Articles of Incorporation Document for Texas State

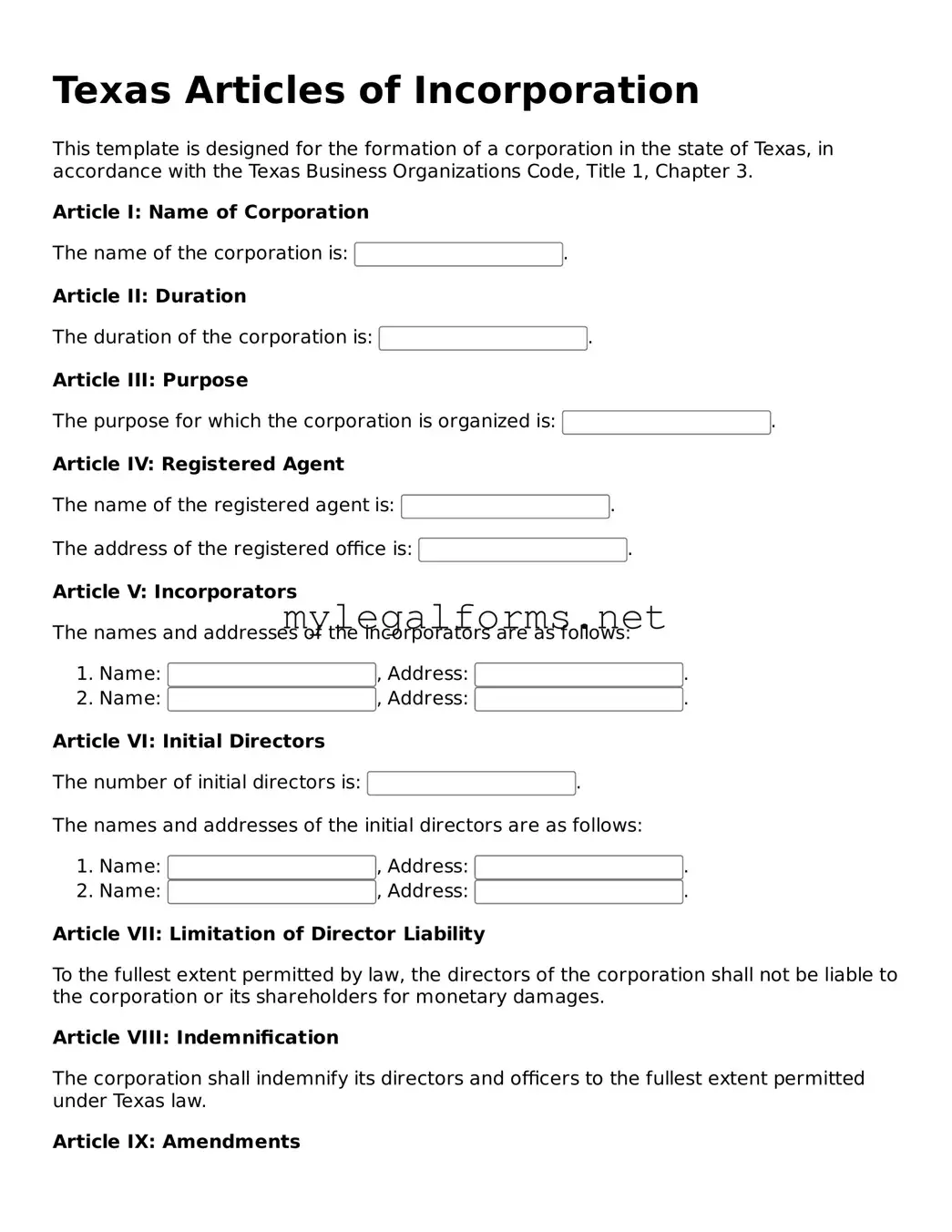

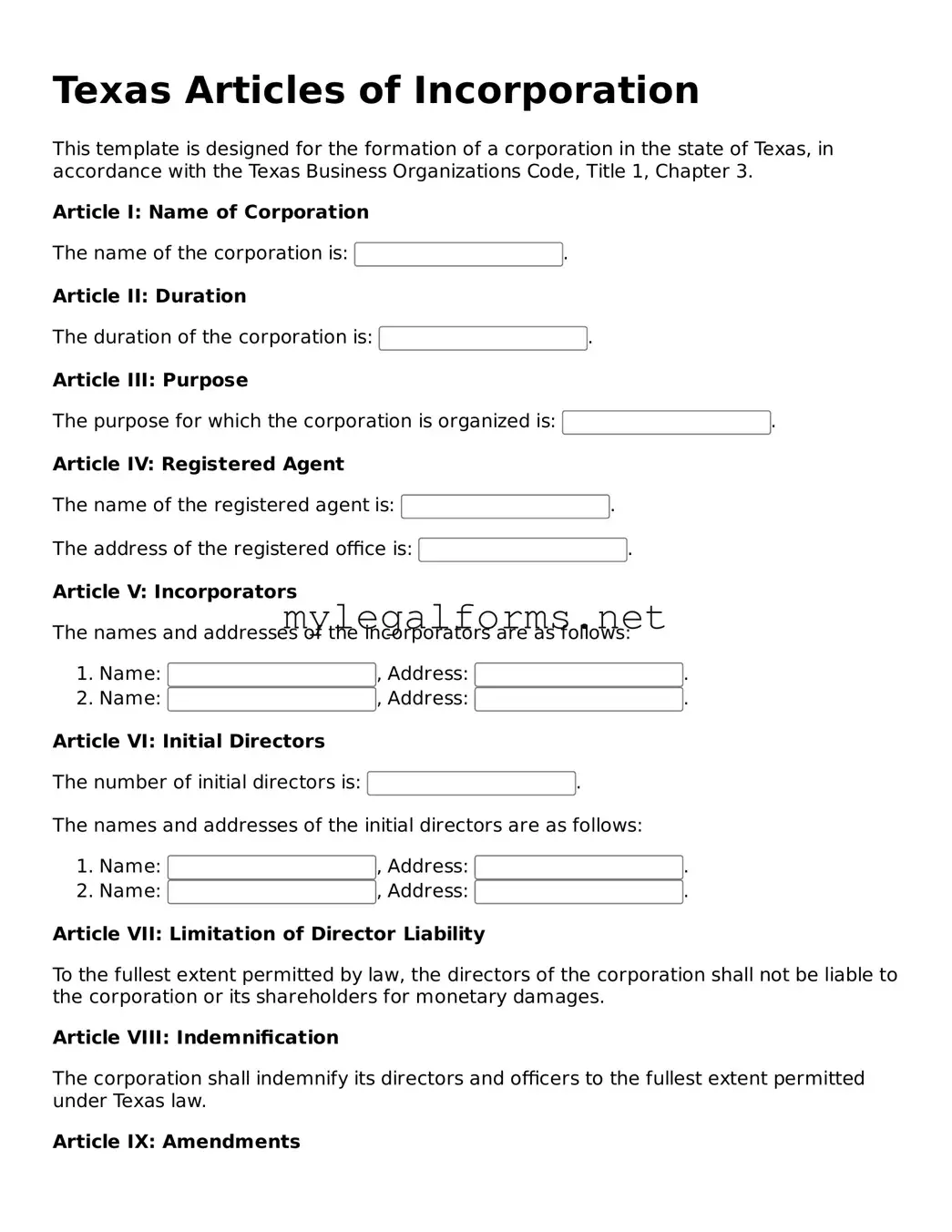

The Texas Articles of Incorporation form is a legal document required to establish a corporation in the state of Texas. This form outlines essential information about the corporation, including its name, purpose, and structure. Completing this form is a crucial step for anyone looking to create a business entity in Texas.

Launch Articles of Incorporation Editor

Articles of Incorporation Document for Texas State

Launch Articles of Incorporation Editor

Launch Articles of Incorporation Editor

or

⇓ PDF Form

Complete the form at your pace — fast

Finish your Articles of Incorporation online and download the final version.