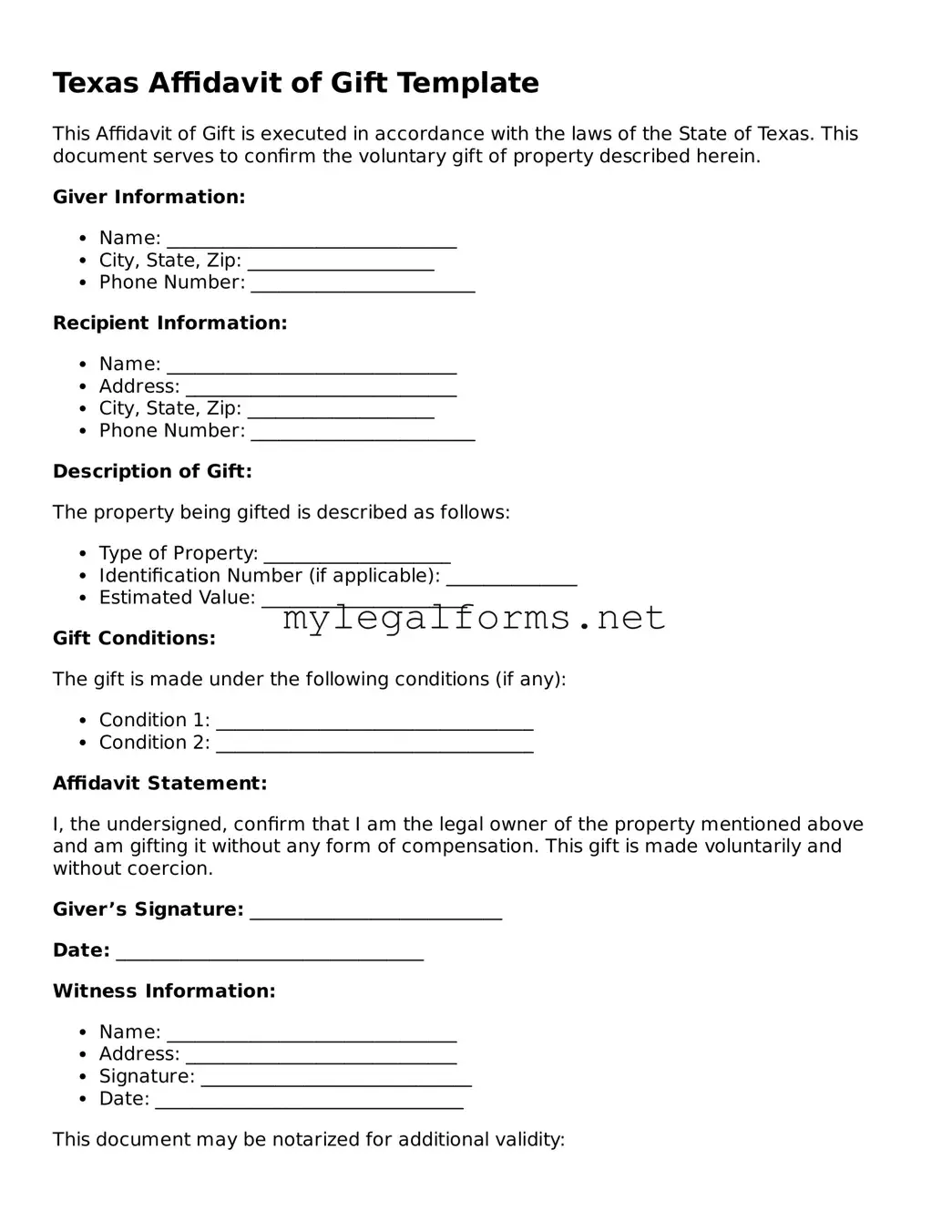

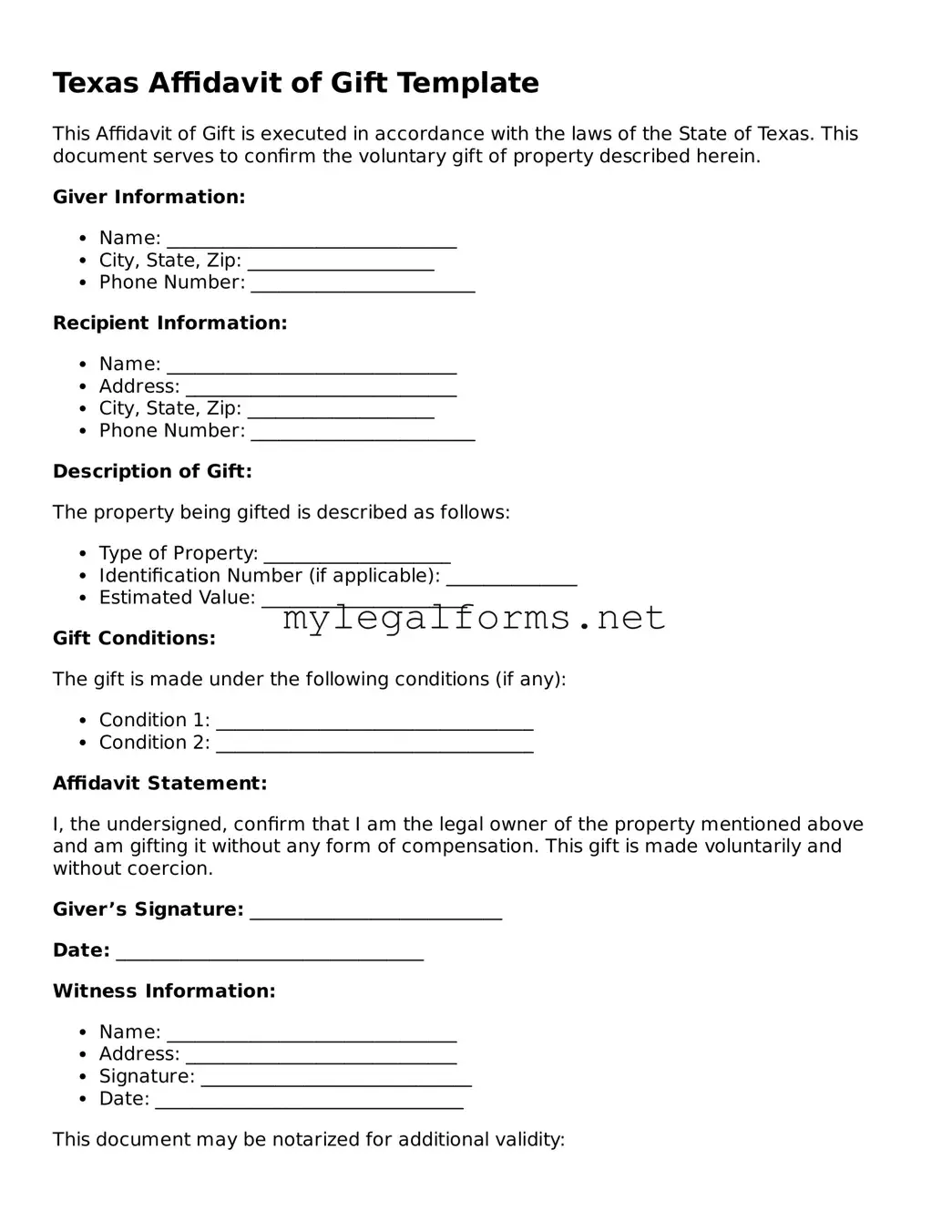

Filling out the Texas Affidavit of Gift form can seem straightforward, but many individuals make common mistakes that can lead to delays or complications. One frequent error is not providing complete and accurate information. Each section of the form requires specific details, and omitting any part can result in the form being rejected. It's essential to double-check all entries for accuracy.

Another mistake involves the signatures. Both the donor and the recipient must sign the affidavit. If either party forgets to sign, the document will not be valid. It’s a good practice to have both parties present when filling out the form to ensure all necessary signatures are collected.

People often overlook the importance of dating the affidavit. The date of the signatures is crucial for establishing when the gift was made. Without a date, it can create confusion regarding the timeline of the transaction. Always include the date next to each signature to avoid this issue.

Additionally, some individuals fail to provide adequate identification information. The form typically requires details such as driver's license numbers or Social Security numbers. Missing this information can lead to questions about the identities of the parties involved. Providing complete identification helps to validate the transaction.

Another common oversight is not having the affidavit notarized. In Texas, notarization is often required for the affidavit to be legally recognized. Without a notary’s signature and seal, the document may not hold up in legal situations. It’s advisable to find a notary before submitting the form.

Some people mistakenly assume that the Affidavit of Gift form is the only document needed for transferring ownership. In many cases, additional documentation may be required, such as a bill of sale or proof of ownership. Understanding the full scope of what is needed can prevent potential issues later on.

Another issue arises when individuals use outdated versions of the form. Forms can be updated, and using an older version may lead to complications. Always check for the most current version of the Affidavit of Gift to ensure compliance with Texas law.

Additionally, neglecting to keep a copy of the completed form is a common mistake. After submission, having a personal record can be invaluable for future reference or if any questions arise regarding the gift. Always make a photocopy or digital scan before sending the form off.

Lastly, some people rush through the process without fully understanding the implications of gifting property. It’s important to consider potential tax consequences or legal ramifications before completing the affidavit. Taking the time to understand these aspects can prevent misunderstandings or disputes in the future.