Attorney-Approved Owner Financing Contract Form

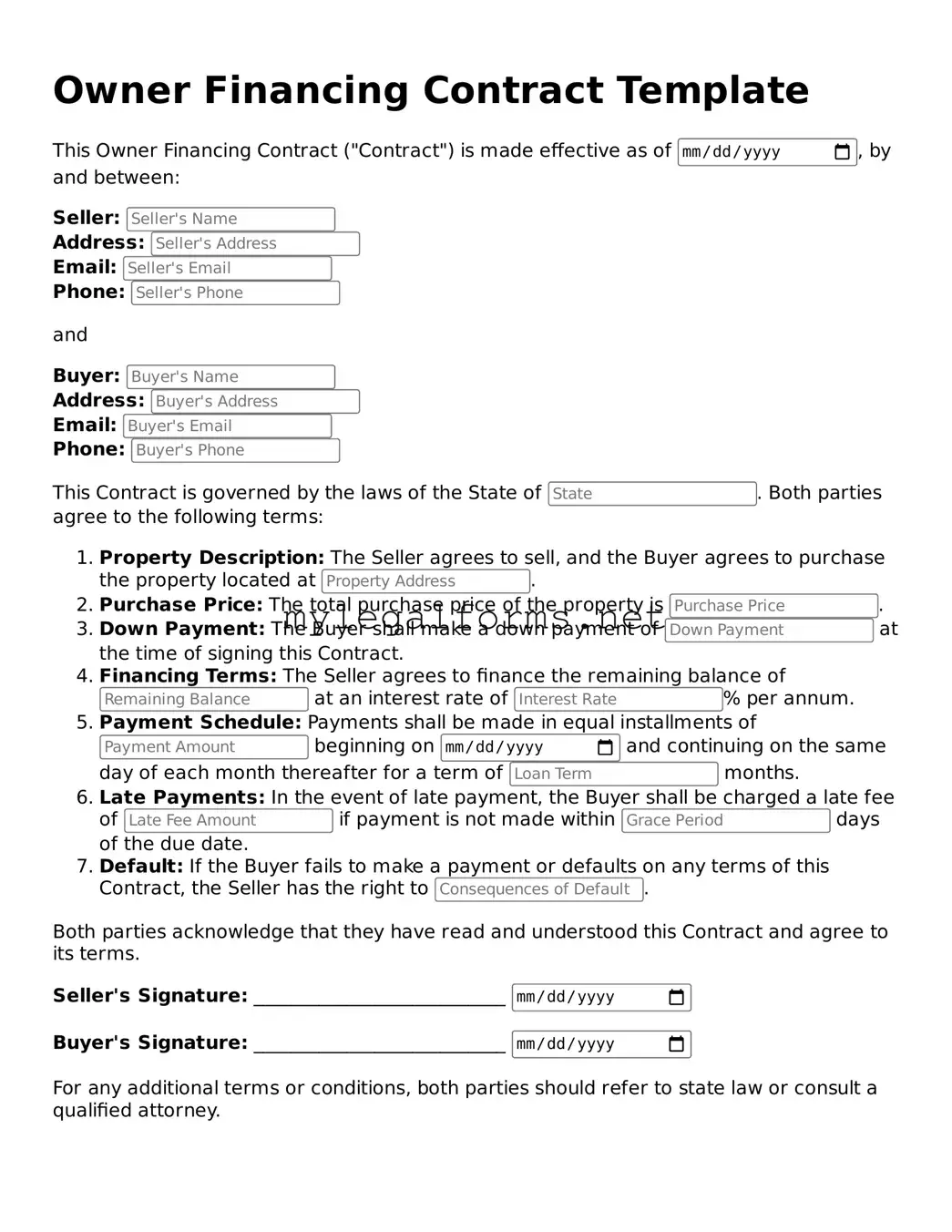

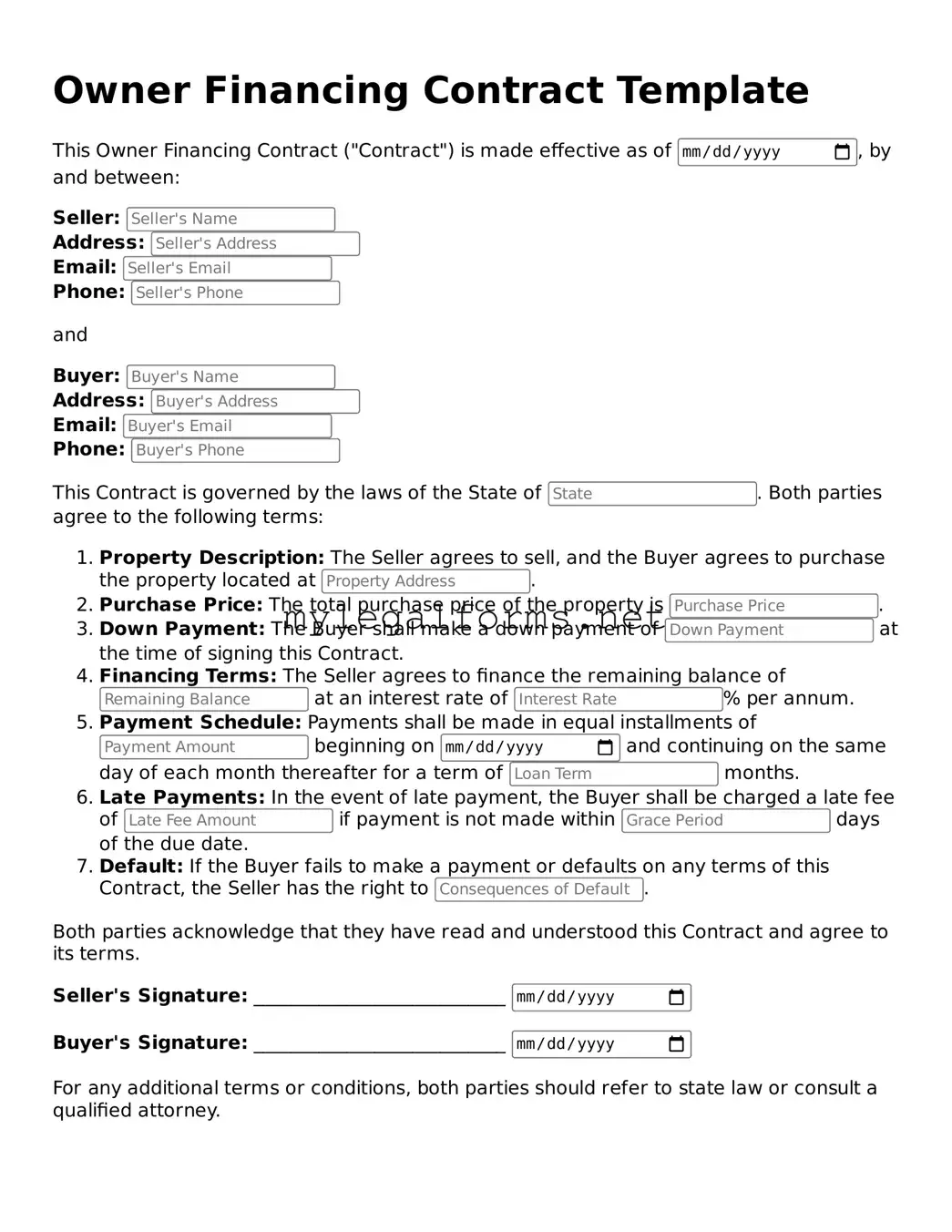

An Owner Financing Contract is a legal agreement between a property seller and a buyer, allowing the buyer to purchase the property directly from the seller without involving a traditional mortgage lender. This arrangement can provide benefits for both parties, including flexible payment terms and faster transactions. Understanding the details of this contract is essential for anyone considering owner financing as a viable option in real estate transactions.

Launch Owner Financing Contract Editor

Attorney-Approved Owner Financing Contract Form

Launch Owner Financing Contract Editor

Launch Owner Financing Contract Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Owner Financing Contract online and download the final version.