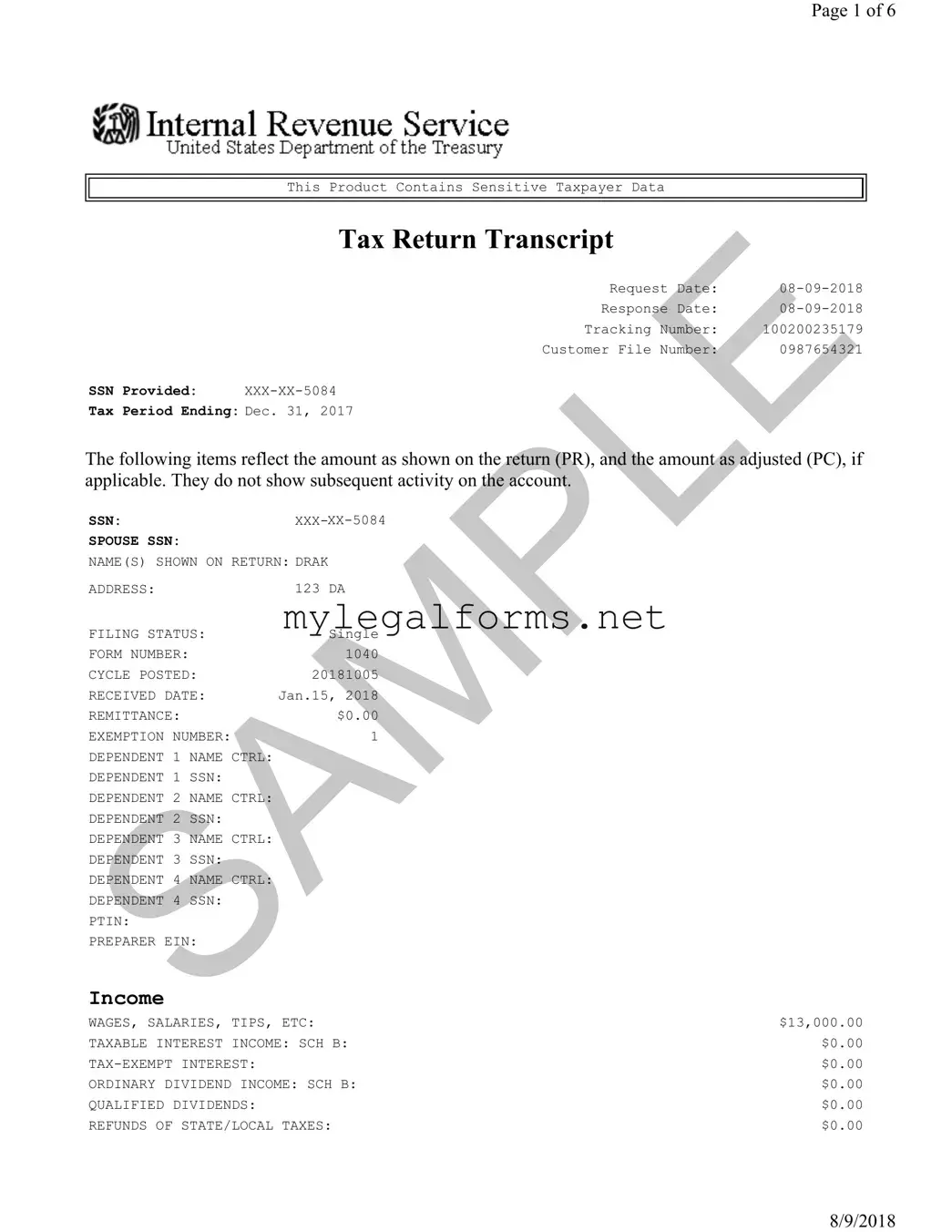

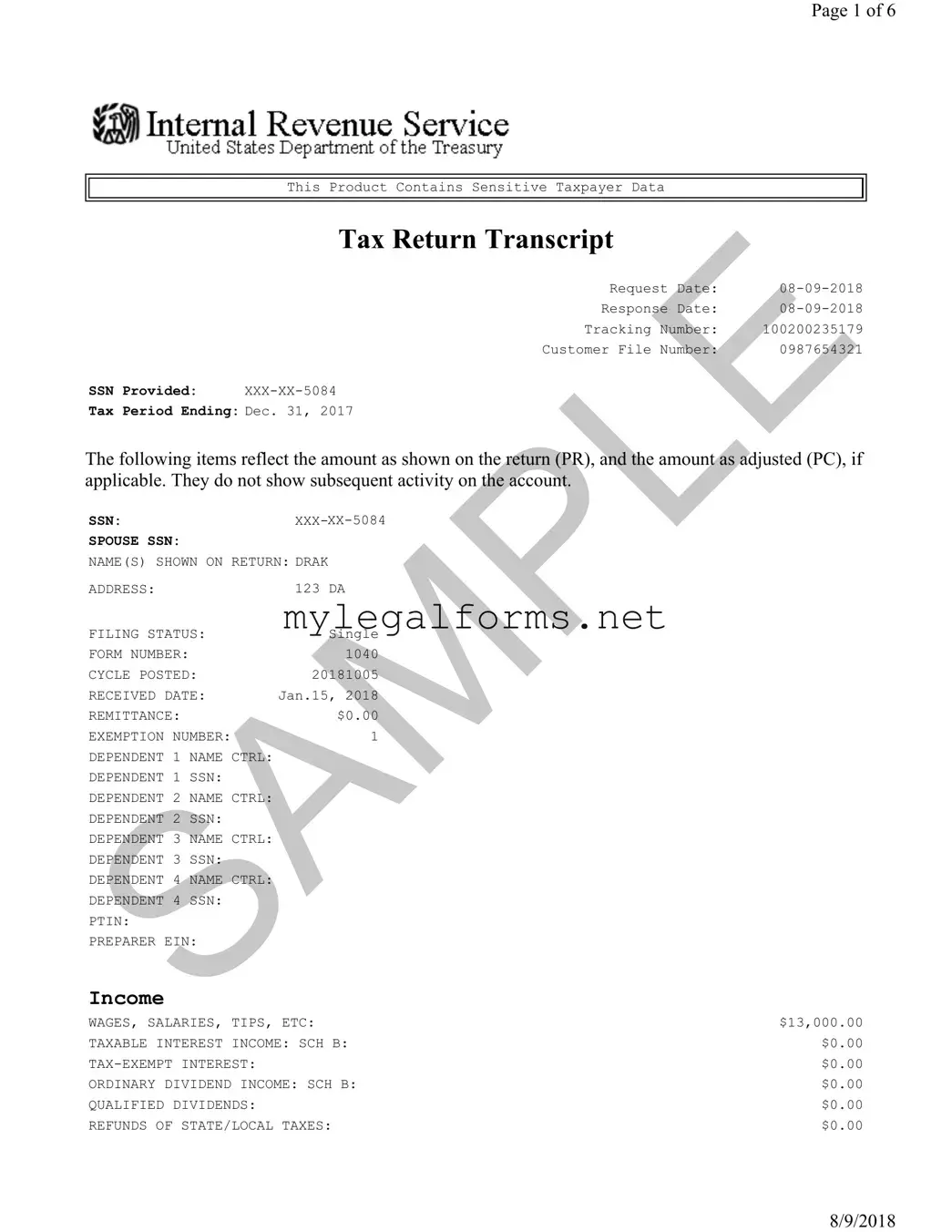

Sample Tax Return Transcript Template

The Sample Tax Return Transcript form is a document that provides a summary of a taxpayer's income, deductions, and tax liabilities as reported on their federal tax return. This transcript is often used by individuals for various purposes, such as applying for loans or verifying income. It reflects the information as it was submitted to the IRS, including any adjustments made after the original filing.

Launch Sample Tax Return Transcript Editor

Sample Tax Return Transcript Template

Launch Sample Tax Return Transcript Editor

Launch Sample Tax Return Transcript Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Sample Tax Return Transcript online and download the final version.