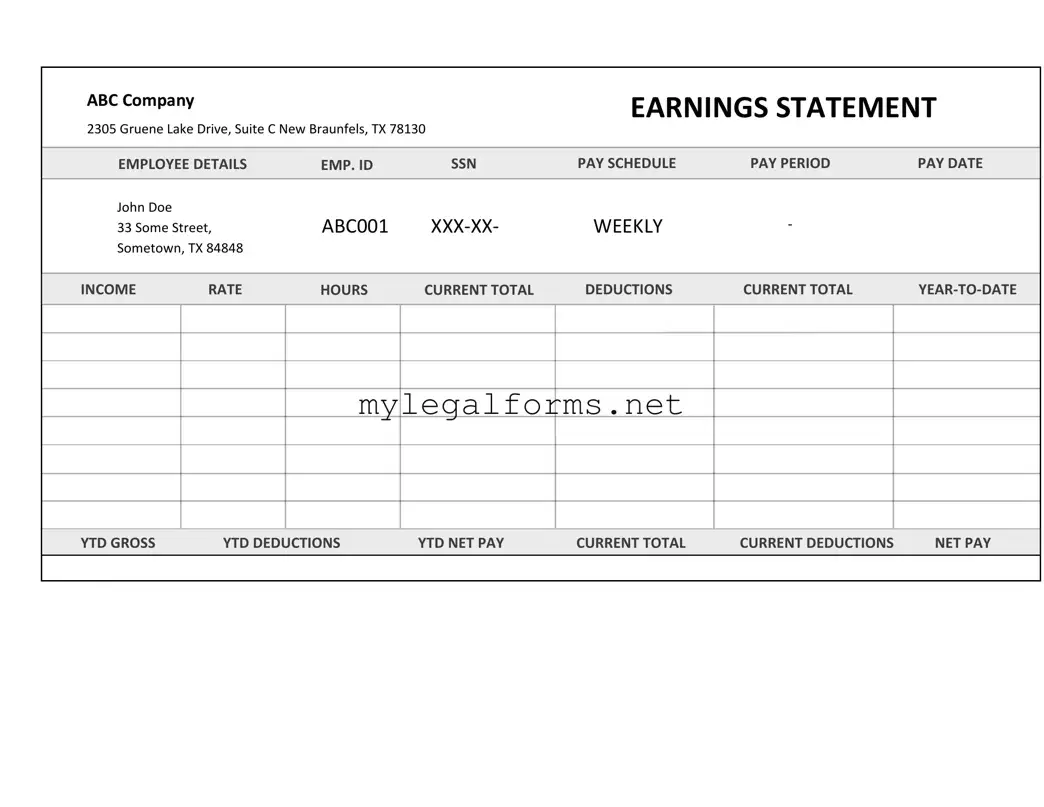

Independent Contractor Pay Stub Template

The Independent Contractor Pay Stub form serves as a vital document that outlines the earnings and deductions for individuals working on a contract basis. This form not only provides clarity regarding payment but also ensures compliance with tax regulations. Understanding its components can empower independent contractors to manage their finances more effectively.

Launch Independent Contractor Pay Stub Editor

Independent Contractor Pay Stub Template

Launch Independent Contractor Pay Stub Editor

Launch Independent Contractor Pay Stub Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Independent Contractor Pay Stub online and download the final version.