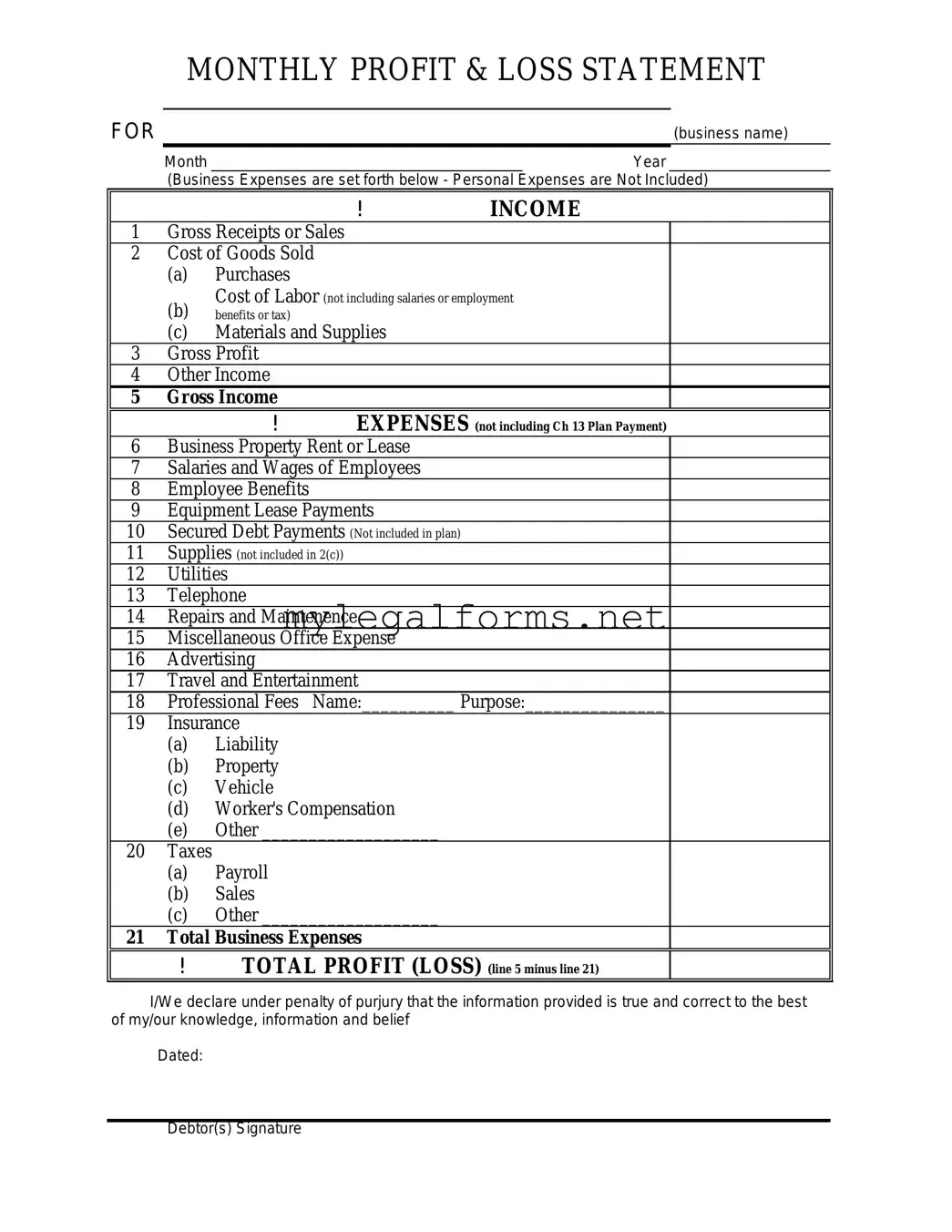

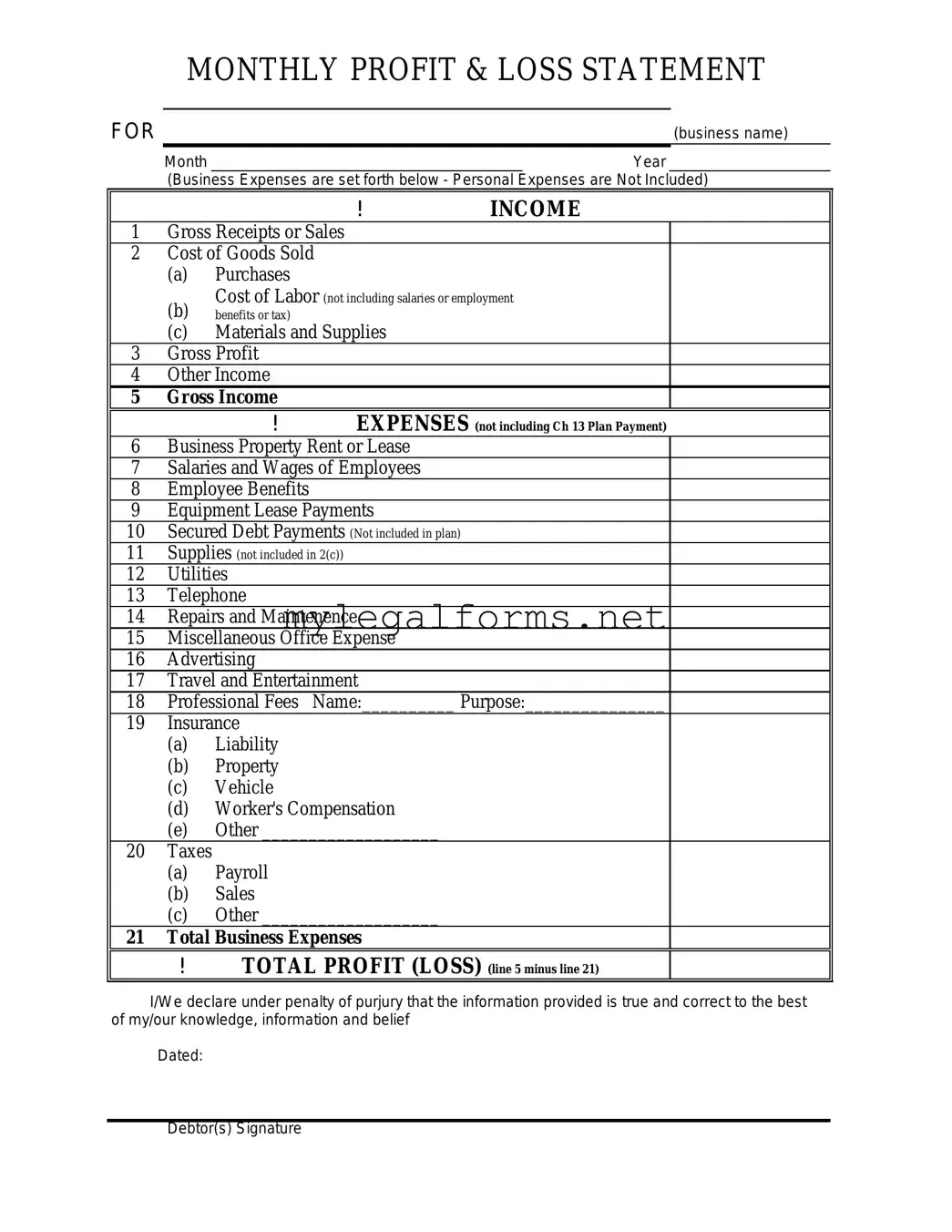

Profit And Loss Template

The Profit and Loss form, also known as an income statement, is a financial document that summarizes a company's revenues and expenses over a specific period. This form helps businesses assess their financial performance, providing insights into profitability and operational efficiency. Understanding the Profit and Loss form is essential for making informed financial decisions and strategic planning.

Launch Profit And Loss Editor

Profit And Loss Template

Launch Profit And Loss Editor

Launch Profit And Loss Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Profit And Loss online and download the final version.