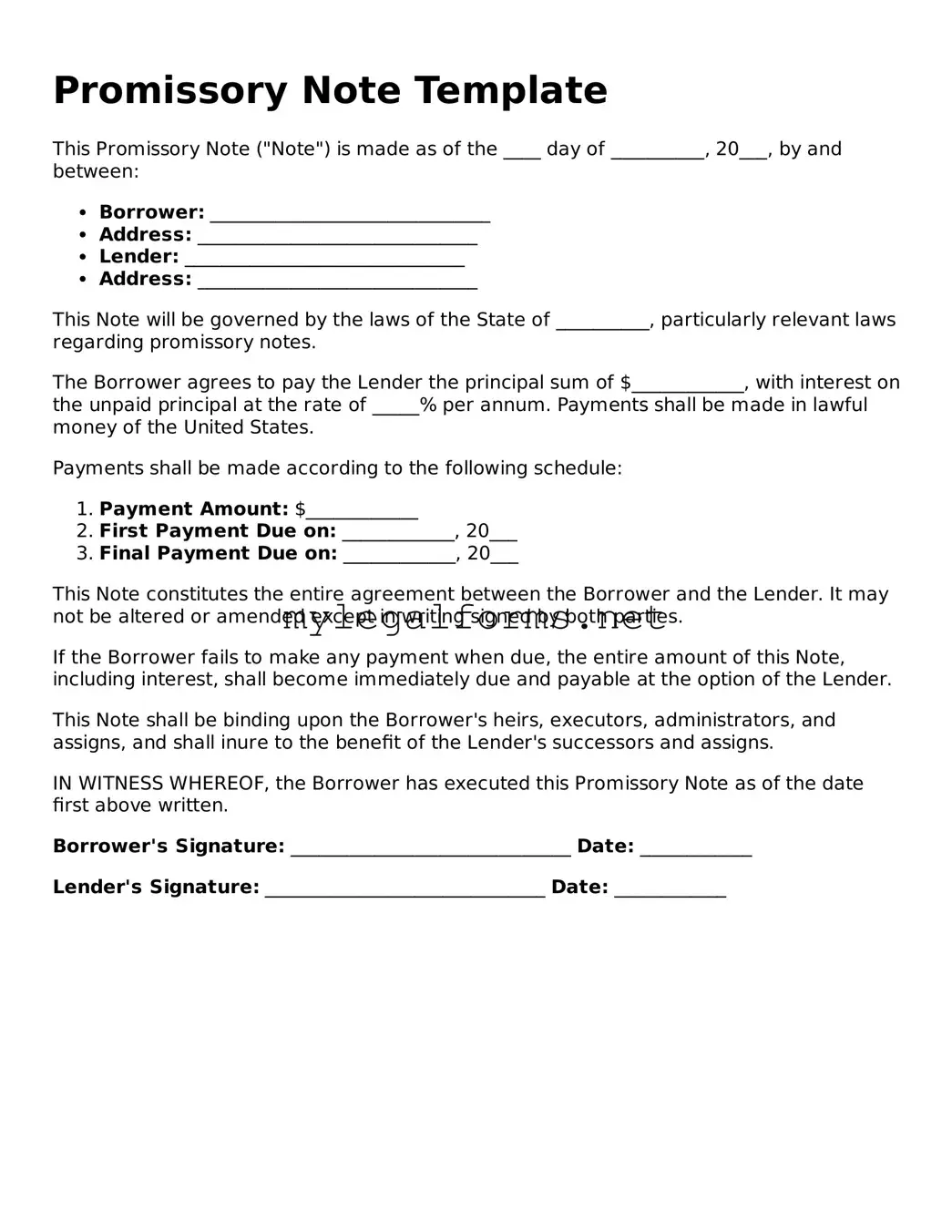

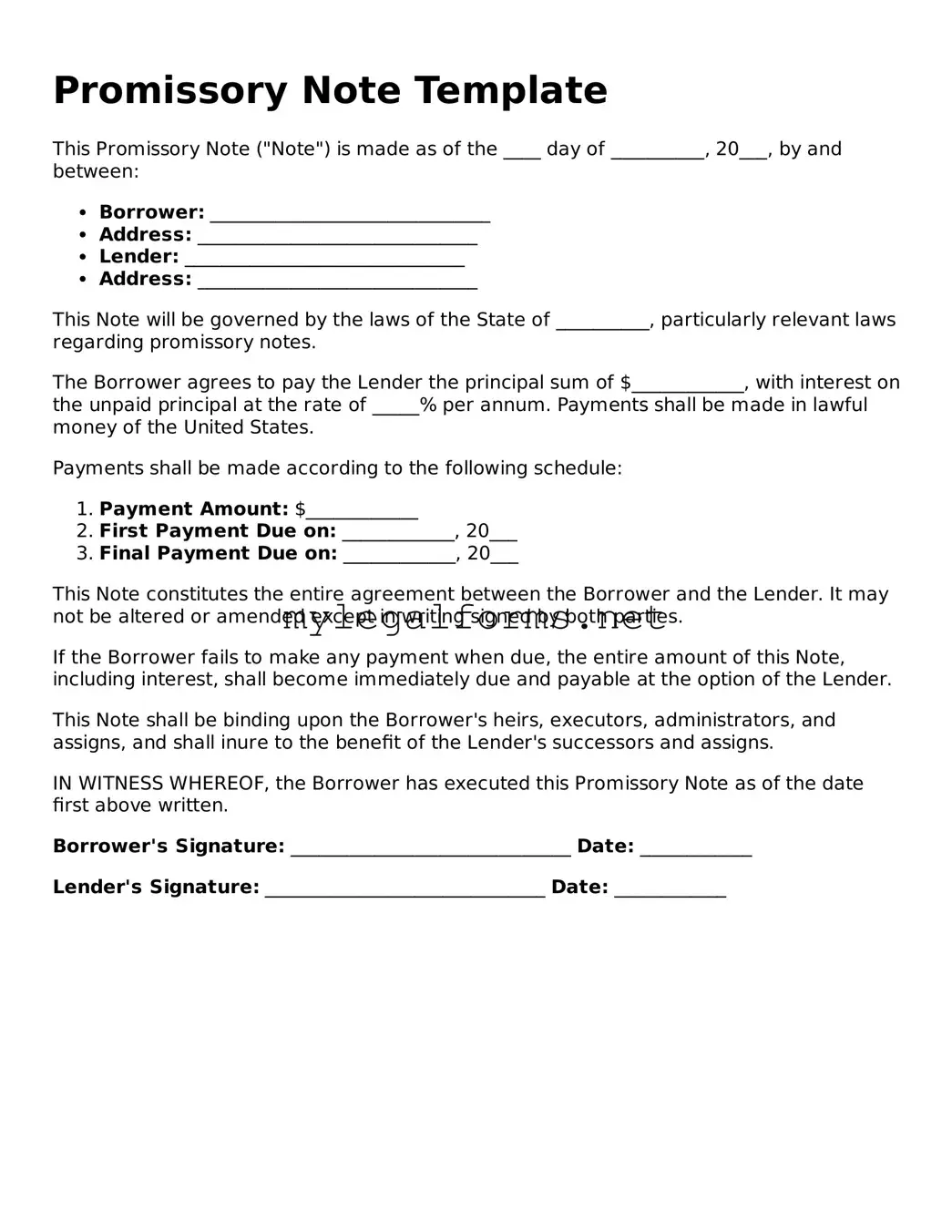

Attorney-Approved Promissory Note Form

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. This simple yet powerful financial document serves as a critical tool in various transactions, providing clarity and security for both the borrower and the lender. Understanding its components and implications can help individuals navigate their financial commitments more effectively.

Launch Promissory Note Editor

Attorney-Approved Promissory Note Form

Launch Promissory Note Editor

Launch Promissory Note Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Promissory Note online and download the final version.