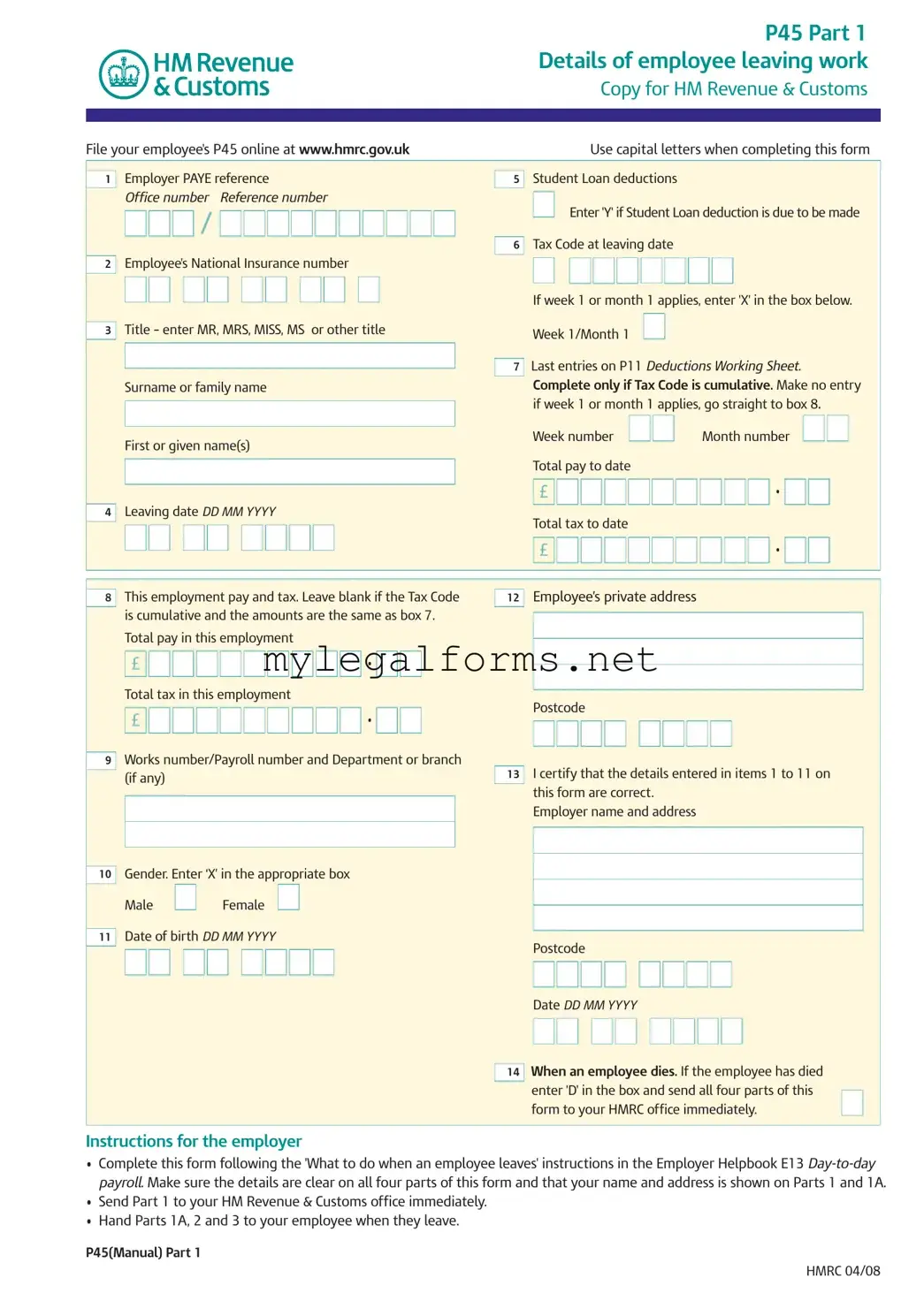

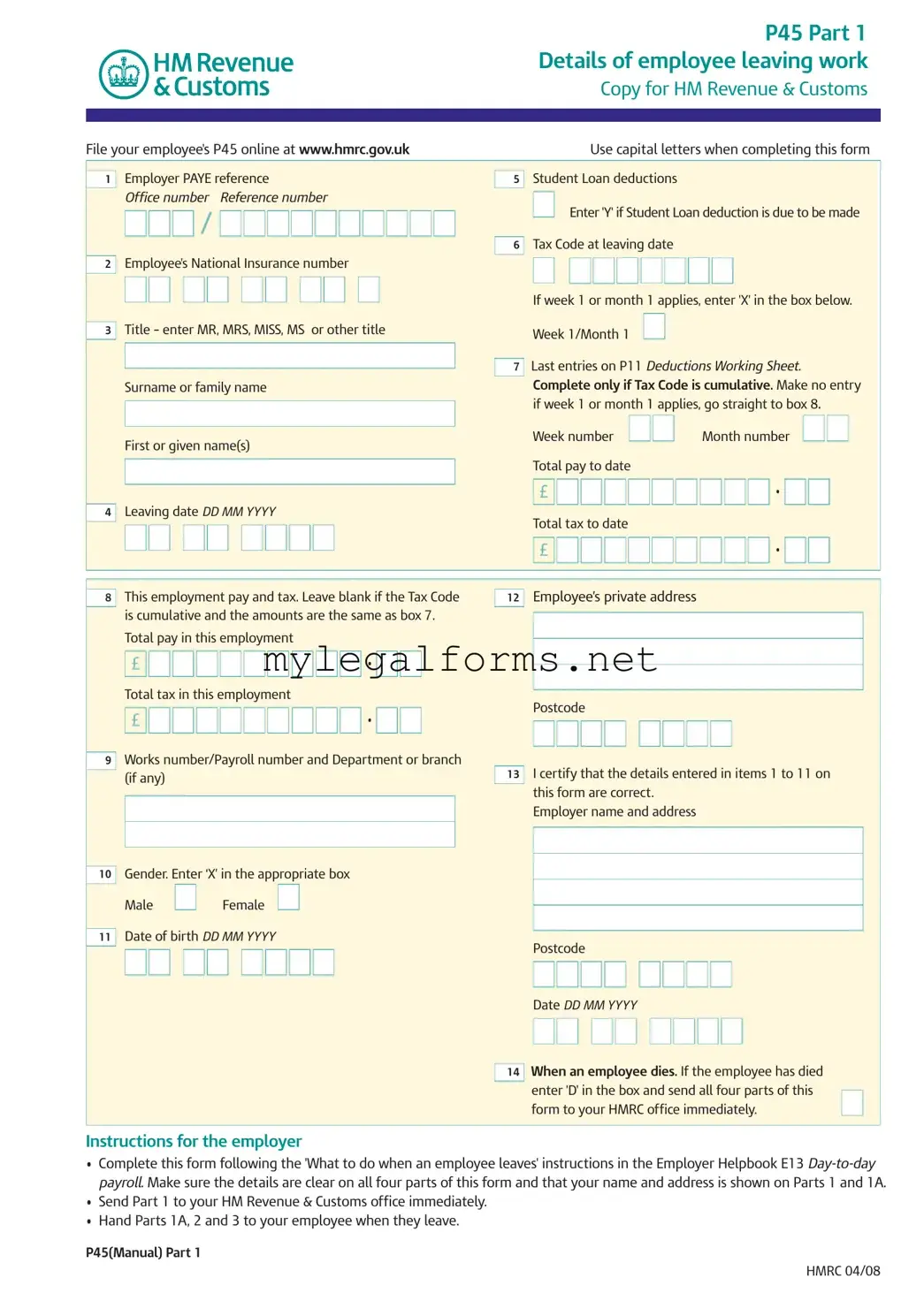

P 45 It Template

The P45 It form is an important document used in the UK to record details when an employee leaves their job. It serves as a formal record for both the employee and the employer, detailing earnings, tax deductions, and other essential information. Understanding how to complete and use this form can help ensure a smooth transition for employees moving to new roles or claiming benefits.

Launch P 45 It Editor

P 45 It Template

Launch P 45 It Editor

Launch P 45 It Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your P 45 It online and download the final version.

/

/

•

•

•

•

/

/

•

•