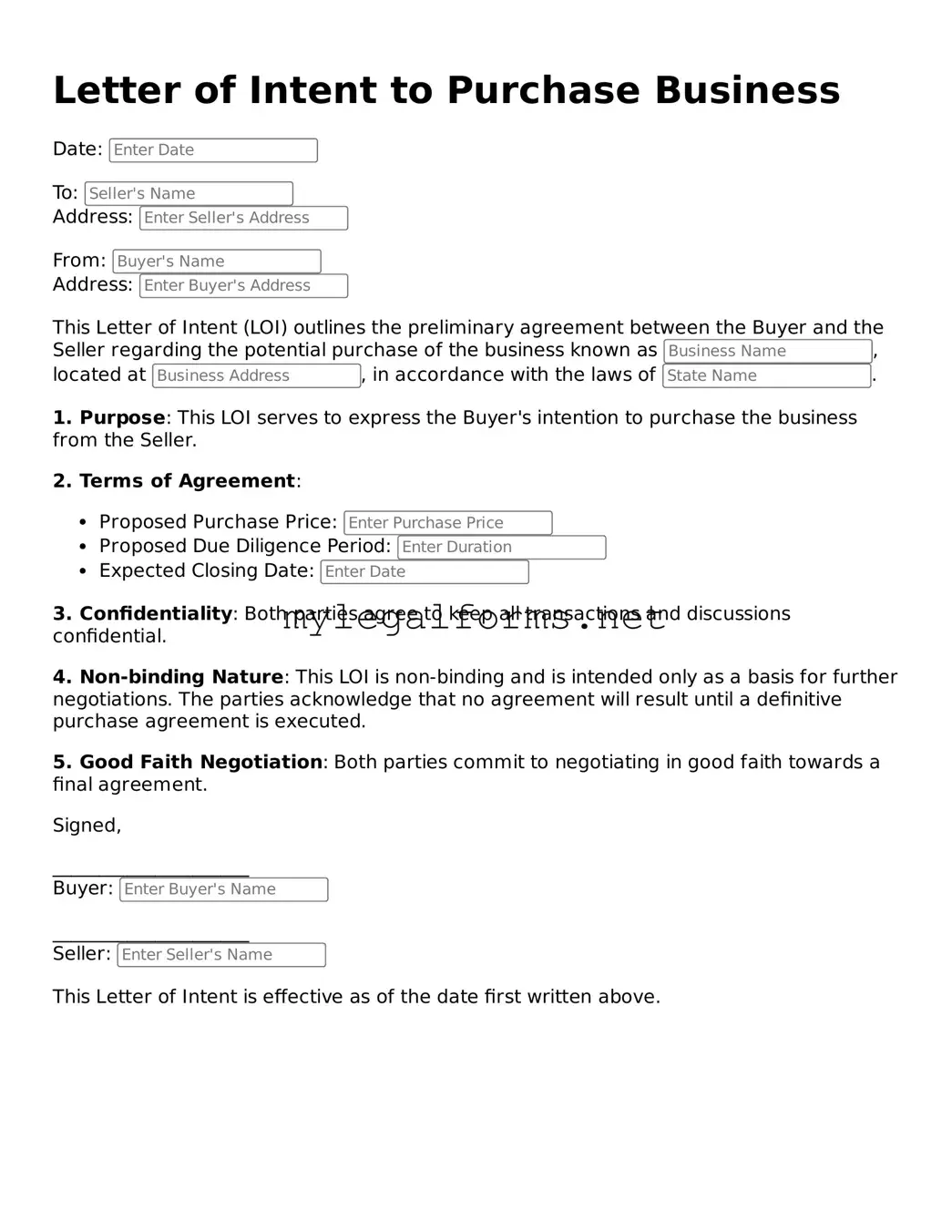

When completing a Letter of Intent to Purchase Business form, individuals often make several common mistakes that can lead to misunderstandings or complications later in the process. One significant error is failing to provide complete information about the parties involved. It is essential to include full names, addresses, and contact details for both the buyer and the seller. Omitting this information can create confusion and hinder communication.

Another frequent mistake is neglecting to specify the terms of the purchase clearly. Buyers should outline the purchase price, payment structure, and any contingencies. Without these details, the intent of the agreement may become ambiguous, potentially leading to disputes. Additionally, vague language can result in different interpretations of the terms by the parties involved.

People also often overlook the importance of including a timeline for the transaction. A well-defined timeline helps both parties understand the expectations and deadlines associated with the purchase. Without a clear timeline, delays may occur, causing frustration and uncertainty for both the buyer and seller.

Another common error is failing to address any necessary due diligence. Buyers should state their intention to conduct due diligence before finalizing the purchase. This step is crucial for assessing the business's financial health, liabilities, and potential risks. Neglecting this can lead to unforeseen issues after the purchase is completed.

Some individuals mistakenly believe that the Letter of Intent is a legally binding contract. While it does express intent, it typically serves as a preliminary agreement. It is vital to clarify which provisions are binding and which are not. Misunderstanding this aspect can lead to false expectations and potential legal complications.

Another mistake is not consulting with professionals, such as attorneys or accountants, before submitting the form. Their expertise can provide valuable insights into the process and help avoid pitfalls. Relying solely on personal knowledge may result in oversights that could have been easily addressed.

Inaccurate or incomplete financial information is also a common issue. Buyers should ensure that all financial data provided in the Letter of Intent is accurate and reflects the current state of the business. Discrepancies can undermine trust and complicate negotiations.

Furthermore, some individuals fail to include contingencies related to financing. Buyers should clearly state any conditions that must be met for the purchase to proceed, such as securing a loan or investment. Without these contingencies, buyers may find themselves in a difficult position if financing falls through.

Lastly, neglecting to review the document for errors before submission is a mistake that can have significant consequences. Typos or inaccuracies can lead to misunderstandings and may even affect the enforceability of the agreement. A thorough review ensures that the Letter of Intent accurately reflects the intentions of both parties.