Promissory Note Document for New York State

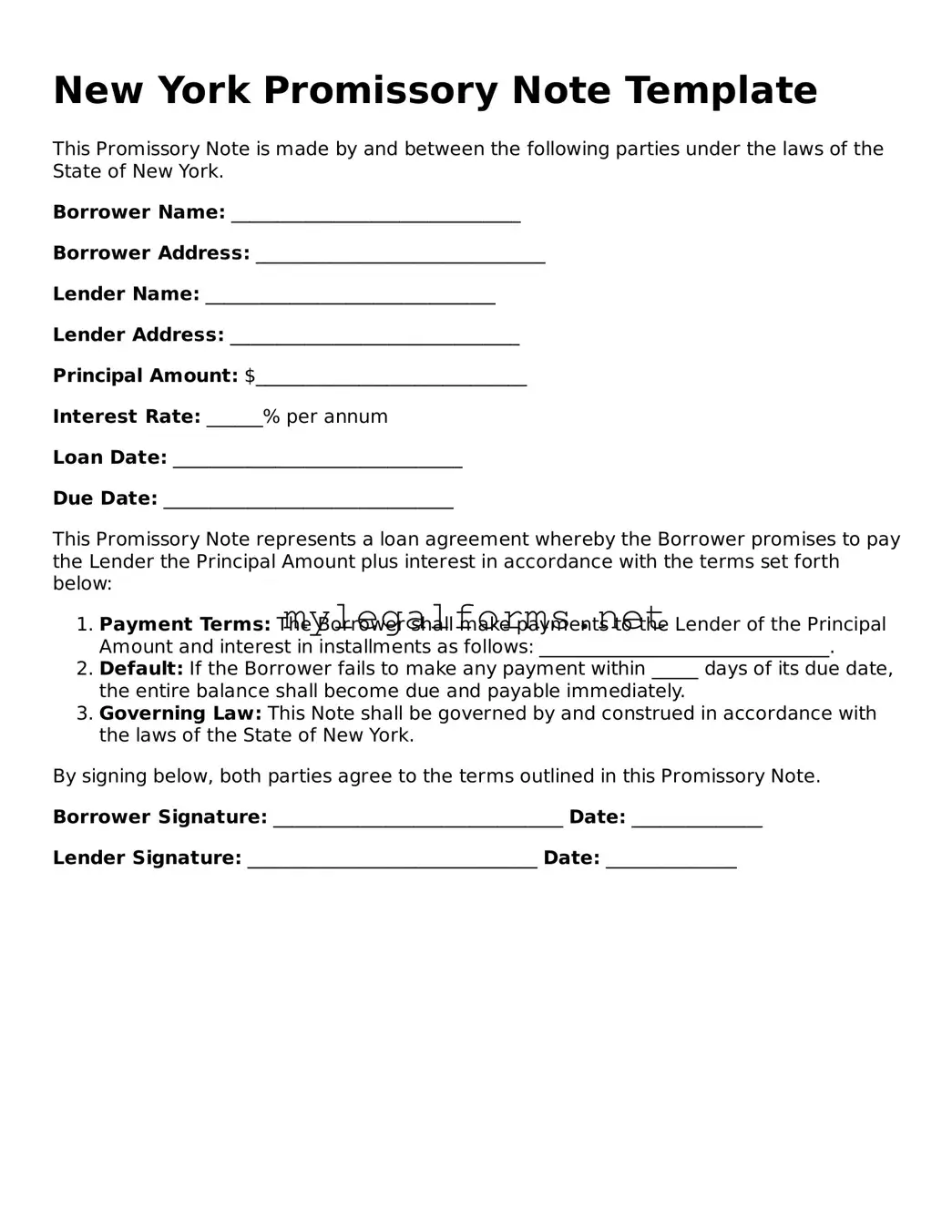

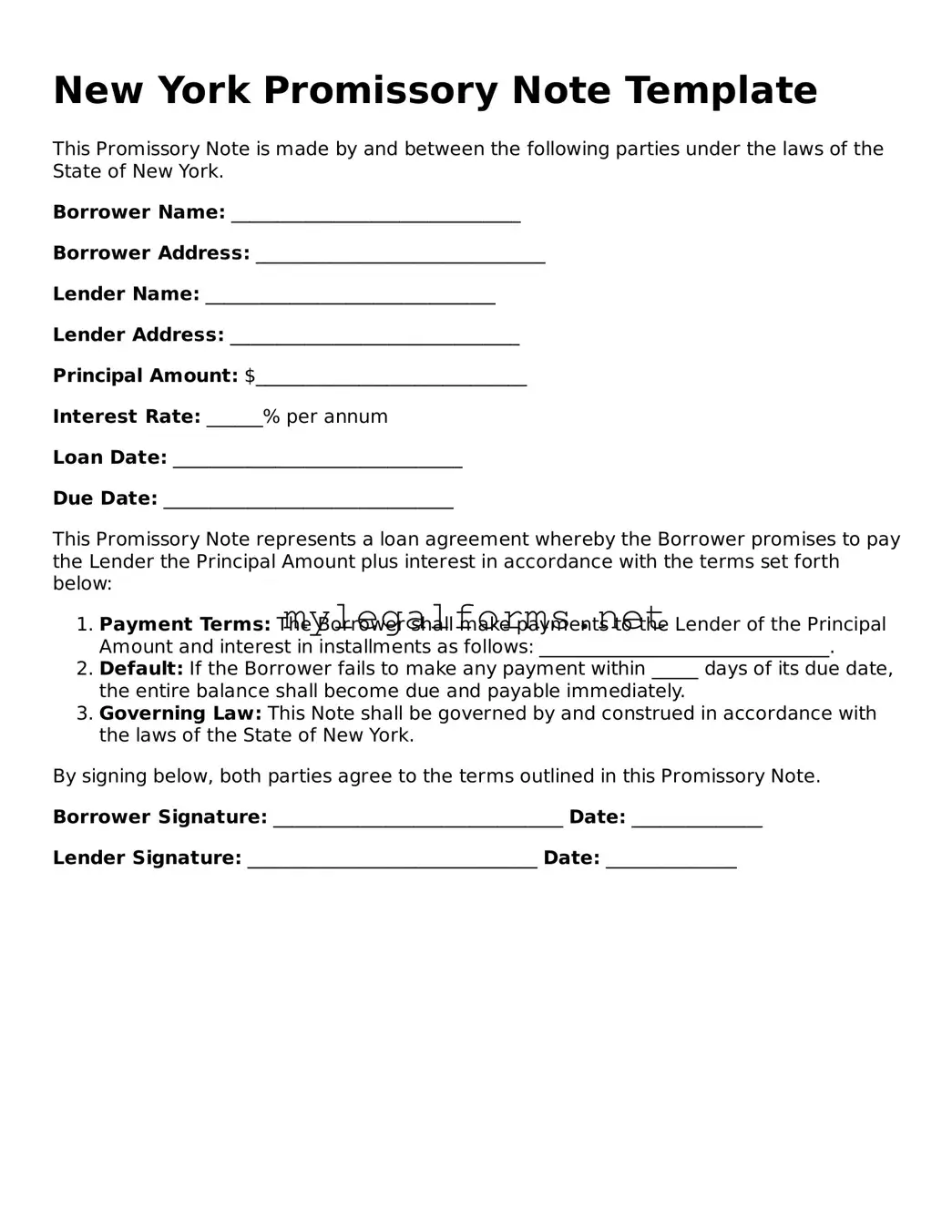

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time or on demand. This legal document outlines the terms of the loan, including interest rates and repayment schedules, ensuring clarity for both the lender and borrower. Understanding this form is essential for anyone involved in lending or borrowing money in New York.

Launch Promissory Note Editor

Promissory Note Document for New York State

Launch Promissory Note Editor

Launch Promissory Note Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Promissory Note online and download the final version.