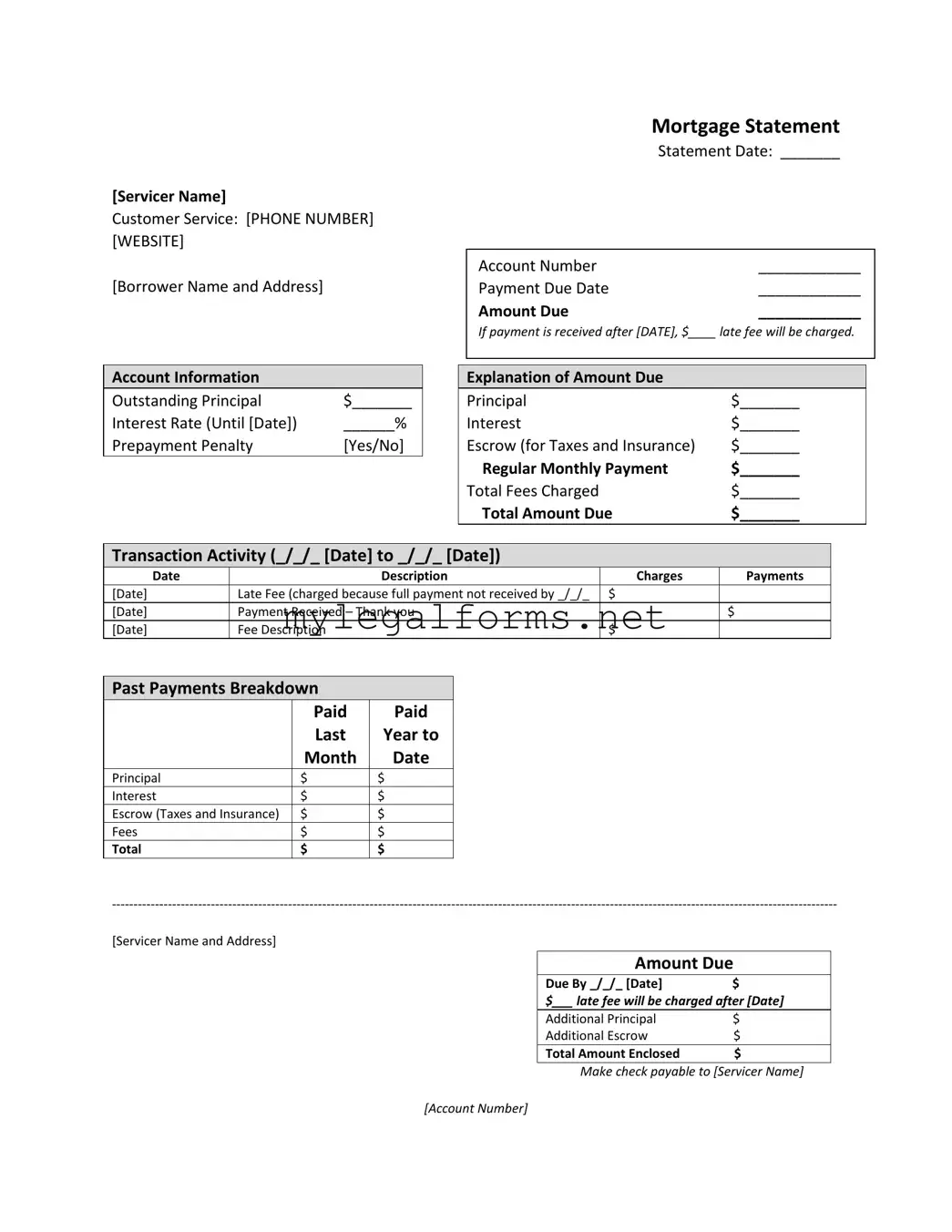

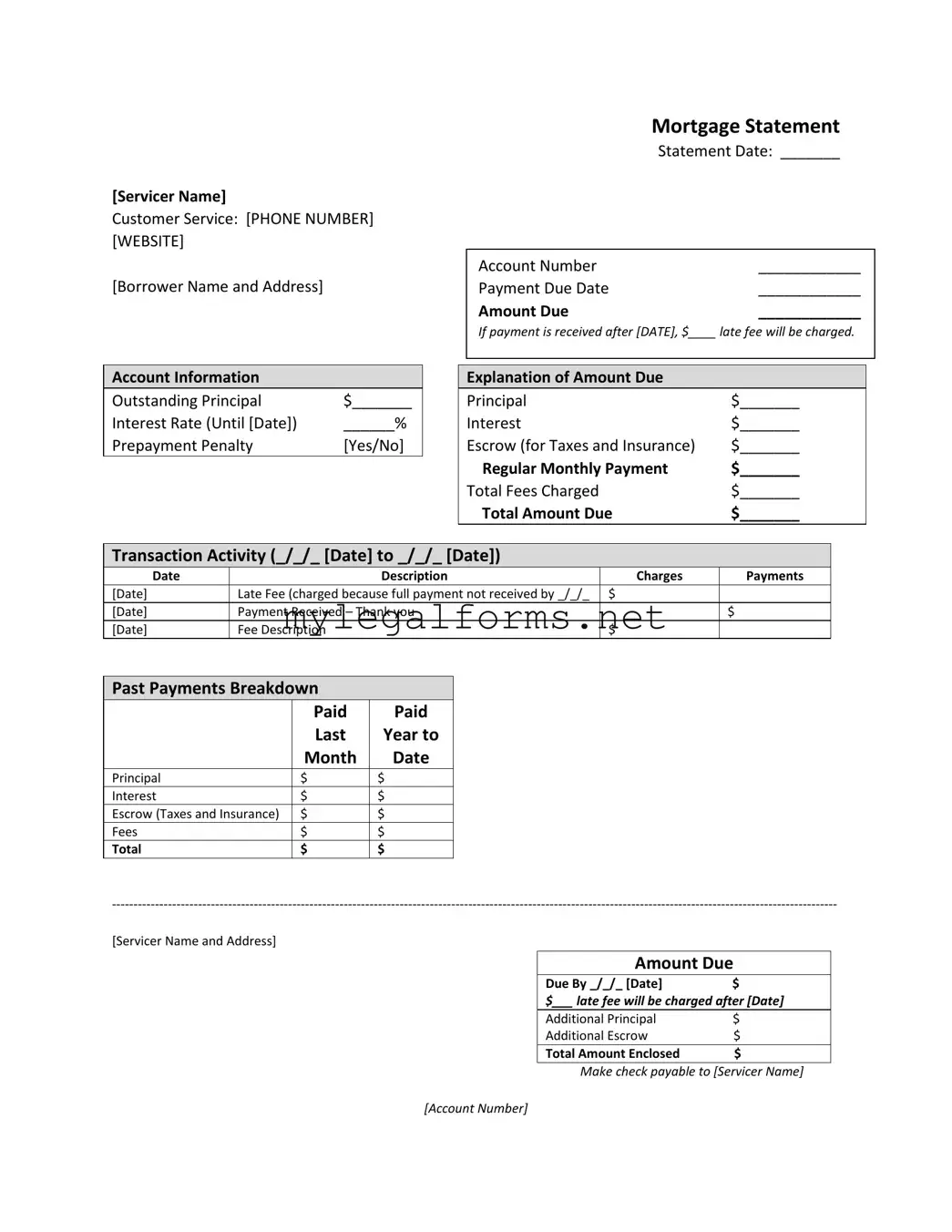

Mortgage Statement Template

A Mortgage Statement is a document provided by a mortgage servicer that details the status of a borrower's loan. It includes vital information such as the amount due, payment history, and any fees incurred. Understanding this form is essential for borrowers to manage their mortgage effectively and avoid potential pitfalls like late fees or foreclosure.

Launch Mortgage Statement Editor

Mortgage Statement Template

Launch Mortgage Statement Editor

Launch Mortgage Statement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Mortgage Statement online and download the final version.