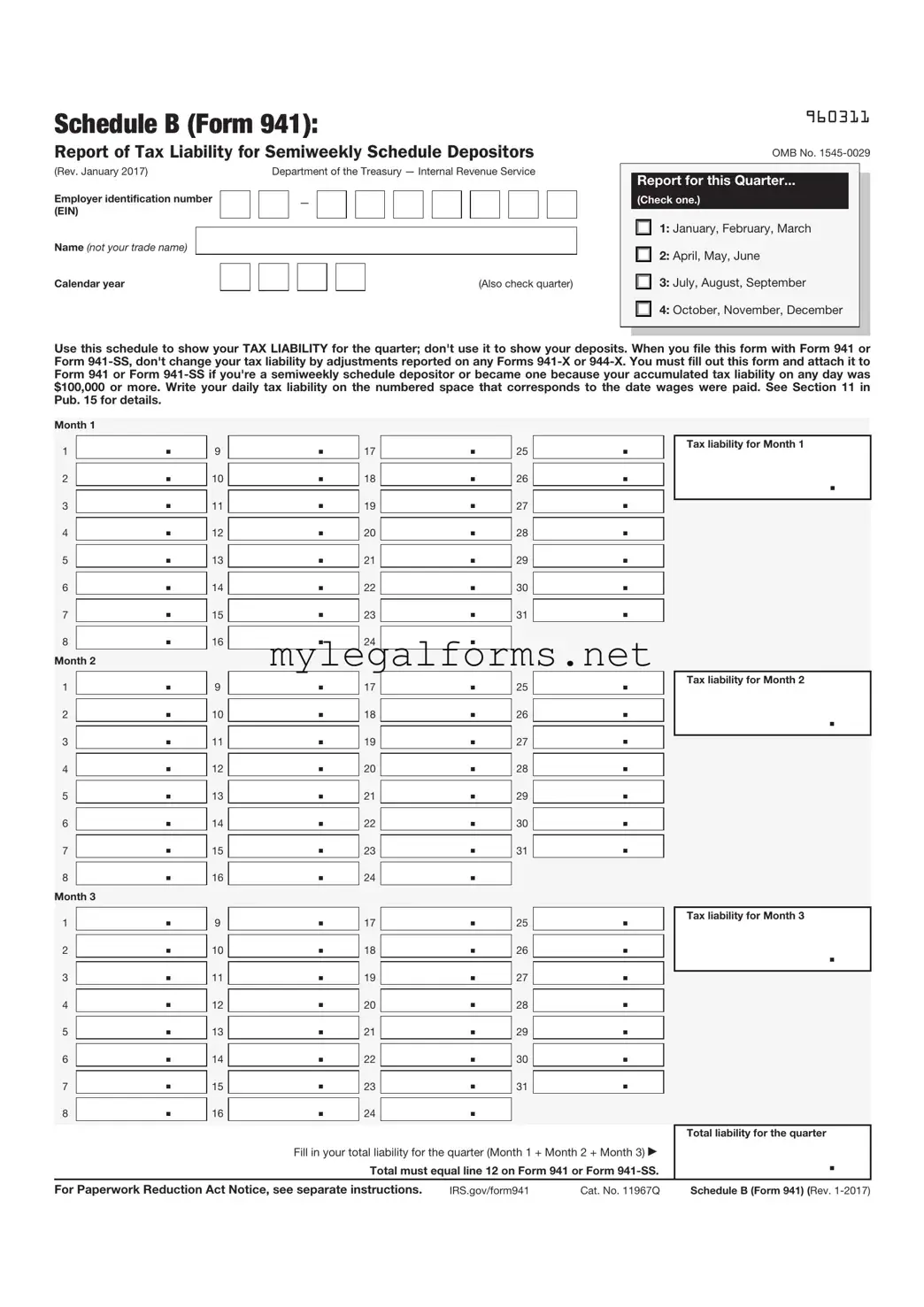

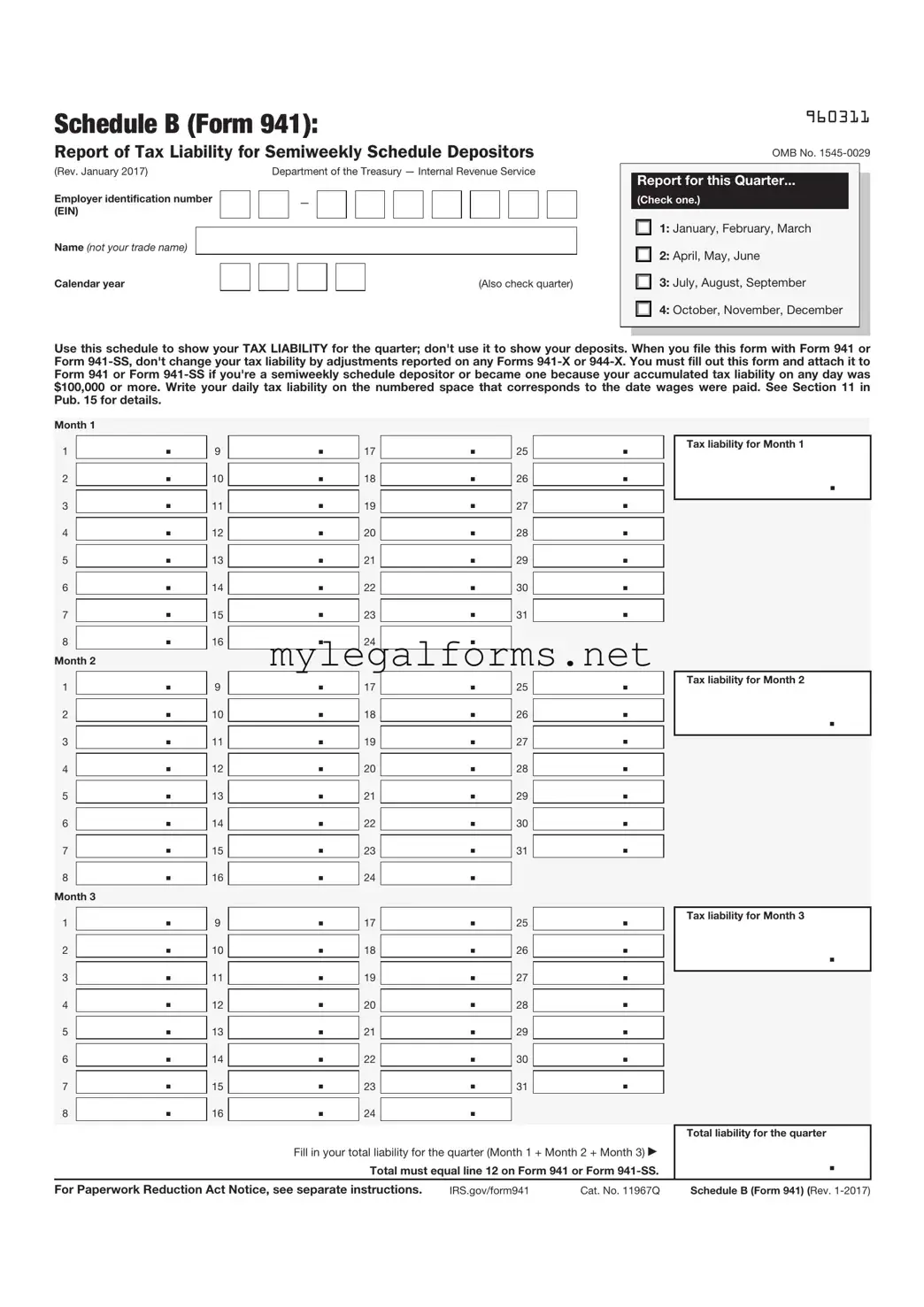

IRS Schedule B 941 Template

The IRS Schedule B 941 form is used by employers to report their federal payroll tax liabilities. This form provides detailed information about the amount of taxes withheld from employees' paychecks and the employer's share of Social Security and Medicare taxes. Understanding how to complete Schedule B accurately is crucial for maintaining compliance with federal tax regulations.

Launch IRS Schedule B 941 Editor

IRS Schedule B 941 Template

Launch IRS Schedule B 941 Editor

Launch IRS Schedule B 941 Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your IRS Schedule B 941 online and download the final version.

.

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

.