Articles of Incorporation Document for Pennsylvania State

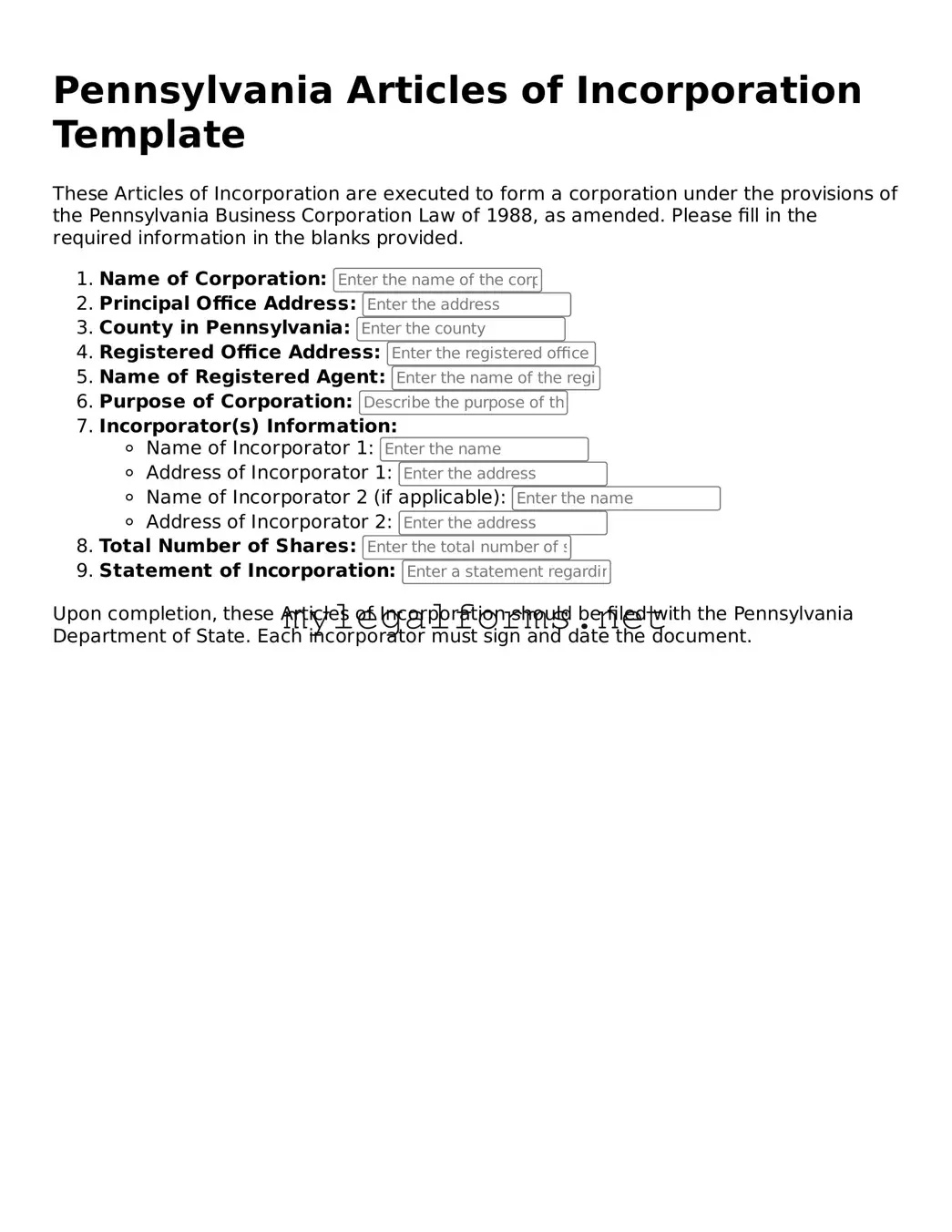

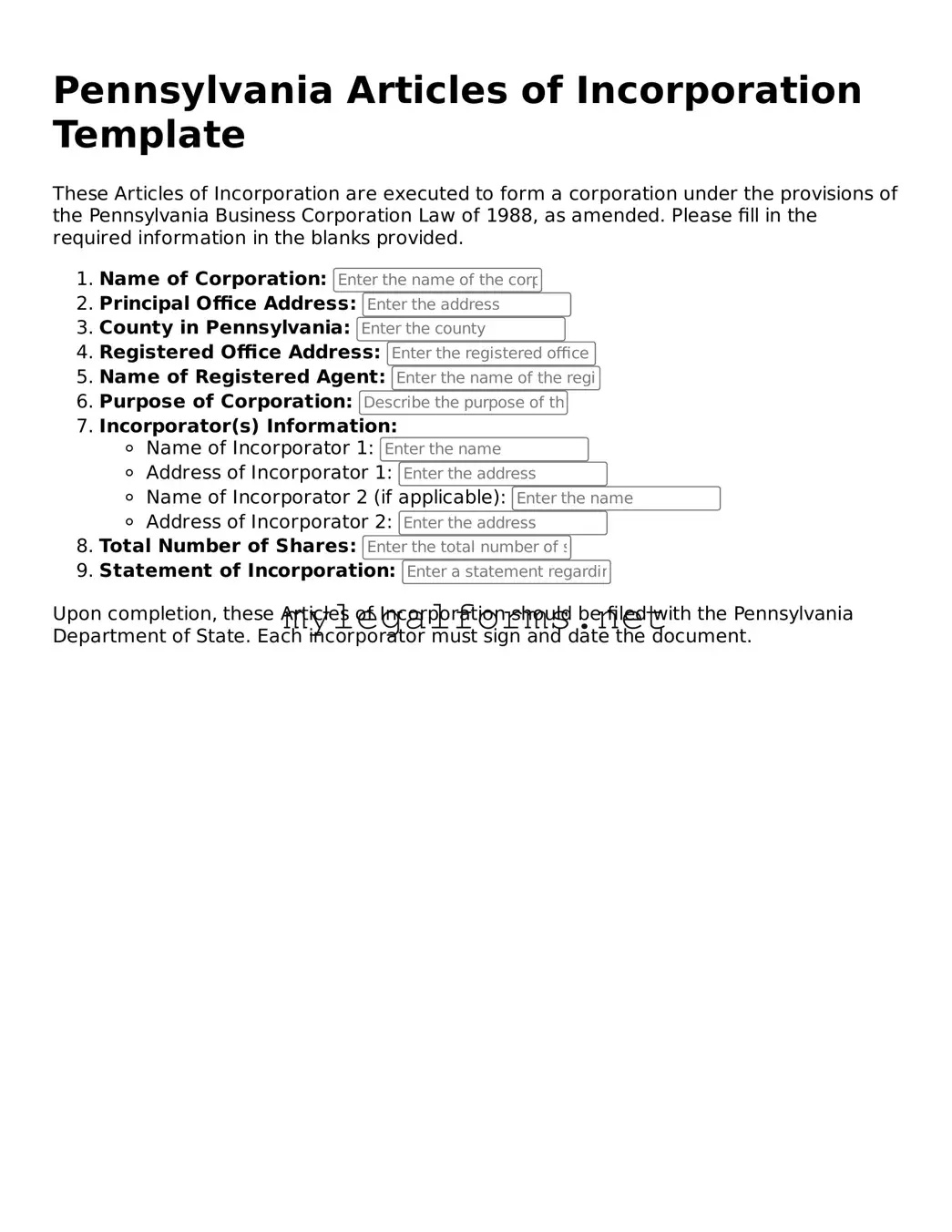

The Pennsylvania Articles of Incorporation form is a crucial document that establishes a corporation's existence in the state. This form outlines essential information about the corporation, including its name, purpose, and structure. By completing and filing this form, individuals take the first step toward creating a legally recognized business entity in Pennsylvania.

Launch Articles of Incorporation Editor

Articles of Incorporation Document for Pennsylvania State

Launch Articles of Incorporation Editor

Launch Articles of Incorporation Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Articles of Incorporation online and download the final version.