Attorney-Approved Release of Promissory Note Form

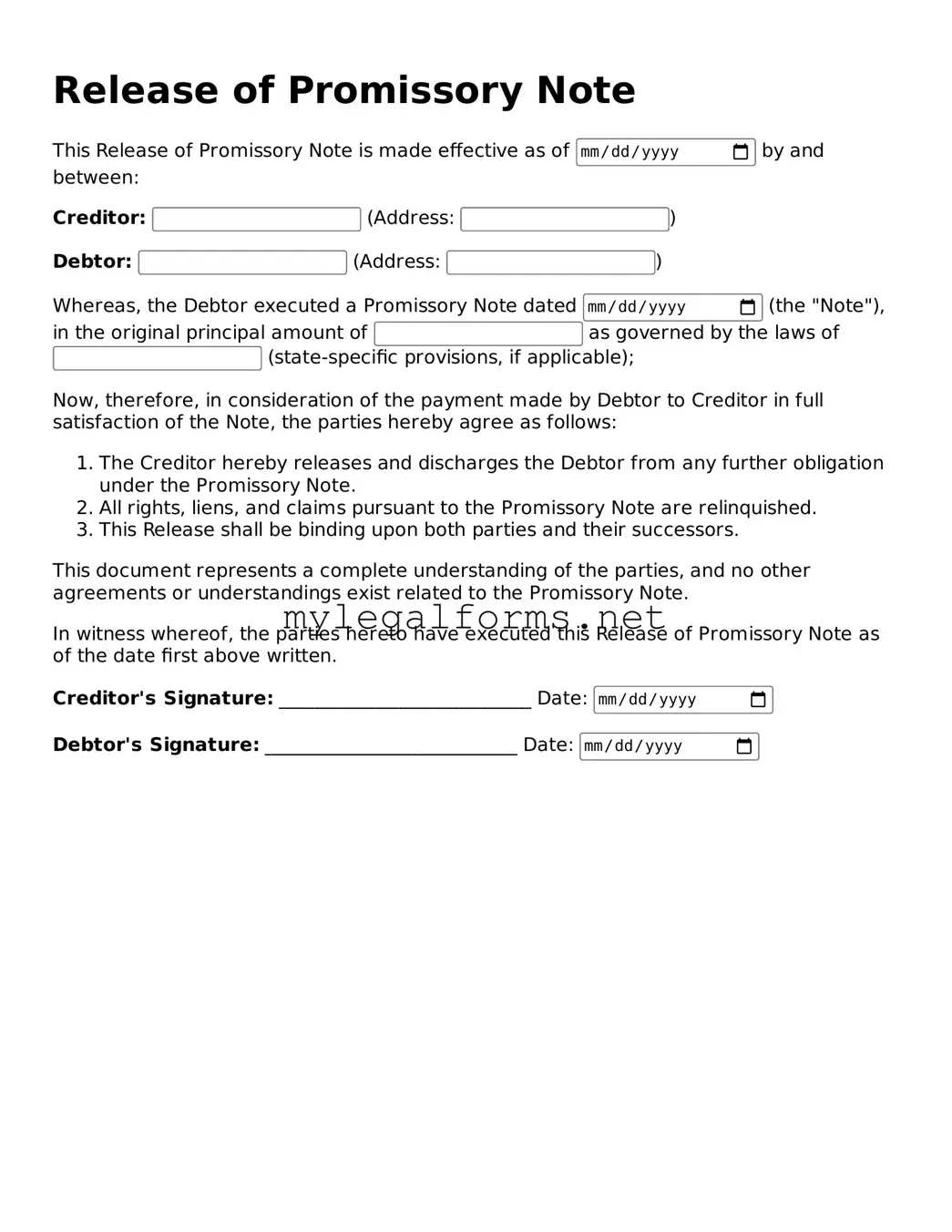

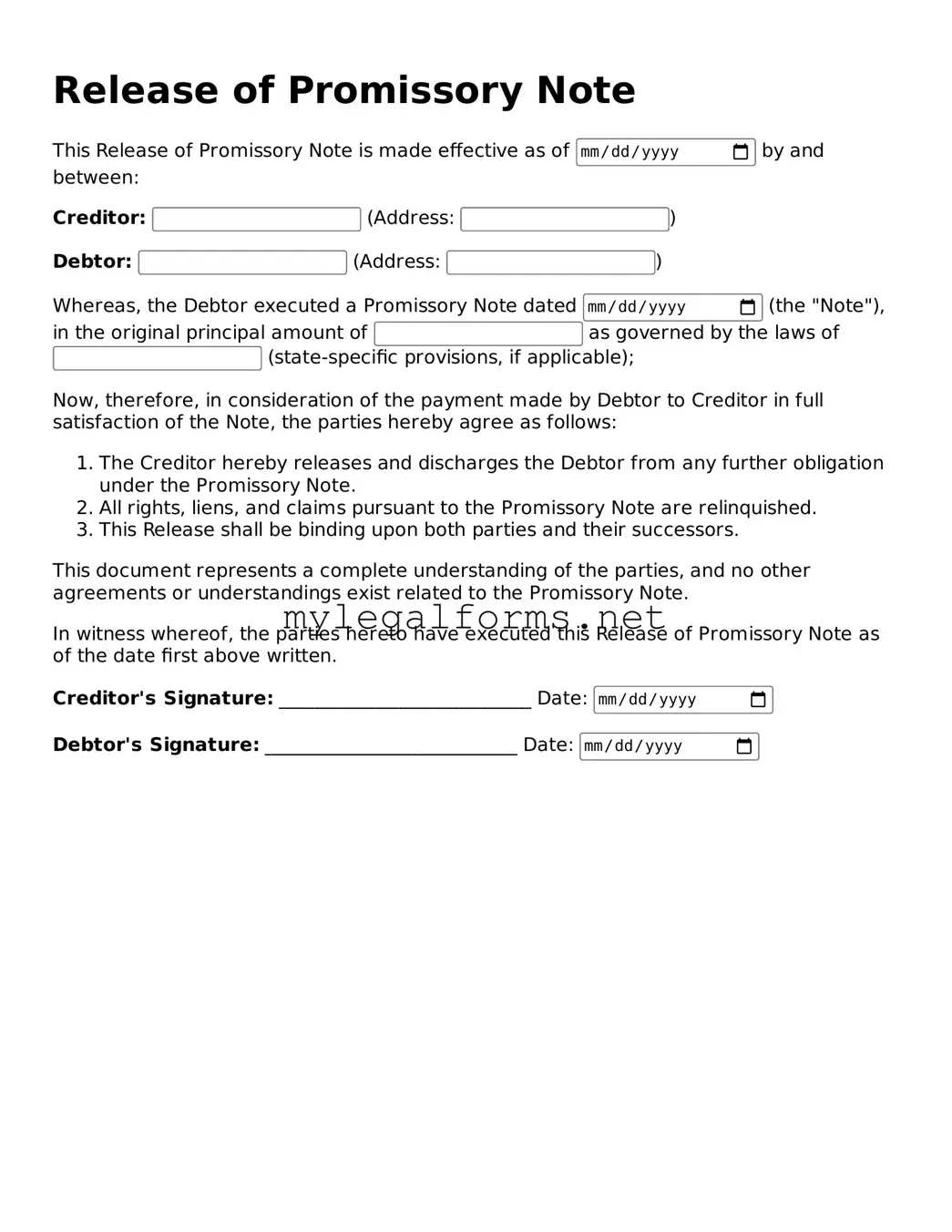

A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note, effectively releasing the borrower from their obligation to repay the debt. This form is essential for both lenders and borrowers to ensure that all parties acknowledge the termination of the debt agreement. Understanding the importance and implications of this document can help prevent future disputes and provide clarity in financial relationships.

Launch Release of Promissory Note Editor

Attorney-Approved Release of Promissory Note Form

Launch Release of Promissory Note Editor

Launch Release of Promissory Note Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Release of Promissory Note online and download the final version.