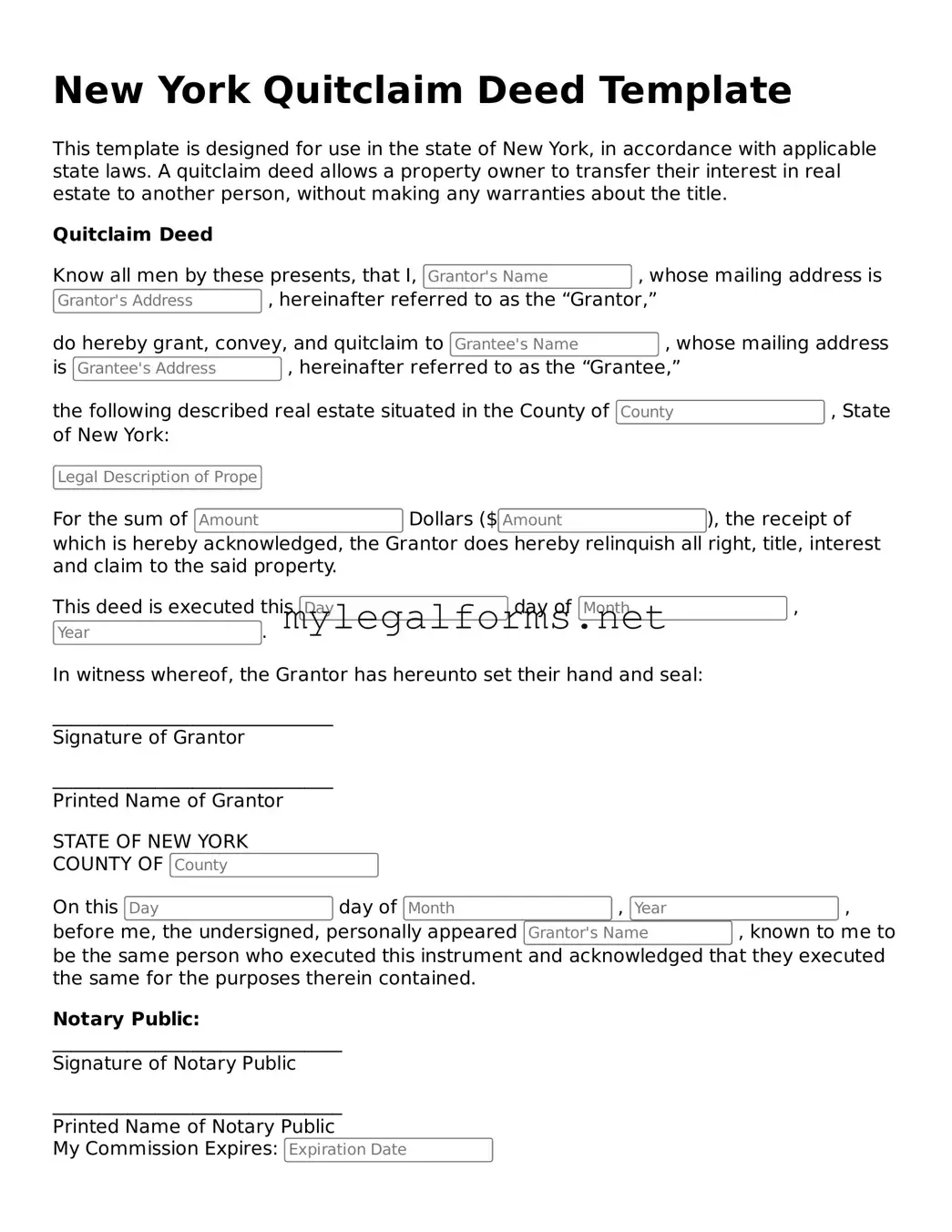

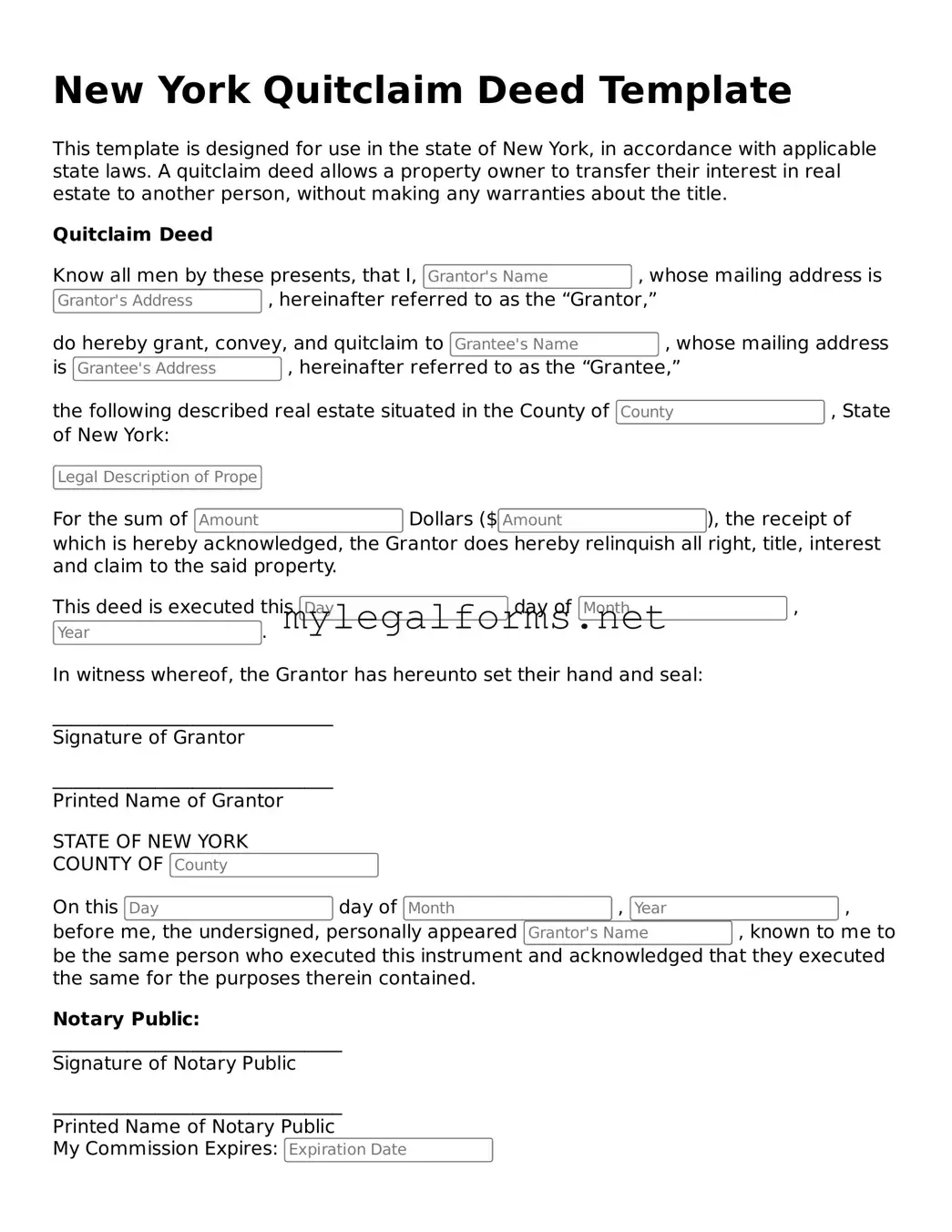

Quitclaim Deed Document for New York State

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. This form is particularly useful when the property is being transferred between family members or in situations where the grantor does not wish to make any guarantees about the property’s condition. Understanding the nuances of the New York Quitclaim Deed form can help ensure a smooth transfer of property rights.

Launch Quitclaim Deed Editor

Quitclaim Deed Document for New York State

Launch Quitclaim Deed Editor

Launch Quitclaim Deed Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Quitclaim Deed online and download the final version.