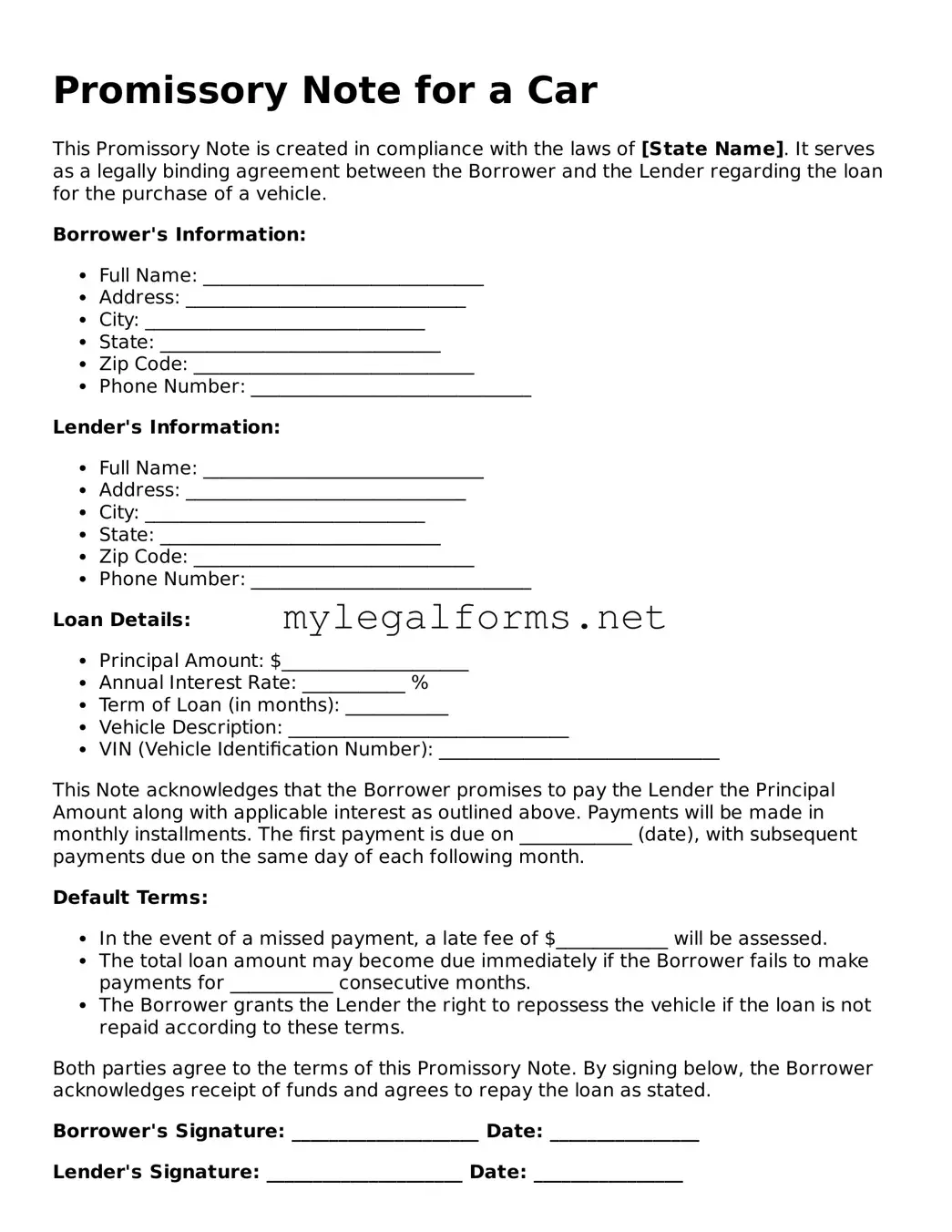

Filling out a Promissory Note for a Car can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is not including the correct names of the parties involved. It’s essential to clearly state the names of both the borrower and the lender. Misspellings or incorrect names can create confusion and potentially invalidate the agreement.

Another mistake often seen is failing to specify the loan amount. This figure should be clearly stated in both numerical and written form. Omitting this detail can lead to disputes about how much money is actually being borrowed, which can complicate repayment terms.

Many individuals neglect to include the interest rate in their Promissory Note. This rate should be clearly defined and agreed upon by both parties. Without this information, the lender may face difficulties in collecting the agreed-upon interest, and the borrower may be unsure of their total repayment obligation.

Some people overlook the importance of outlining the repayment schedule. It is crucial to specify when payments are due, how much each payment will be, and the total duration of the loan. A vague repayment schedule can lead to misunderstandings and missed payments.

Another common oversight is not including a clause for late payments. This clause can stipulate penalties or additional interest that may accrue if payments are not made on time. Without this provision, the lender may have limited recourse if the borrower fails to meet their obligations.

Additionally, individuals often forget to sign and date the document. A Promissory Note is not legally binding unless it is signed by both parties. Failing to do so can render the agreement unenforceable, leaving both parties unprotected.

Some borrowers may mistakenly think that a verbal agreement is sufficient. Relying solely on verbal promises can lead to misunderstandings. A written Promissory Note serves as a clear record of the terms agreed upon, providing security for both parties.

People also frequently neglect to include a section for witnesses or notarization. Depending on state laws, having a witness or a notary public can add an extra layer of legitimacy to the document, making it harder for either party to dispute the agreement later on.

Another common error is not reviewing the document thoroughly before signing. Skimming through the terms can lead to overlooking important details. Taking the time to read the entire Promissory Note ensures that both parties understand their rights and obligations.

Lastly, some individuals fail to keep copies of the signed Promissory Note. It’s vital for both the lender and the borrower to retain a copy of the agreement for their records. This documentation can be crucial in case of future disputes or misunderstandings.