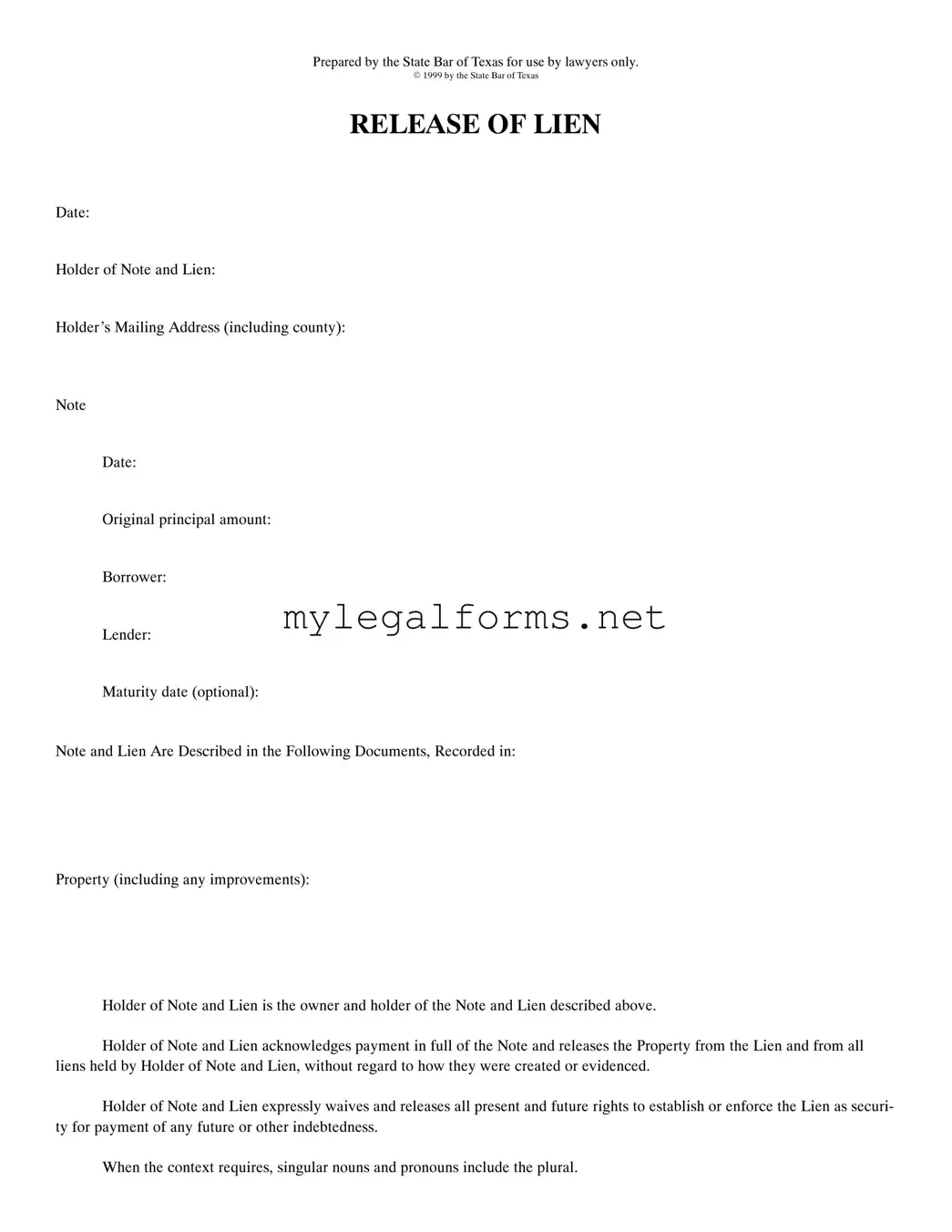

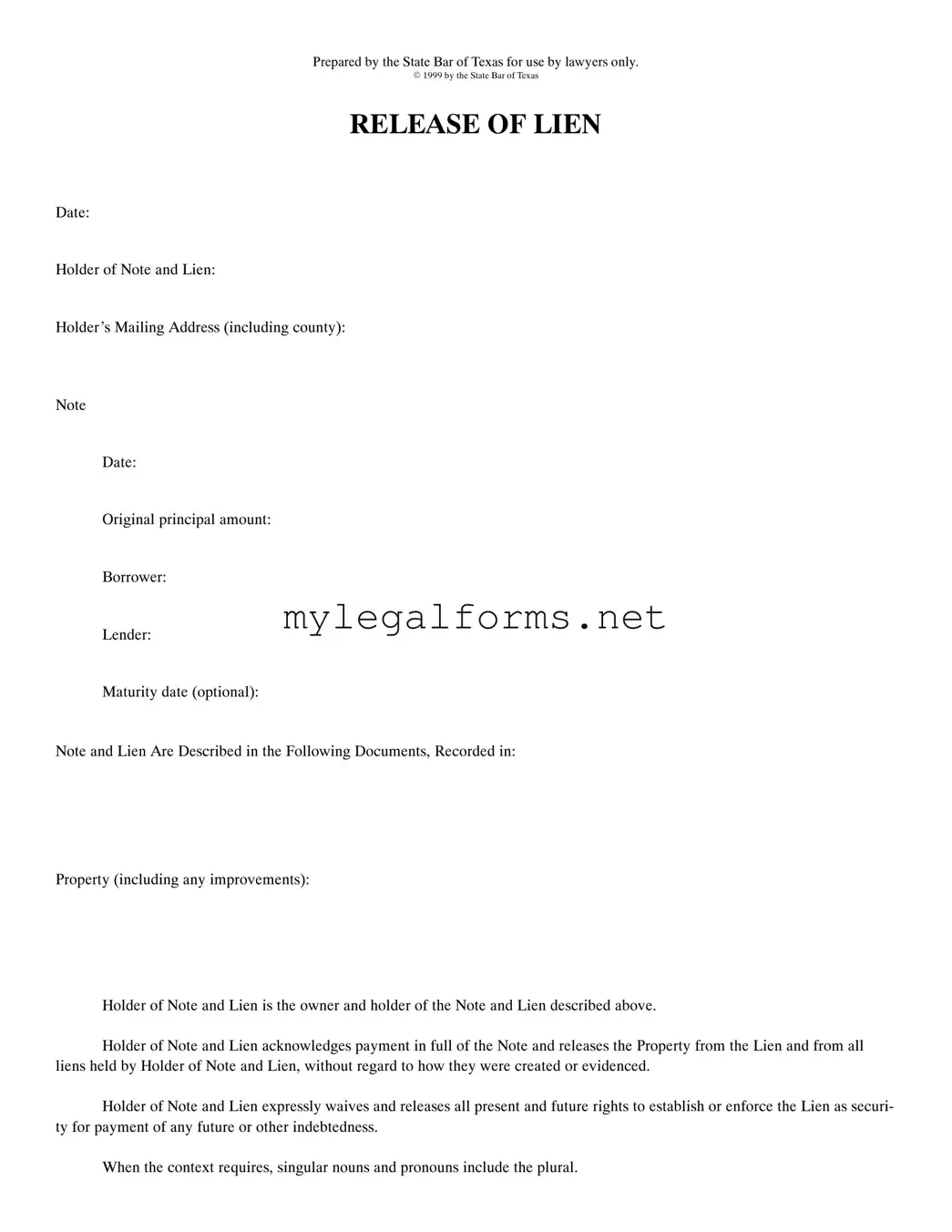

Release Of Lien Texas Template

The Release of Lien Texas form is a legal document used to formally acknowledge the satisfaction of a debt secured by a lien on a property. This form is essential for property owners who have paid off their obligations, as it serves to clear the lien from public records. By completing this document, the holder of the lien relinquishes all rights associated with it, providing peace of mind to the borrower.

Launch Release Of Lien Texas Editor

Release Of Lien Texas Template

Launch Release Of Lien Texas Editor

Launch Release Of Lien Texas Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Release Of Lien Texas online and download the final version.