Attorney-Approved Self-Proving Affidavit Form

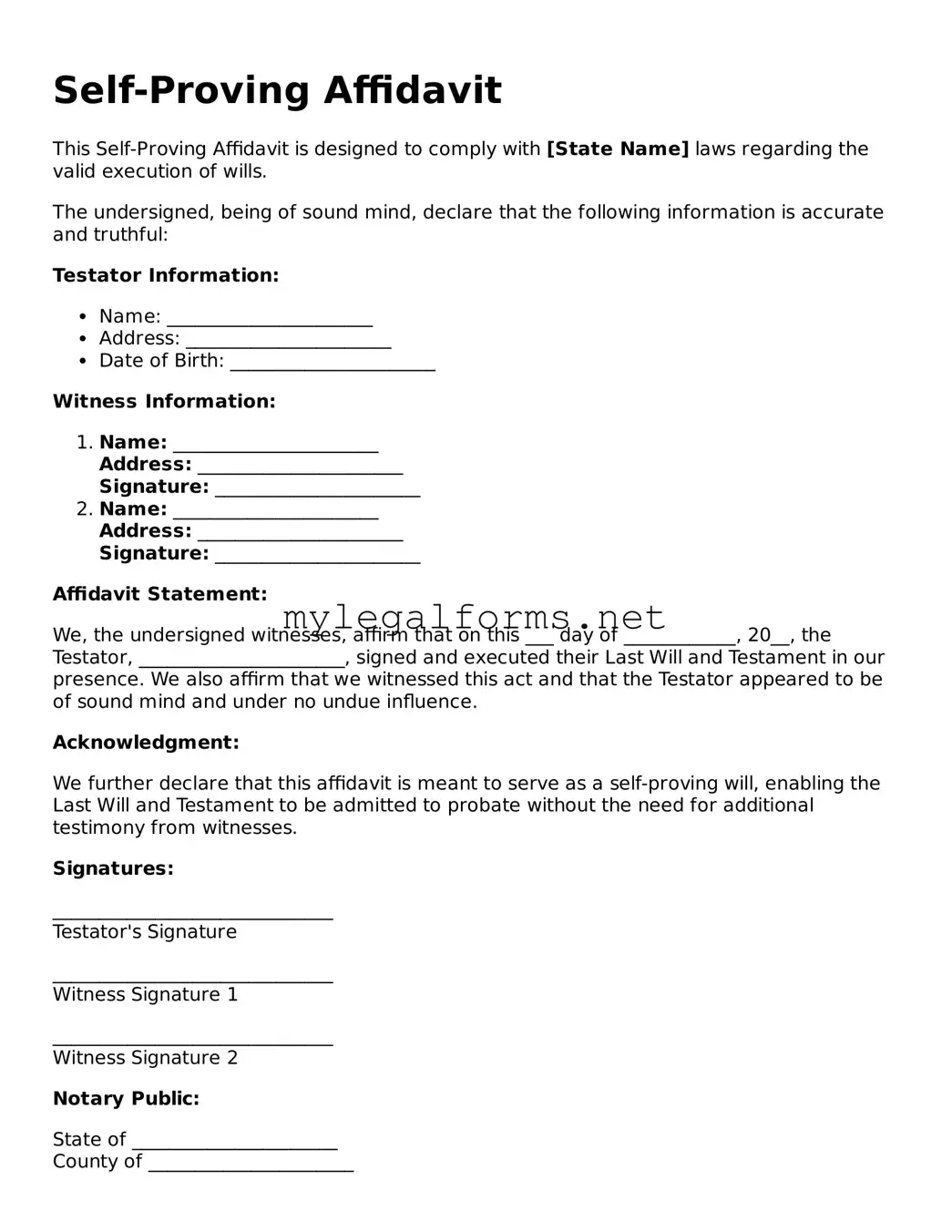

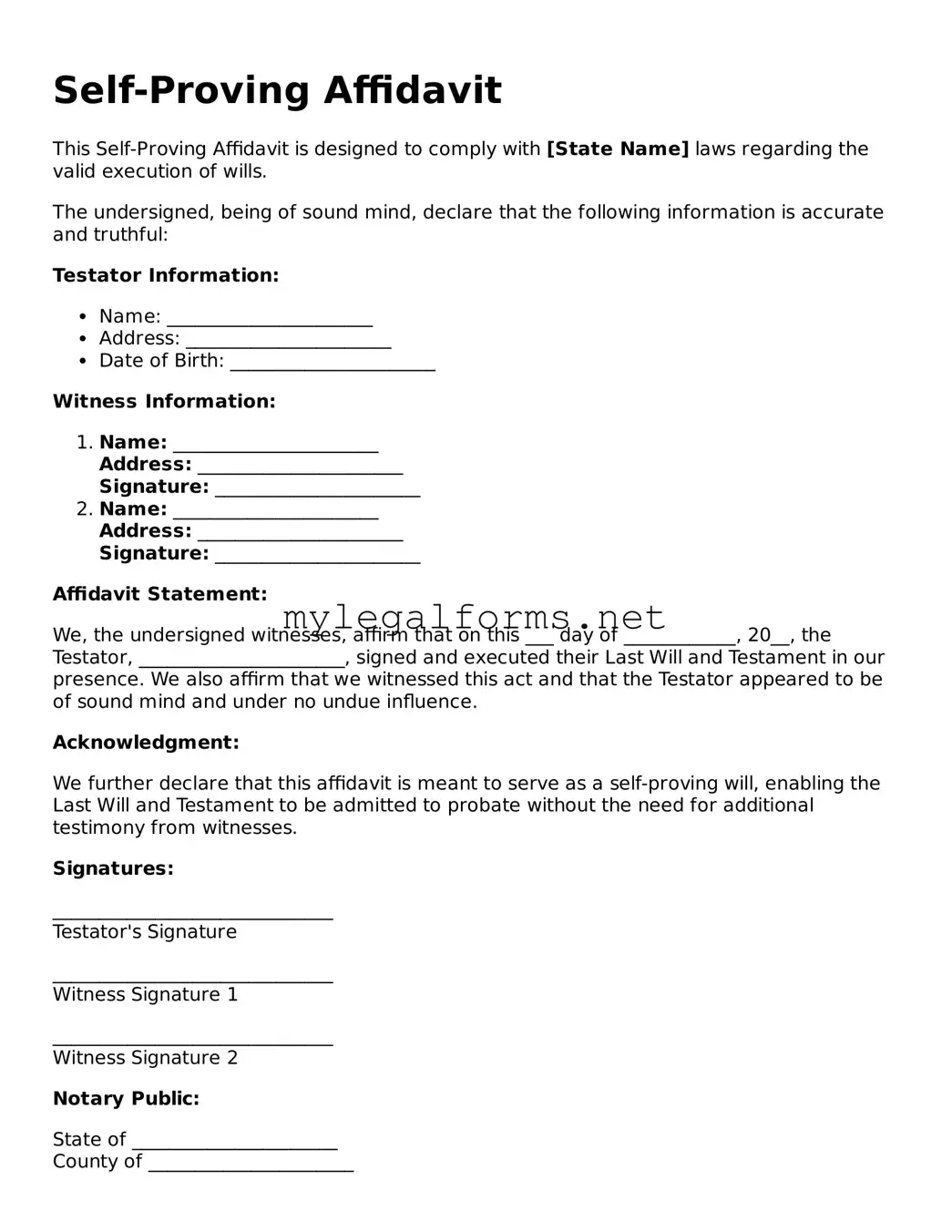

The Self-Proving Affidavit is a legal document that allows a testator's will to be validated without the need for witnesses to appear in court. This form serves to streamline the probate process by affirming the authenticity of the will at the time of its execution. By providing a sworn statement from the testator and witnesses, it enhances the reliability of the will's contents.

Launch Self-Proving Affidavit Editor

Attorney-Approved Self-Proving Affidavit Form

Launch Self-Proving Affidavit Editor

Launch Self-Proving Affidavit Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Self-Proving Affidavit online and download the final version.