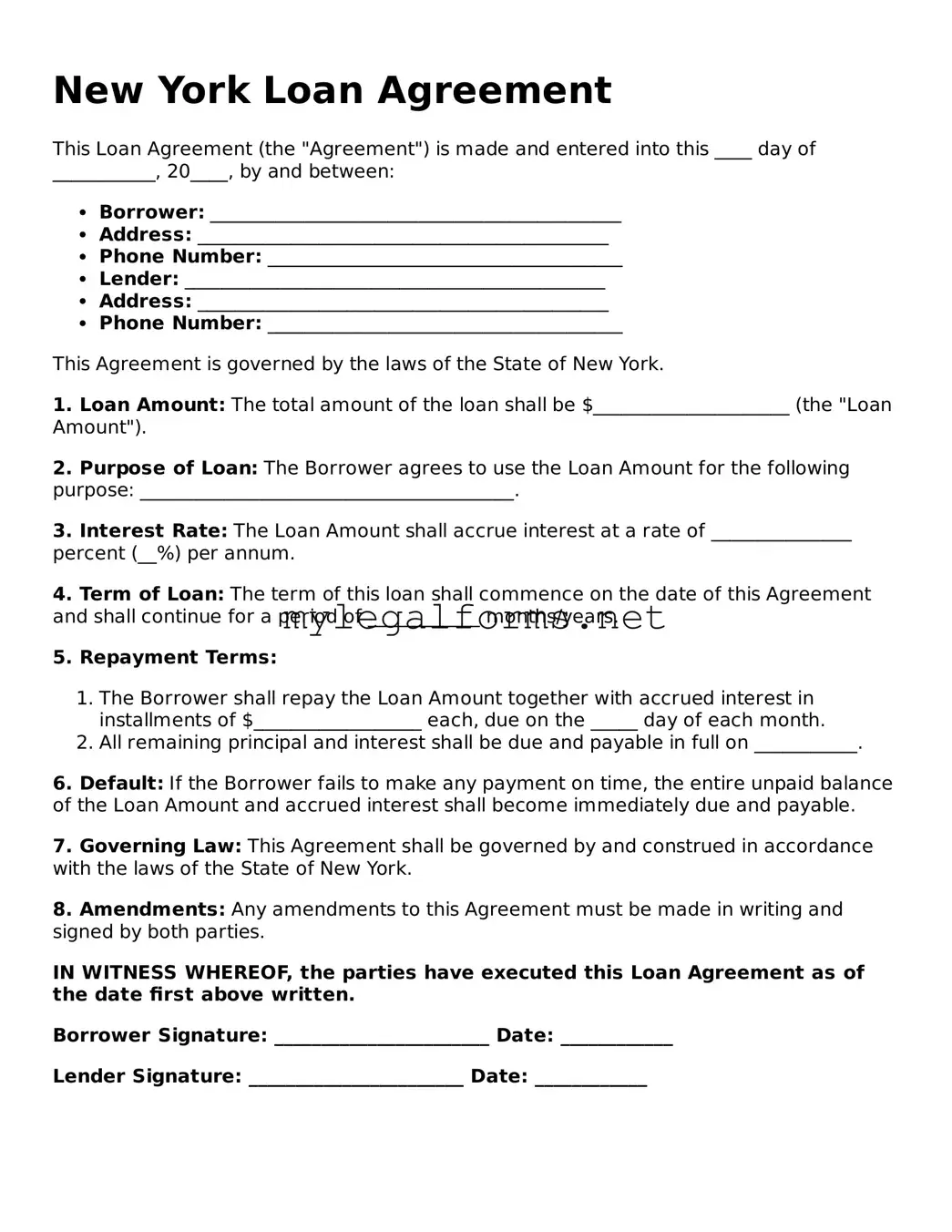

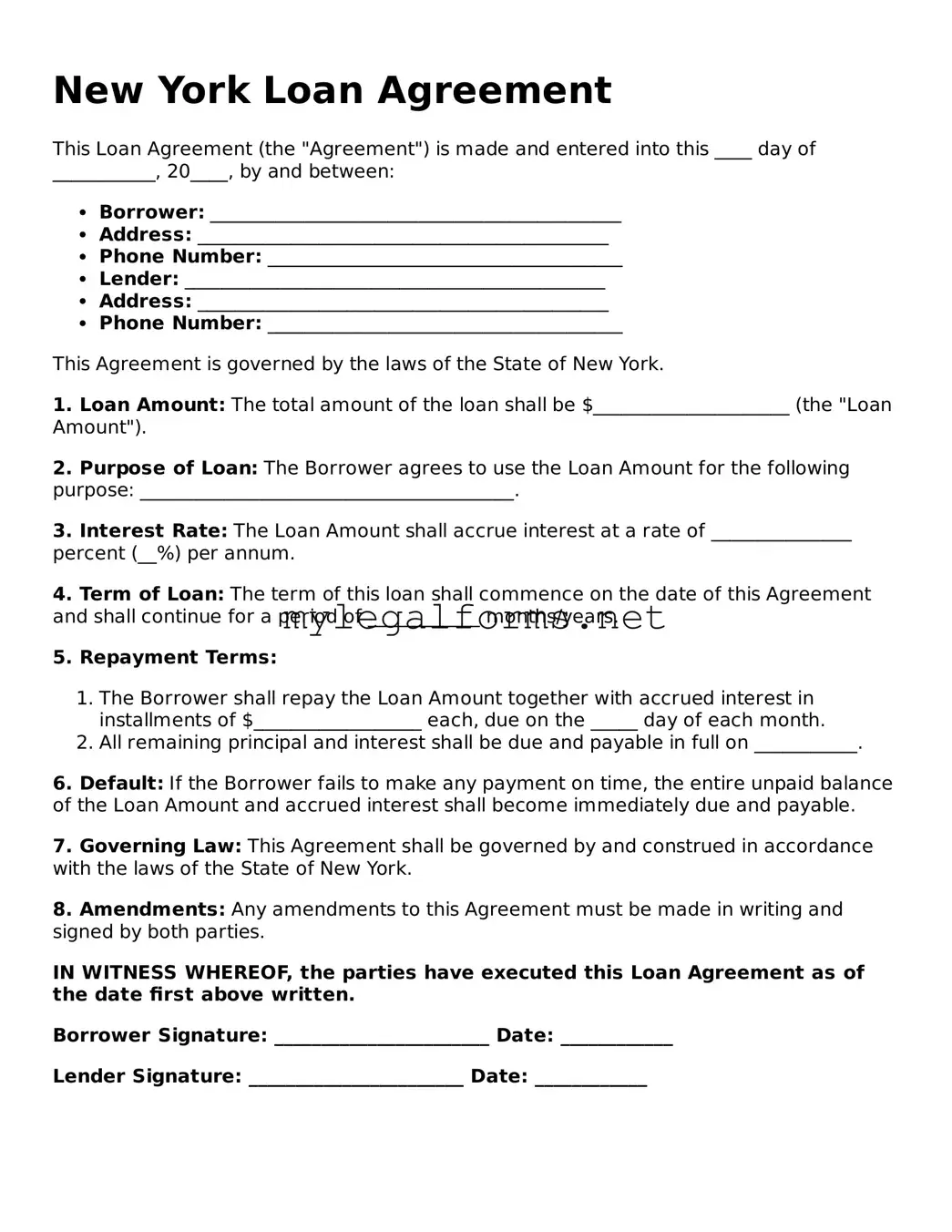

Loan Agreement Document for New York State

A New York Loan Agreement form is a legal document that outlines the terms of a loan between a lender and a borrower. This form helps both parties understand their rights and responsibilities, ensuring clarity throughout the borrowing process. Whether for personal or business use, having a well-drafted agreement is essential for a smooth transaction.

Launch Loan Agreement Editor

Loan Agreement Document for New York State

Launch Loan Agreement Editor

Launch Loan Agreement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Loan Agreement online and download the final version.