Filling out a Pennsylvania Promissory Note can seem straightforward, but many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure that your document is valid and enforceable.

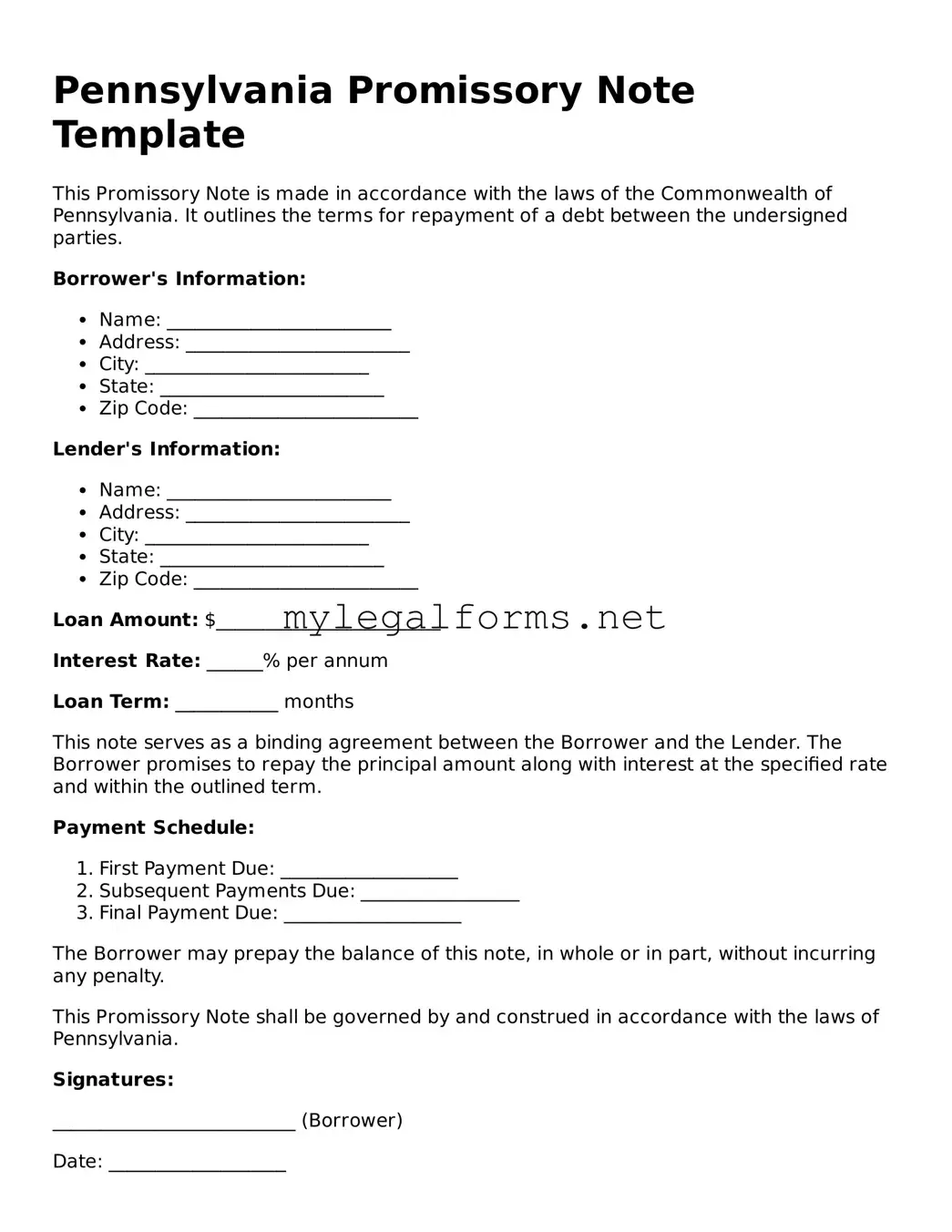

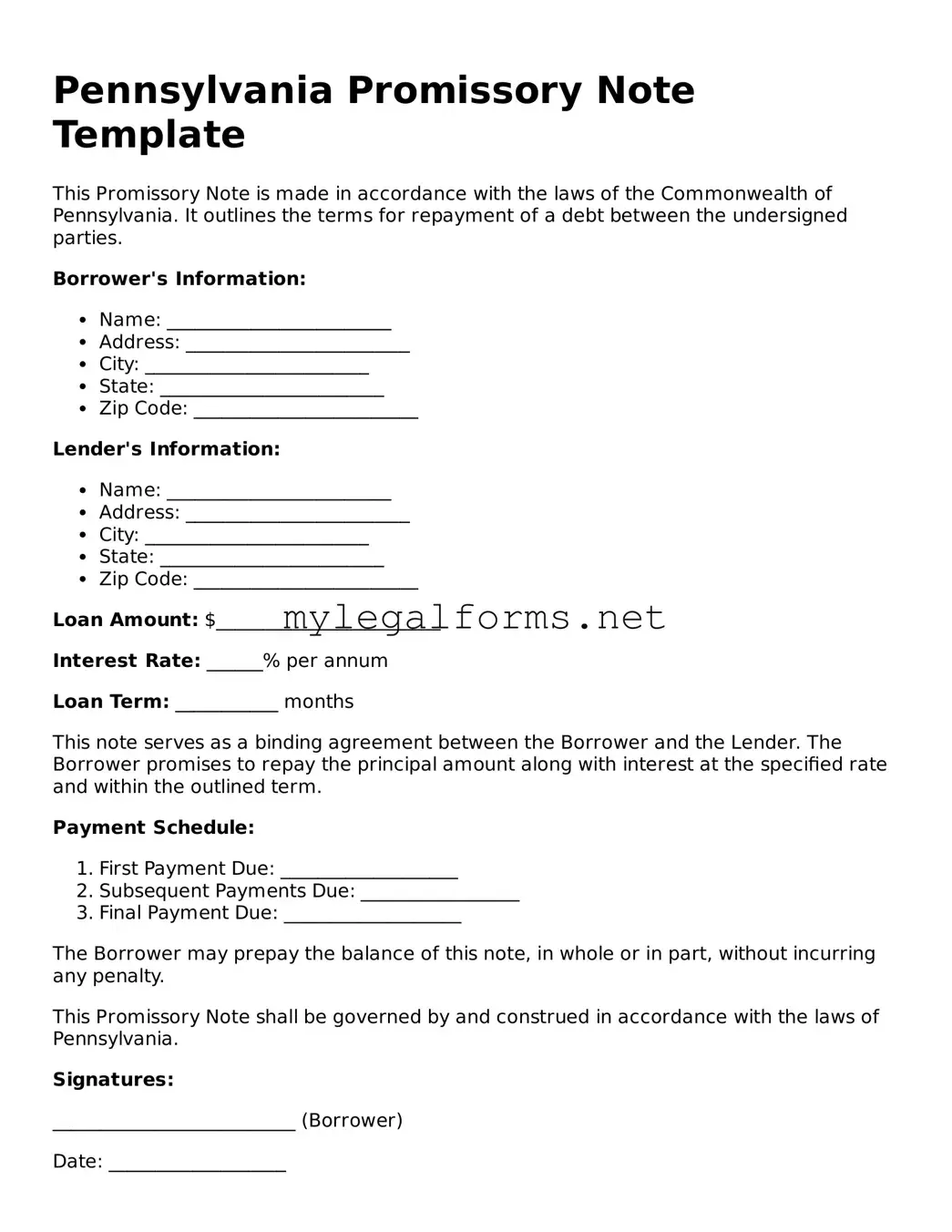

One frequent error is neglecting to clearly state the loan amount. While it may seem obvious, failing to write out the amount in both numerals and words can create confusion. This ambiguity can lead to disputes about the actual amount owed. Always double-check that the figure is accurate and clearly articulated.

Another common mistake is not including the interest rate. If the loan is to accrue interest, it’s essential to specify this rate. Leaving it blank or failing to mention it can result in legal issues later, especially if the borrower defaults. Clearly stating the interest rate protects both parties and ensures everyone understands the terms.

Many people also forget to include the repayment schedule. It’s vital to outline when payments are due—whether monthly, quarterly, or in a lump sum. Without this information, the borrower might be unsure of their obligations, which can lead to missed payments and potential legal action.

Inadequate signatures can also be a significant mistake. Both the borrower and lender must sign the document for it to be legally binding. Some individuals might overlook this step or forget to date their signatures. Ensure that all parties involved sign and date the document to avoid any enforceability issues.

Another oversight is not specifying the consequences of default. It’s important to outline what happens if the borrower fails to make payments. This might include late fees, acceleration of the loan, or legal action. Clearly stating these terms can help prevent misunderstandings and protect the lender’s interests.

People often forget to include a governing law clause. This clause indicates which state’s laws will govern the agreement. In Pennsylvania, it’s best to specify that the agreement will be interpreted under Pennsylvania law. This can save time and confusion if a dispute arises.

Additionally, failing to keep copies of the signed Promissory Note is a common mistake. Both parties should retain a copy for their records. This ensures that both the lender and borrower have access to the agreed-upon terms, which can be crucial in case of future disputes.

Lastly, some individuals may not consider having the document notarized. While notarization isn’t always required, it can add an extra layer of security and authenticity to the agreement. A notary can verify the identities of the parties involved, which can be helpful if legal issues arise later.

By being aware of these common mistakes, you can better navigate the process of filling out a Pennsylvania Promissory Note. Taking the time to ensure accuracy and clarity can prevent future complications and help protect your interests.