Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. However, many individuals make common mistakes that can lead to confusion, disputes, or even invalidation of the will. One frequent error is failing to properly identify the beneficiaries. It is crucial to include full names and, if possible, their relationship to you. Simply stating “my children” can lead to misunderstandings, especially in blended families.

Another common mistake is neglecting to update the will after significant life events. Major changes, such as marriage, divorce, or the birth of a child, should prompt a review of your will. If these events are not reflected in the document, it may not accurately represent your current wishes.

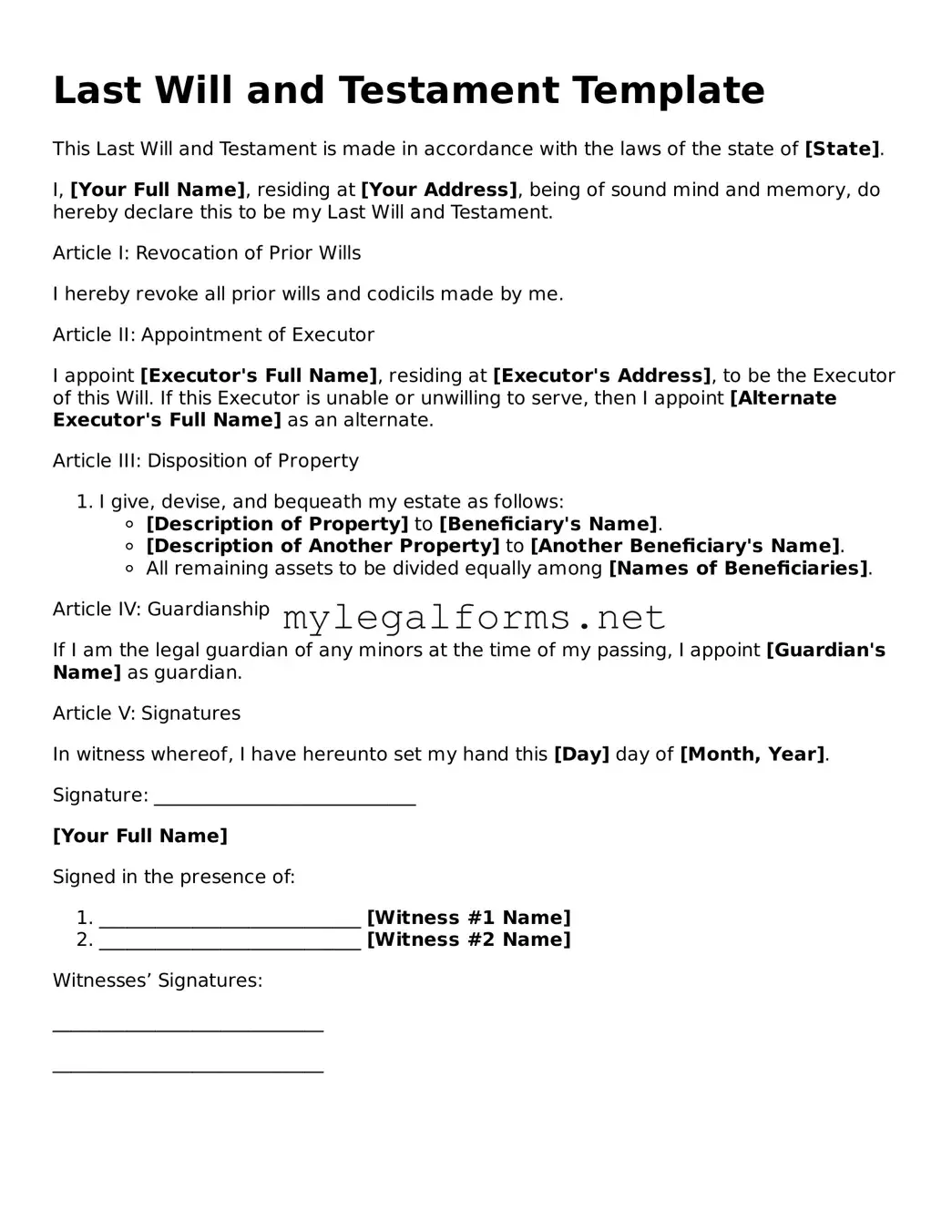

Many people also overlook the importance of having witnesses present during the signing of the will. Most states require at least two witnesses who are not beneficiaries of the will. Failing to adhere to this requirement can render the will invalid, leaving your estate to be distributed according to state law rather than your intentions.

Additionally, some individuals mistakenly assume that a handwritten will, or a “holographic will,” is automatically valid. While some states do recognize these documents, they often have specific requirements that must be met. It is wise to consult local laws to ensure compliance.

Another pitfall is the lack of clarity in the language used within the will. Vague terms or ambiguous phrases can lead to different interpretations. For example, stating “my personal belongings” without specifying what those items are can cause disputes among heirs. Clear and precise language helps ensure that your wishes are understood.

People often forget to include alternate beneficiaries. Life is unpredictable, and naming only one beneficiary can create complications if that person predeceases you. By designating alternates, you can help ensure that your assets are distributed according to your wishes, even if circumstances change.

Furthermore, failing to consider the tax implications of your estate can be a significant oversight. Understanding how your assets will be taxed upon your passing can help you make informed decisions about your estate plan. Consulting a financial advisor can provide insights into minimizing tax burdens for your beneficiaries.

Another mistake is not addressing digital assets in the will. In today’s digital age, online accounts, cryptocurrencies, and digital photos are often overlooked. Clearly stating how you want these assets handled can prevent confusion and ensure your digital legacy is preserved.

Some individuals also neglect to communicate their wishes with their loved ones. While a will is a legal document, discussing your intentions with family members can help manage expectations and reduce potential conflicts. Open communication fosters understanding and respect for your decisions.

Finally, a common error is not storing the will in a secure yet accessible location. A will that cannot be found after your passing is as good as nonexistent. Consider placing it in a safe deposit box or with a trusted attorney, ensuring that your loved ones know how to access it when the time comes.