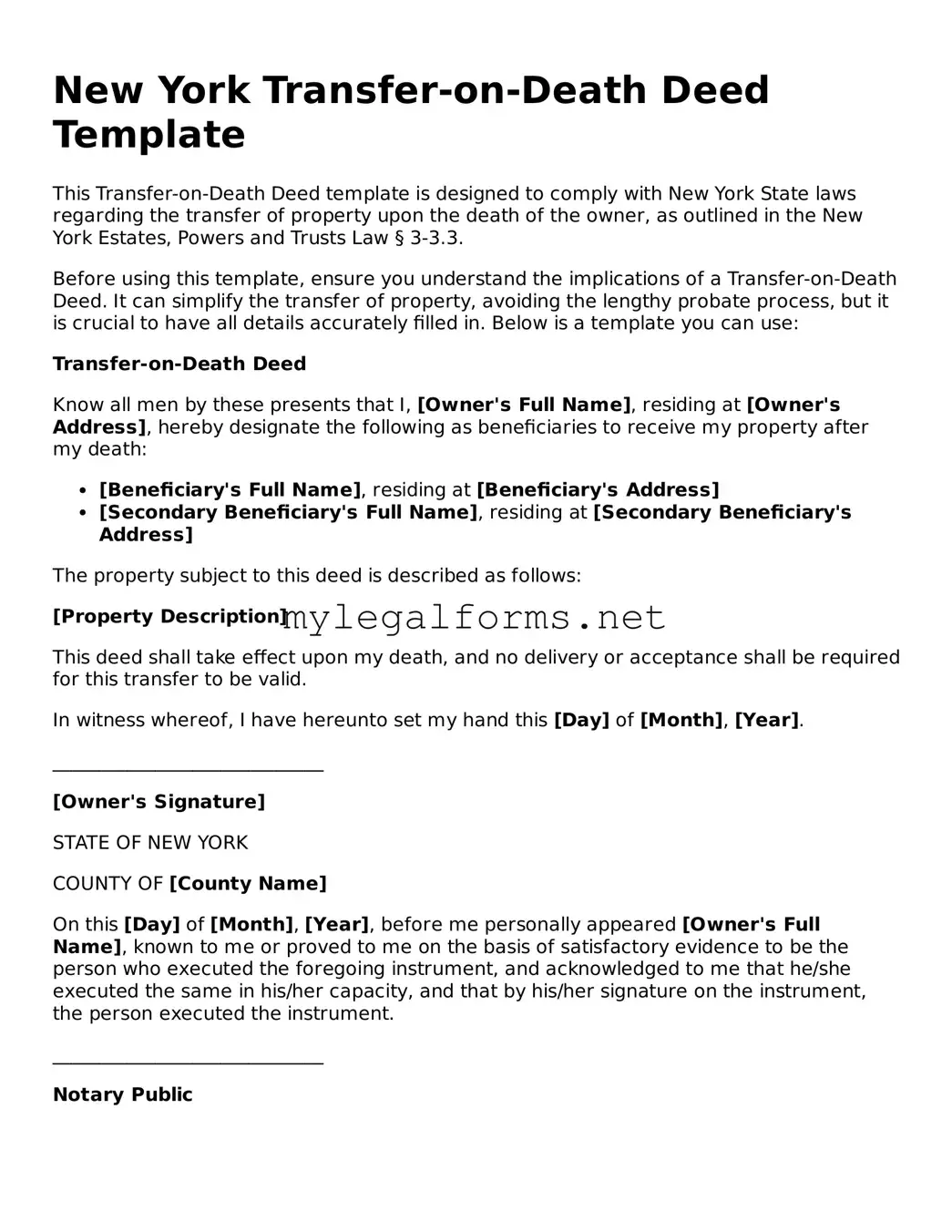

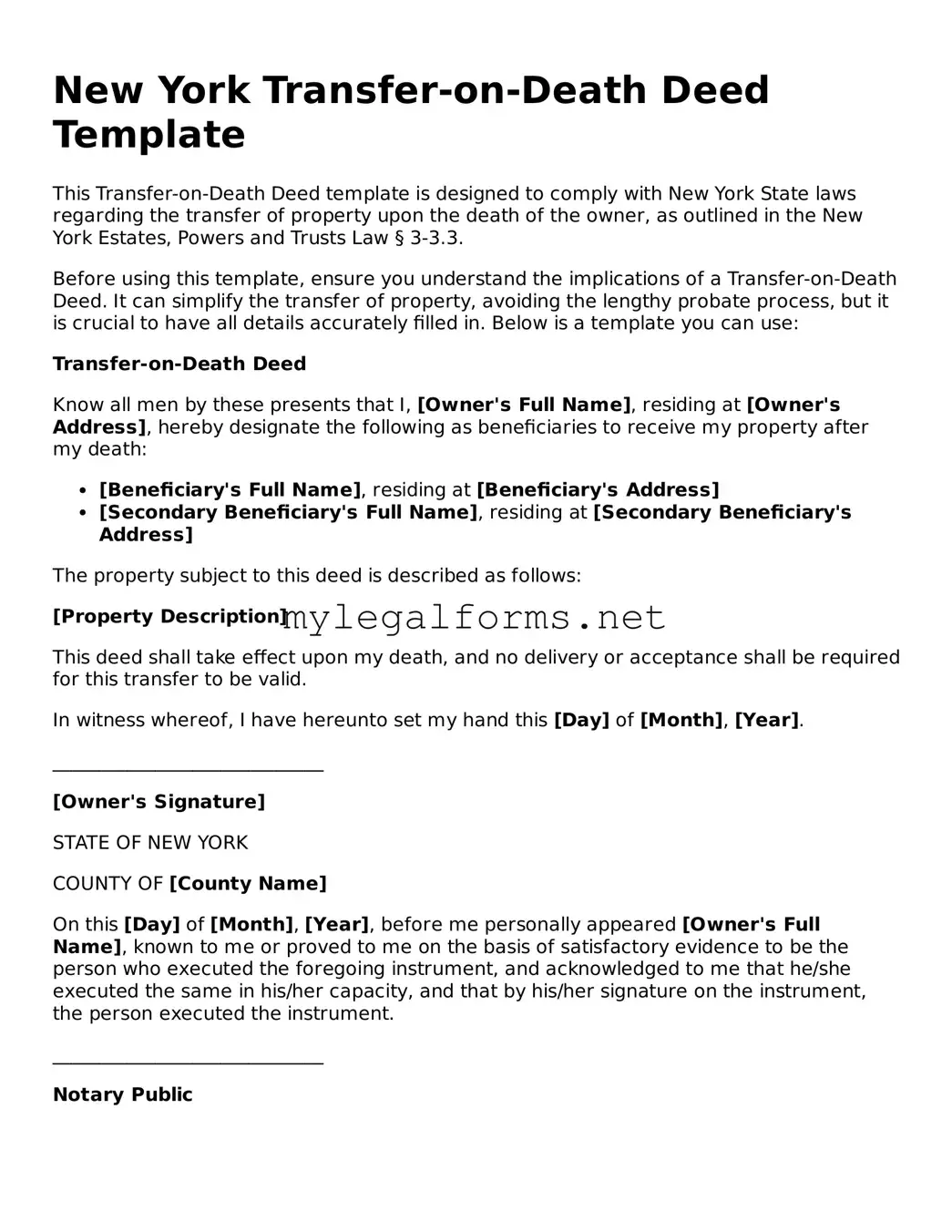

Transfer-on-Death Deed Document for New York State

The Transfer-on-Death Deed form is a legal document that allows property owners in New York to transfer their real estate to beneficiaries upon their death without the need for probate. This streamlined process can simplify estate management and ensure that assets are passed on according to the owner's wishes. Understanding the specifics of this form is essential for anyone looking to plan their estate effectively.

Launch Transfer-on-Death Deed Editor

Transfer-on-Death Deed Document for New York State

Launch Transfer-on-Death Deed Editor

Launch Transfer-on-Death Deed Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Transfer-on-Death Deed online and download the final version.