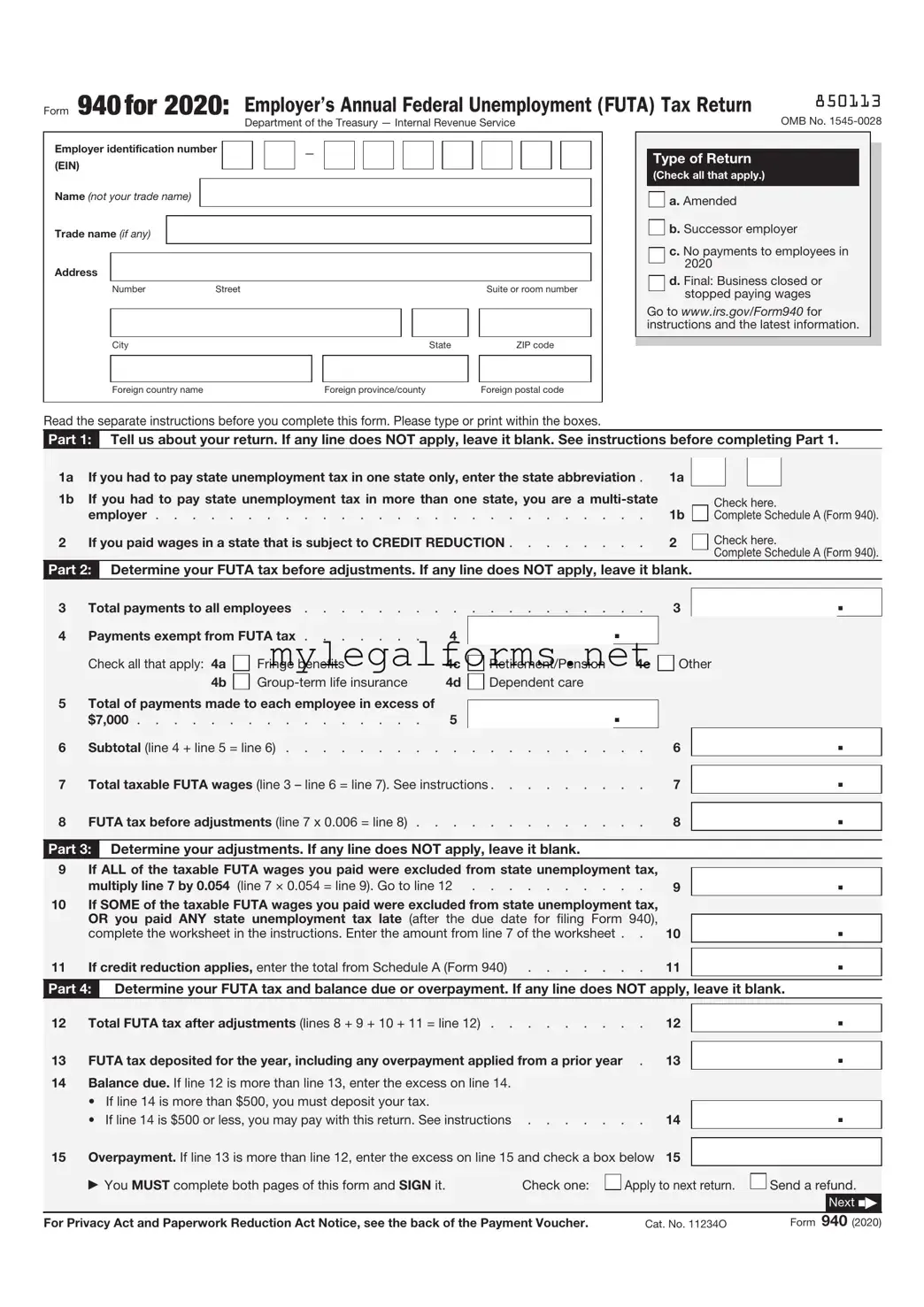

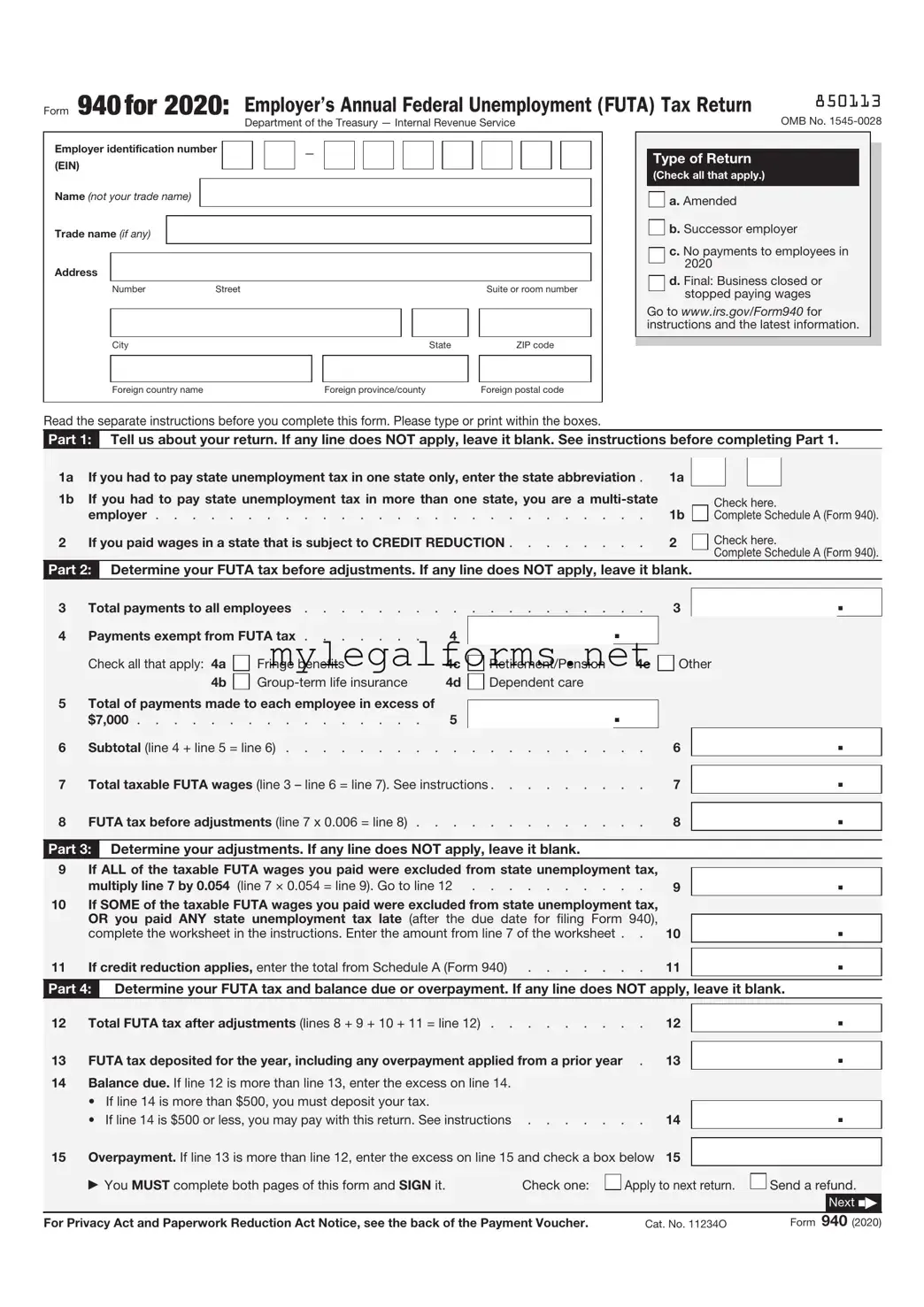

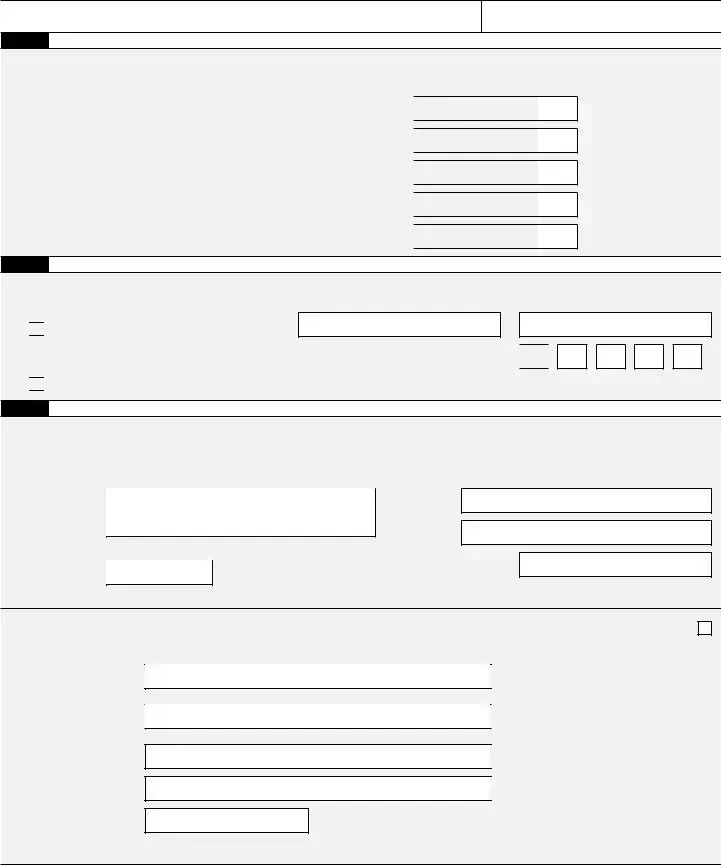

IRS 940 Template

The IRS 940 form is a crucial document used by employers to report annual Federal Unemployment Tax Act (FUTA) taxes. This form helps the Internal Revenue Service track unemployment tax contributions, ensuring compliance with federal regulations. Understanding how to complete and file the IRS 940 form is essential for businesses to meet their tax obligations and support workforce stability.

Launch IRS 940 Editor

IRS 940 Template

Launch IRS 940 Editor

Launch IRS 940 Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your IRS 940 online and download the final version.

.

. .

. .

. .

. .

.

No.

No.