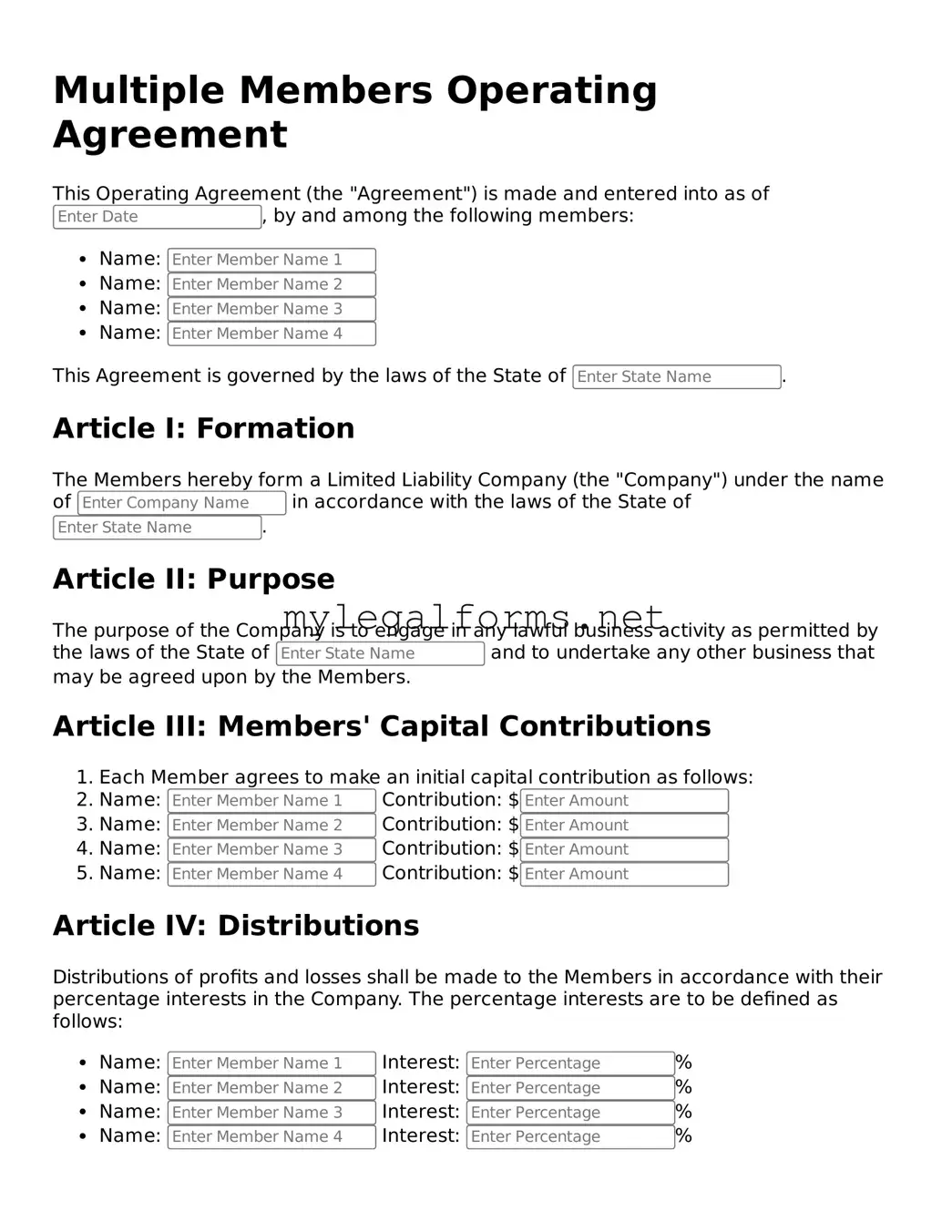

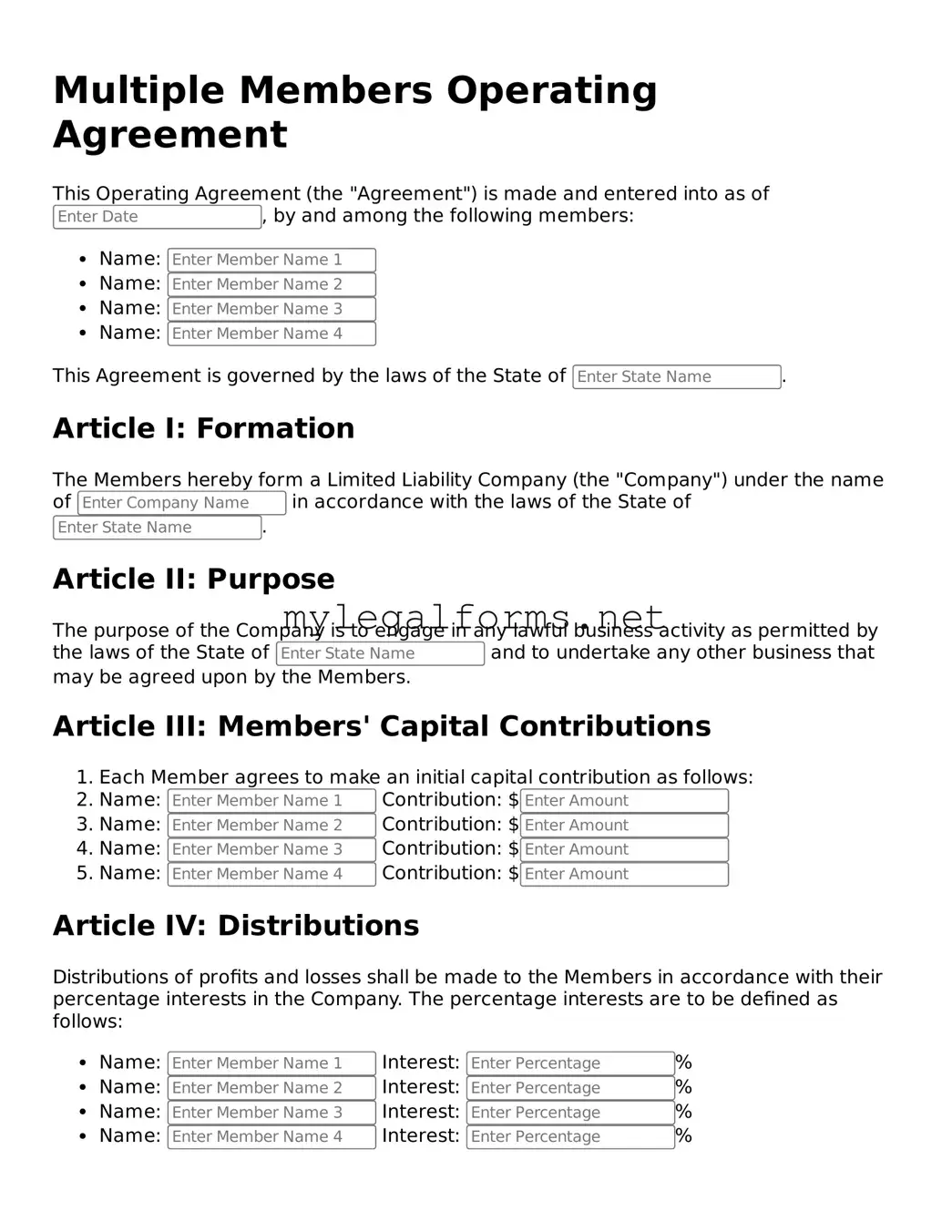

Attorney-Approved Multiple Members Operating Agreement Form

The Multiple Members Operating Agreement is a legal document that outlines the management structure and operating procedures for a business with multiple owners. This agreement helps clarify the rights and responsibilities of each member, ensuring smooth operations and minimizing disputes. Understanding this form is essential for anyone involved in a multi-member business venture.

Launch Multiple Members Operating Agreement Editor

Attorney-Approved Multiple Members Operating Agreement Form

Launch Multiple Members Operating Agreement Editor

Launch Multiple Members Operating Agreement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Multiple Members Operating Agreement online and download the final version.