Attorney-Approved Real Estate Purchase Agreement Form

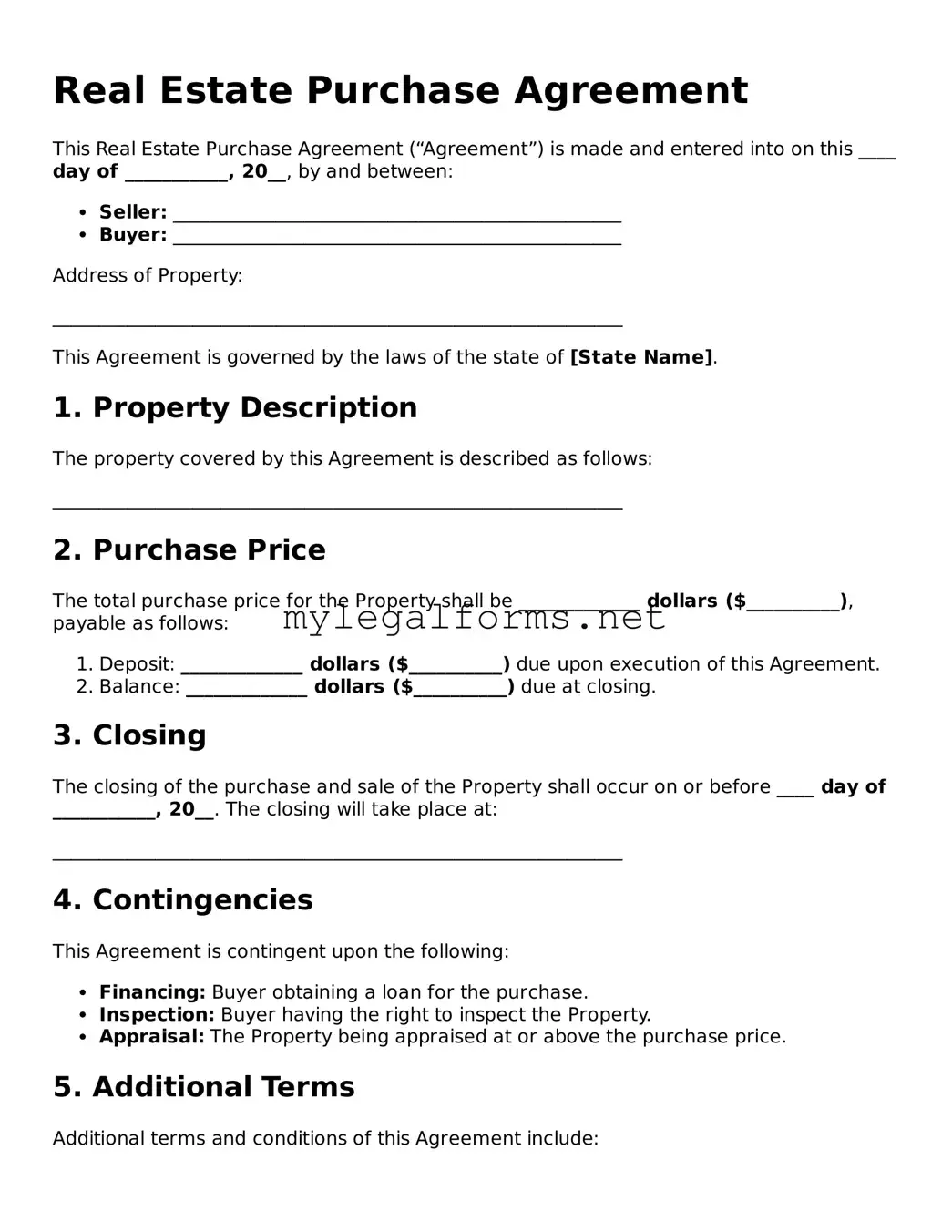

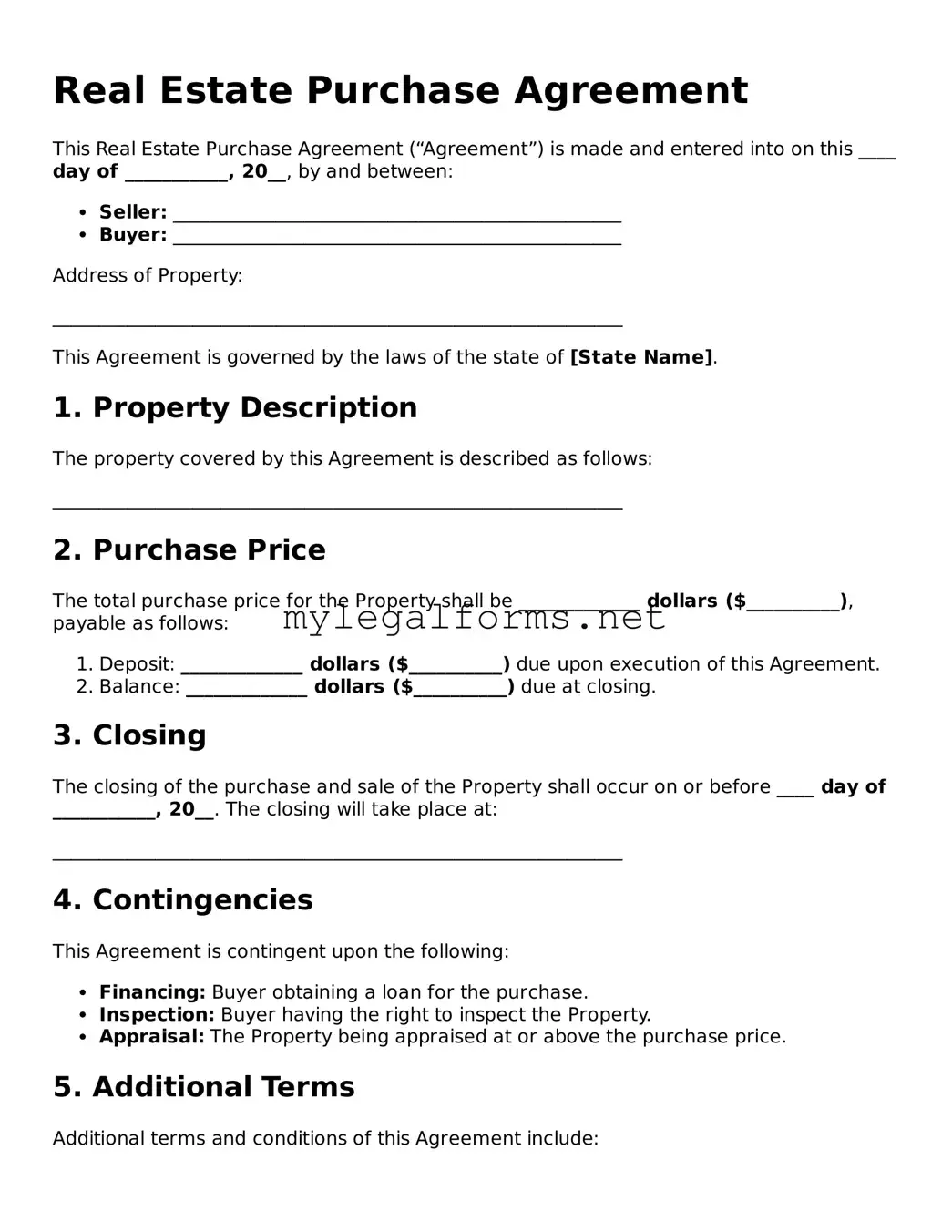

A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale between a buyer and a seller. This agreement serves as a roadmap for the transaction, detailing important aspects like price, financing, and contingencies. Understanding this form is crucial for anyone looking to navigate the real estate market successfully.

Launch Real Estate Purchase Agreement Editor

Attorney-Approved Real Estate Purchase Agreement Form

Launch Real Estate Purchase Agreement Editor

Launch Real Estate Purchase Agreement Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Real Estate Purchase Agreement online and download the final version.