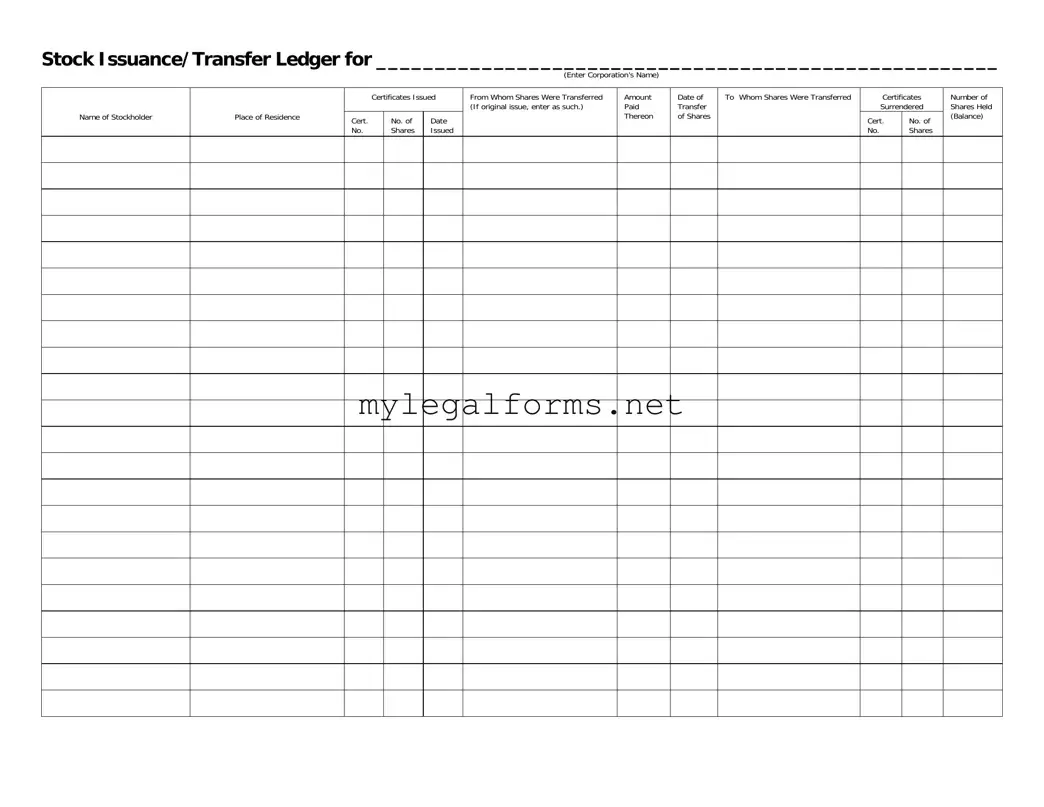

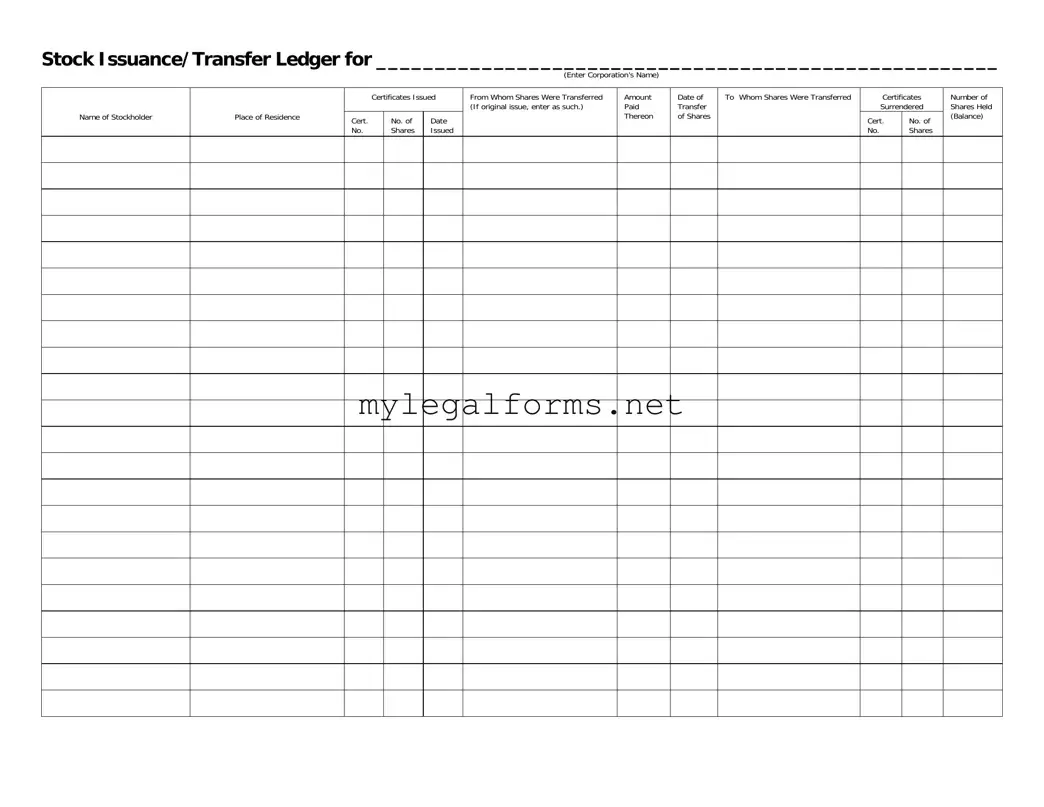

Stock Transfer Ledger Template

The Stock Transfer Ledger form is a crucial document that records the issuance and transfer of shares within a corporation. It captures essential details such as the stockholder's name, the number of shares transferred, and the dates of these transactions. Maintaining an accurate ledger ensures transparency and compliance in the management of corporate stock.

Launch Stock Transfer Ledger Editor

Stock Transfer Ledger Template

Launch Stock Transfer Ledger Editor

Launch Stock Transfer Ledger Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Stock Transfer Ledger online and download the final version.