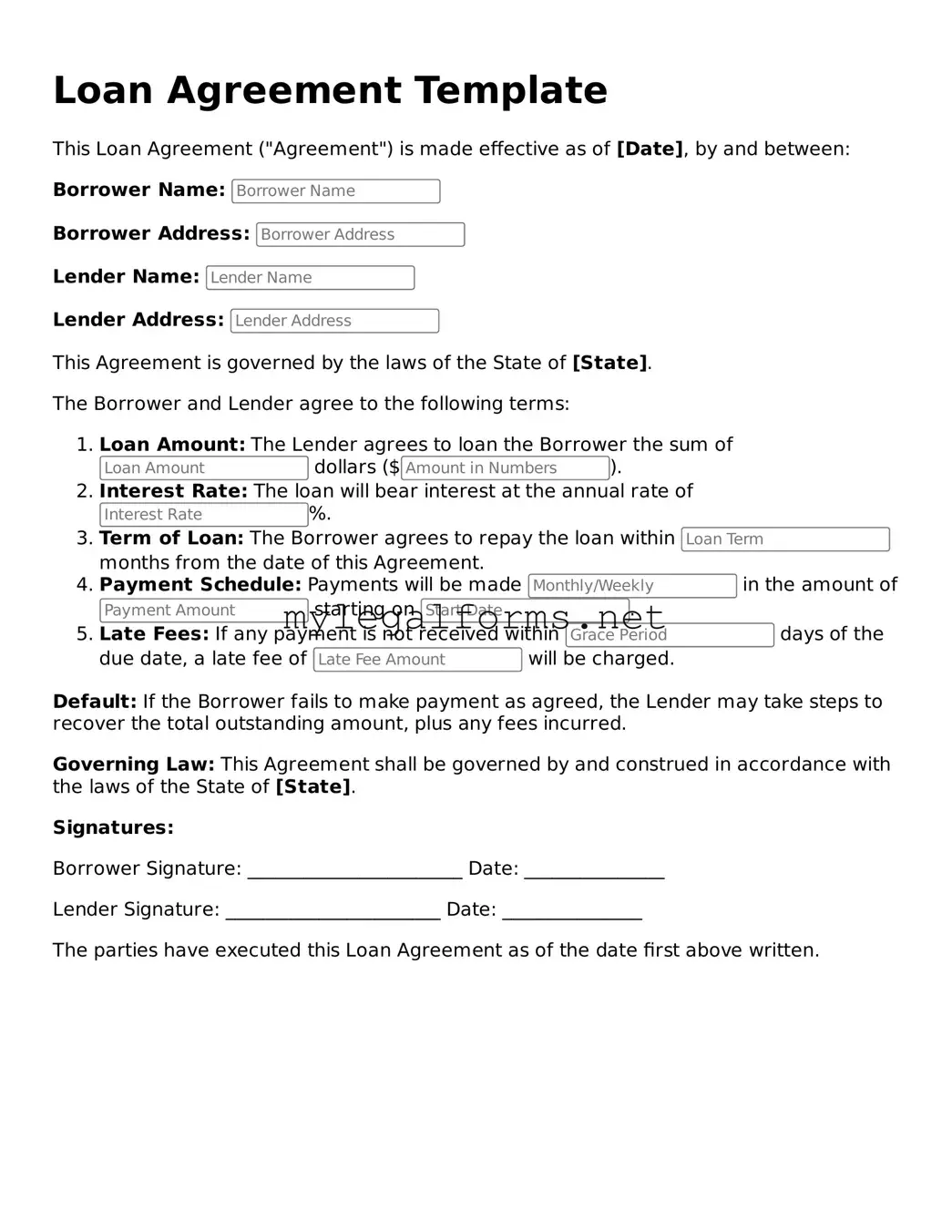

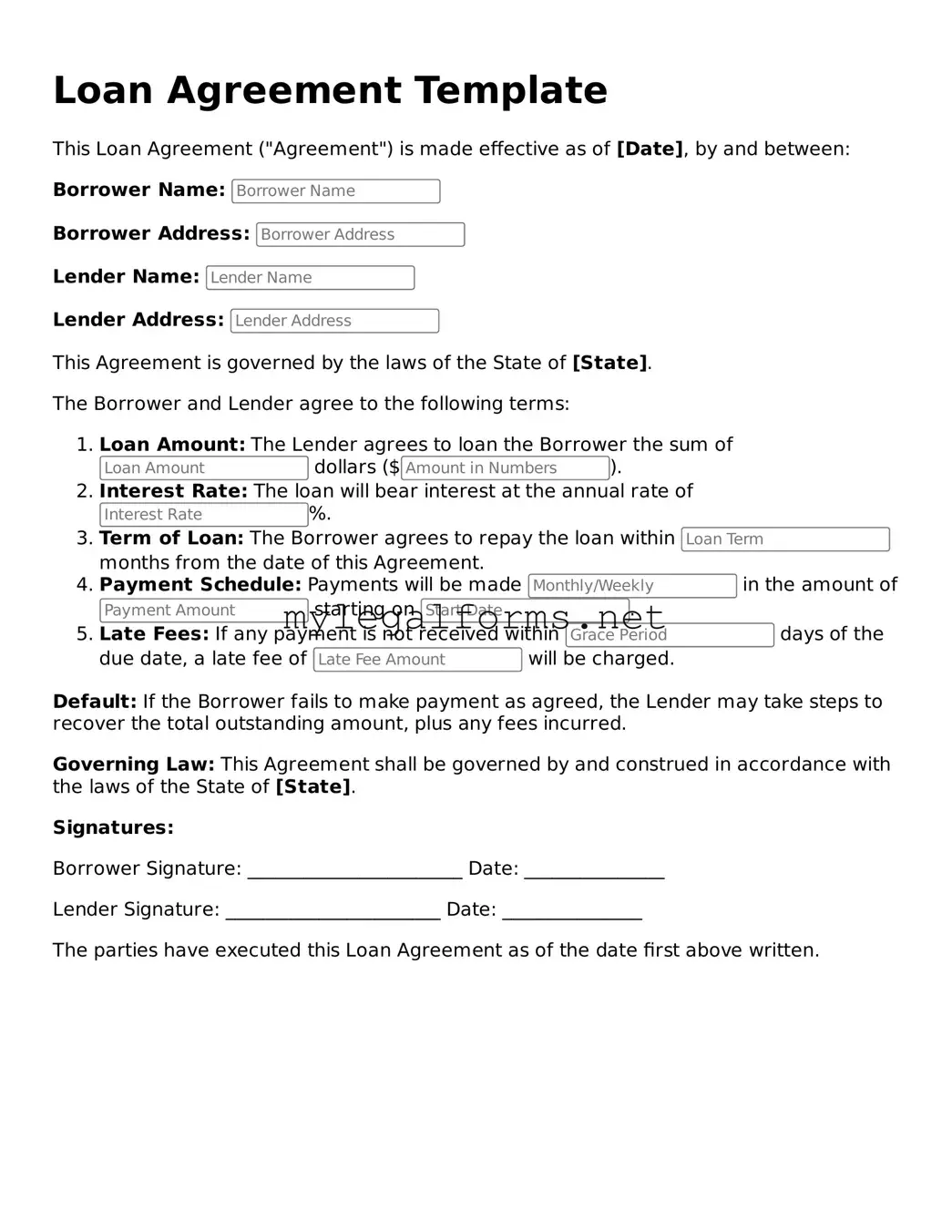

Filling out a Loan Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications later on. One frequent error is failing to provide accurate personal information. Borrowers should ensure that their names, addresses, and contact details are correct. Inaccuracies can delay processing and create confusion during communication.

Another mistake involves overlooking the loan amount. Borrowers may either request too much or too little. It's essential to carefully calculate the needed funds and ensure that the requested amount aligns with the purpose of the loan. Misjudging this figure can lead to financial strain or missed opportunities.

Many people neglect to read the terms and conditions thoroughly. Each loan agreement contains specific clauses that outline repayment schedules, interest rates, and penalties for late payments. Ignoring these details can result in unexpected costs or unfavorable terms. It’s advisable to understand what one is agreeing to before signing.

In addition, some borrowers fail to consider their repayment capacity. Individuals should evaluate their financial situation realistically. Taking on a loan without a clear repayment plan can lead to default and damage credit scores. A budget review can help in determining what is manageable.

Another common oversight is not providing the required documentation. Lenders often request proof of income, identification, and other financial records. Failing to submit these documents can delay the approval process or lead to outright denial of the loan.

Additionally, some borrowers skip the comparison of loan offers. Each lender may provide different terms and rates. By not shopping around, individuals might miss out on better deals that could save them money in the long run.

People often forget to ask questions. If any part of the loan agreement is unclear, borrowers should seek clarification. Misunderstandings can lead to costly mistakes or unmet expectations.

Furthermore, some individuals do not consider the impact of their credit score. A low credit score can result in higher interest rates or loan denial. It’s wise to check credit reports and address any issues before applying for a loan.

Lastly, rushing through the process can lead to errors. Taking the time to review the form carefully can prevent mistakes. A thorough check can ensure that all information is accurate and complete, ultimately making the loan process smoother.